Lotte Energy Materials Surges 63% in Three Days

Sluggish Performance Expected Through Next Year Due to Weak U.S. EV Demand

Significant Profitability Improvement from Circuit Foil Expected Starting in 2027

Lotte Energy Materials has seen its stock price surge following the release of its third-quarter results this year. Although the third-quarter performance fell short of market expectations, news that the company will convert its copper foil production line for secondary batteries to one for artificial intelligence (AI) applications has fueled investor sentiment. While its performance is likely to remain sluggish through next year, there are forecasts that profits will begin to increase from 2027.

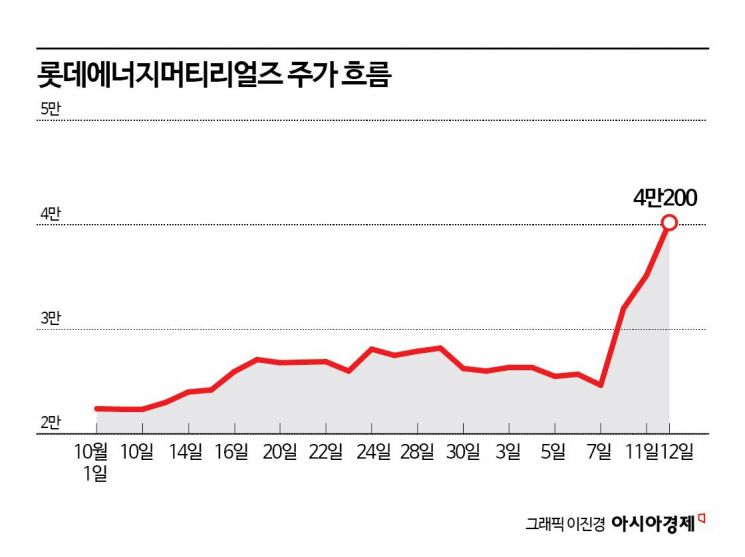

According to the financial investment industry on November 13, Lotte Energy Materials' share price rose by 63.1% over three trading days starting from the 10th. Its market capitalization has recovered to 2.1 trillion won.

Previously, on the 10th, the company released its third-quarter results for this year. Revenue was 143.7 billion won, down 32.0% from the same period last year, and the operating loss was 34.3 billion won, with the deficit slightly widening year-on-year. IBK Investment & Securities estimated that Lotte Energy Materials would record 184 billion won in revenue and a 28 billion won operating loss in the fourth quarter of this year. In the company's main market, the United States, electric vehicle sales reached 94,000 units last month, a 50.7% decrease compared to the previous month.

Lee Hyunwook, a researcher at IBK Investment & Securities, explained, "In Europe, shipments of Chinese low-cost batteries are increasing rather than Korean premium batteries," and added, "In the United States, the suspension of electric vehicle subsidies since September this year has caused the utilization rate to drop to the mid-30% range."

Although it is difficult to expect a turnaround into profitability within this year, investors are focusing on the future growth potential stemming from expanded circuit foil production capacity. At its third-quarter earnings briefing, Lotte Energy Materials stated, "To respond to the increase in circuit foil demand driven by expanded AI data center investment, we will increase our production capacity by 1.7 times next year compared to the current level, and by 5.7 times by 2028." The company has decided to convert the battery foil production facilities at its Iksan plant in North Jeolla Province to circuit foil facilities.

Park Hyungwoo, a researcher at SK Securities, said, "It has been confirmed that Lotte Energy Materials has received copper foil supply requests from big tech companies and domestic and international copper-clad laminate (CCL) manufacturers," adding, "Accordingly, the company is expanding its circuit foil capacity from 3,300 tons this year to 5,500 tons next year." He continued, "However, this is still insufficient to meet order volumes," and added, "We also expect the company to benefit from the de-China trend in the AI server and network substrate value chain."

Circuit foil is more than three times as expensive to process as battery foil. As the proportion of revenue from circuit foil increases, profitability improves. However, it is expected that profits will begin to rise in earnest only from 2027, after the conversion to circuit foil facilities.

Joo Minwoo, a researcher at NH Investment & Securities, analyzed, "Due to the slowdown in U.S. electric vehicle demand, it is inevitable that next year's performance forecast will be revised downward," and added, "However, with the expansion of high-profitability business centered on circuit foil, the company is expected to turn profitable in 2027."

As expectations for the circuit foil conversion have been reflected in advance, the stock price has surpassed the target prices suggested by domestic securities firms' research centers. IBK Investment & Securities set a target price of 32,000 won for Lotte Energy Materials, while Heungkuk Securities, Korea Investment & Securities, Kiwoom Securities, and DS Investment & Securities all set target prices below 40,000 won. Eugene Investment & Securities set a target price of 40,000 won, while SK Securities and NH Investment & Securities suggested 44,500 won and 45,000 won, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)