Share of Advanced Processes in Smartphone Chips Rises

Top Players in Chip Design and Manufacturing Extend Their Lead

Samsung in Pursuit: "Boost Yield and Performance"

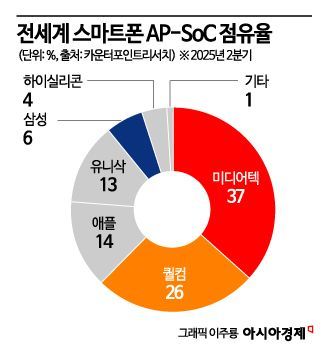

This year, the proportion of smartphone system-on-chips (SoCs) produced using advanced 2-5nm (1nm = one billionth of a meter) processes is expected to reach 50%. As the spread of generative artificial intelligence (AI) accelerates the transition to advanced manufacturing processes for smartphone chips, analysts predict that the dominance of Qualcomm and TSMC, both of which responded early to process miniaturization, will become even more solidified. There are also concerns that Samsung, which handles both chip design and manufacturing, will find it difficult to close the gap in performance and yield in the short term.

According to market research firm Counterpoint Research on November 11, the share of advanced processes such as 2-5nm in total smartphone SoC shipments this year is expected to approach half. This represents a significant increase from 43% last year, and the revenue share is projected to exceed 80%.

Advanced semiconductor processes involve etching fine circuits measured in nanometers (nm) onto wafers, with 2nm and 3nm being the core technologies. The finer the process, the higher the performance and power efficiency, which determines the competitiveness of smartphones running generative AI. Accordingly, major companies are accelerating the development of chips that integrate more powerful central processing units (CPUs), graphics processing units (GPUs), and neural processing units (NPUs), and the SoC supply chain is moving from 5nm to 4nm and toward the 3nm and 2nm era by 2026.

The dominance of companies that have rapidly transitioned to advanced processes is expected to accelerate. Counterpoint Research forecasts that the share of advanced processes in total smartphone SoC shipments will reach 60% next year. Qualcomm, a leading semiconductor design company, is expected to account for about 40% of shipments.

This growth trend is attributed to the transition of mid-range 5G (fifth-generation mobile communication) SoCs to 4nm and 5nm processes, as well as the expansion of mass production of flagship 3nm SoCs. In particular, Qualcomm has a low proportion of 4G (fourth-generation mobile communication) chips, and most of its mid- to low-end 5G SoCs are being migrated to 4nm and 5nm processes. In South Korea, Samsung is designing its own smartphone SoC, the Exynos 2600, but other domestic companies have low market shares and are also struggling to keep up with advanced process transitions.

The same applies to chip manufacturers. The dominance of TSMC, the world's leading foundry focusing on SoC production based on advanced processes, is expected to become even more solid. Next year, both TSMC and Samsung Foundry, ranked second globally, plan to begin mass production of smartphone SoCs using 2nm processes. However, the market believes that as Samsung Foundry faces yield issues in processes below 3nm, TSMC will further strengthen its leadership. There is a prevailing view that TSMC's advantage could be prolonged as Samsung continues to struggle in the next-generation 2nm market. Industry insiders also point out that if the pace of transition to advanced processes is excessively fast, it will be difficult for Samsung to catch up in the short term. However, some analysts note that if Samsung continues to invest in technology and improve yields, there is potential to narrow the gap in the mid-term.

An industry official stated, "Samsung has announced that it has secured leading-edge technology, but this has not yet translated into customer trust, so there have been limitations in winning orders so far. However, with the Tesla order as a catalyst, we expect Samsung Foundry to secure more contracts with big tech companies." Another official explained, "Because Samsung has a lower proportion of mature processes compared to TSMC, it may not be as heavily affected. Nevertheless, it is true that industry leaders Qualcomm and TSMC hold an overwhelming advantage under any circumstances."

Lee Changhan, former Vice Chairman of the Korea Semiconductor Industry Association, said, "To equip smartphones with AI technology, it is natural that chip integration must increase, and TSMC currently has the lead. Since there are no domestic companies that can compete with Qualcomm in application processors (APs), continued dependence is inevitable." He added, "The best course for Samsung Foundry is to narrow the gap with TSMC in terms of performance and yield through technological investment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)