Hanwha Life and Heungkuk Life Enter Final Bidding for IGIS Asset Management

IGIS Asset Management Leads Korean Real Estate Funds; Corporate Value Estimated at 800 Billion Won

"Big Deal" Draws Attention as Hanwha and Taekwang Owner Families Prepa

Hanwha Life Insurance and Heungkuk Life Insurance are competing to acquire IGIS Asset Management, the largest real estate asset management company in South Korea. With their core insurance business facing increasing challenges due to declining birth rates and an aging population, both companies are pursuing alternative investments as a new growth strategy. As the acquisition is closely tied to third-generation succession within both owner families, it is expected that the merger and acquisition (M&A) strategies will be executed with the pride of each group at stake.

According to the financial industry on November 13, Hanwha Life Insurance and Heungkuk Life Insurance have recently submitted their final acquisition proposals in the main bidding process for the sale of management rights in IGIS Asset Management. IGIS Asset Management manages real estate funds totaling approximately 66 trillion won, making it the largest in the country. The company has grown by investing in office buildings, logistics centers, data centers, and hotels.

The stake in IGIS Asset Management up for sale amounts to about 98%, including the 12.4% held by the largest shareholder, Son Hwaja, as well as stakes held by key financial investors. Son is the spouse of the late Kim Daeyoung, the founder and former chairman of the board. If either Hanwha Life Insurance or Heungkuk Life Insurance succeeds in acquiring the company, it is expected that they will not only secure management control but also simplify the ownership structure.

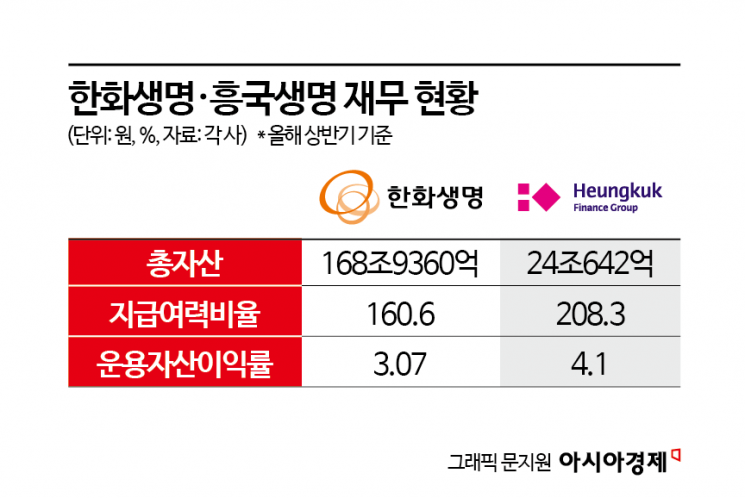

Currently, Hanwha Life Insurance is considered the most likely candidate. As of the first half of this year, Hanwha Life Insurance's assets totaled 168.936 trillion won, about seven times larger than Heungkuk Life Insurance's 24.0642 trillion won. Hanwha Life Insurance has also demonstrated strong acquisition intent. During the preliminary bidding, Hanwha Life Insurance proposed 1 trillion won for a 66% stake in IGIS Asset Management. Considering that the market currently values 100% of IGIS Asset Management at about 800 billion won, this represents an aggressive bid.

Kim Dongwon, President of Hanwha Life Insurance and the second son of Hanwha Group Chairman Kim Seungyeon, is also reportedly showing keen interest in acquiring IGIS Asset Management. President Kim is regarded as having inherited Chairman Kim's "M&A gambler" instincts and has actively pursued M&A deals both domestically and internationally. In April last year, he secured a deal to acquire a 40% stake in Bank Nobu Indonesia, followed by a 75% stake in the US brokerage firm Velocity in November of the same year. If Hanwha Life Insurance acquires IGIS Asset Management, it is expected to create synergies with other group asset management and real estate investment companies, such as Hanwha Asset Management, Hanwha REITs, and Hanwha Asset Management.

Heungkuk Life Insurance, an insurance affiliate of Taekwang Group, is also a strong contender. Although smaller in scale than Hanwha Life Insurance, Heungkuk Life Insurance has been threatening Hanwha Life Insurance in key performance and financial indicators through solid management. As of the first half of this year, Heungkuk Life Insurance's risk-based capital ratio (K-ICS) stood at 208.3%, higher than Hanwha Life Insurance's 160.6%, indicating stronger capital adequacy. Heungkuk Life Insurance's basic capital K-ICS was 107.2%, a stable level, while Hanwha Life Insurance was the only major life insurer with a figure below 100%, at 59.5%. During the same period, Heungkuk Life Insurance's return on invested assets was 4.1%, ahead of Hanwha Life Insurance's 3.07%. The return on invested assets reflects the yield from bonds, stocks, and alternative investments held by the insurer.

Heungkuk Life Insurance has recently bolstered its liquidity by selling assets and issuing hybrid securities. The company sold its headquarters building in Jongno-gu, Seoul, securing about 720 billion won. It also plans to issue 200 billion won in subordinated bonds this month, utilizing approximately 120 billion won. This will secure liquidity of around 840 billion won.

Some interpret this acquisition battle as a contest of pride between the owner families of Hanwha and Taekwang, both facing third-generation succession. President Kim is tasked with succeeding to Hanwha Group's financial management rights and managing the separation of affiliates. In the case of Taekwang Group, Lee Hyunjun, the eldest son of former Chairman Lee Hojun, and his eldest daughter Lee Hanna, are preparing for succession. While they have not yet taken center stage in management like Hanwha Group's third generation, they are seeking opportunities to step forward by participating in Taekwang Group's M&A activities through indirect investment.

Morgan Stanley and Goldman Sachs, the lead managers of the sale, are expected to announce the preferred and secondary negotiation partners later this month. The transaction is expected to be finalized next year after the signing of the stock purchase agreement (SPA) and a major shareholder eligibility review by financial authorities, followed by the settlement of the remaining balance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)