Banks Highlight Top Rankings in Fund Size and Returns

Retirement Pensions Emerge as New Revenue Source Amid Slowing Household Loan Growth

Year-End Surge: Companies Renew Contracts and Individual IRP Customers Flock to Banks

It has been a year since the introduction of the retirement pension transfer system (in-kind transfer system), yet the competition among banks for retirement pension marketing remains fierce. Banks are promoting themselves as number one in accumulated funds or returns, and are launching various events to attract customers. Retirement pensions have emerged as a new revenue source for banks, and the seasonal effect of the year-end peak period is also believed to be a contributing factor.

According to the banking industry on November 10, Shinhan Bank recently recorded 50.1985 trillion won in retirement pension reserves, becoming the first bank in the sector to surpass 50 trillion won. As of the third quarter of 2025, Shinhan Bank ranked first in the industry for accumulated funds in IRP (Individual Retirement Pension). Hana Bank is emphasizing that it ranked first in the increase of retirement pension reserves as of the third quarter of this year. As of the end of September 2025, Hana Bank's retirement pension reserves stood at 44.1083 trillion won, an increase of 3.8349 trillion won compared to the end of the previous year (of which IRP accounted for 2.6583 trillion won and DC-type for 1.1586 trillion won). KB Kookmin Bank is highlighting its number one position in DC-type (Defined Contribution) retirement pension reserves. With 15 trillion won in DC-type reserves, it has maintained the top spot in the financial sector for 14 consecutive years since 2010. NH Nonghyup Bank promoted that its IRP yield reached 16.49% in the third quarter of this year, ranking first among the five major banks.

The reason banks are emphasizing their number one position in retirement pensions using favorable indicators is that retirement pensions have emerged as a new revenue stream for the banking sector. Until now, banks have enjoyed high profits thanks to rapid growth in household loans, but as the government has tightened lending regulations, the growth of mortgage loans has stagnated, creating a need for new sources of income. As a result, banks are shifting from an interest income-centered structure to a strategy focused on expanding non-interest income, with retirement pensions emerging as a core pillar. While corporate loans are also considered a new revenue source for banks, retirement pensions are seen as more stable compared to corporate loans, which come with risk management burdens. Retirement pensions are attractive because of their large scale, steady fee income, and their nature as long-term products that are deposited for a minimum of 10 years and up to 40 years.

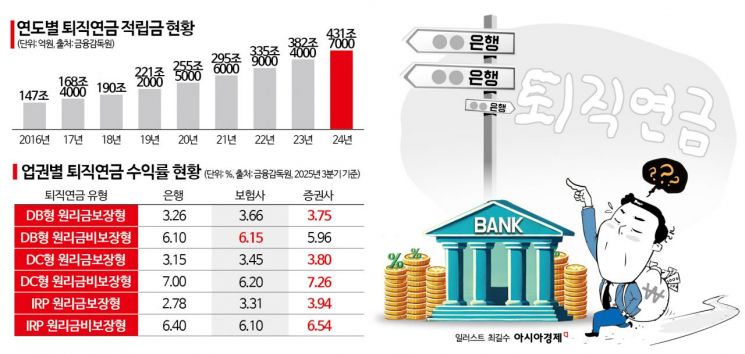

The steadily growing retirement pension market is another reason why banks are going all out to capture market share. According to the Financial Supervisory Service, the size of retirement pension reserves increased from 147 trillion won in 2016 to 221 trillion won in 2019, surpassing 200 trillion won, and continued to grow, reaching 336 trillion won in 2022 and 432 trillion won in 2024. It is projected to exceed 500 trillion won by 2030.

A bank official stated, "Once a retirement pension customer is acquired, the funds are deposited and managed for a long period, so there is a strong sense of crisis that if we fail to secure the market now, we could fall behind in the competition ten years from now." The official added, "Retirement pension customers provide access to financial information such as age, income level, and investment preferences, which creates strong synergy for linking them to wealth management (WM) and private banking (PB) services."

It is also analyzed that the seasonal year-end effect is at play. This is the period when companies renew contracts with retirement pension managers, and when individual IRP subscribers and additional depositors flock to banks for year-end tax deductions.

In response, banks are making every effort to attract customers through various marketing events and differentiated services. Shinhan Bank is running an event to expand the scope of customers eligible for fee waivers, while Hana Bank is offering customized pension asset management services. KB Kookmin Bank is targeting corporate clients by holding seminars for corporate retirement pension managers.

Another bank official commented, "Year-end is also a period of intense performance competition ahead of personnel evaluations," and explained, "With the recent stock market boom, there is a trend of customers moving to securities firms, so banks are putting even more effort into their promotions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.