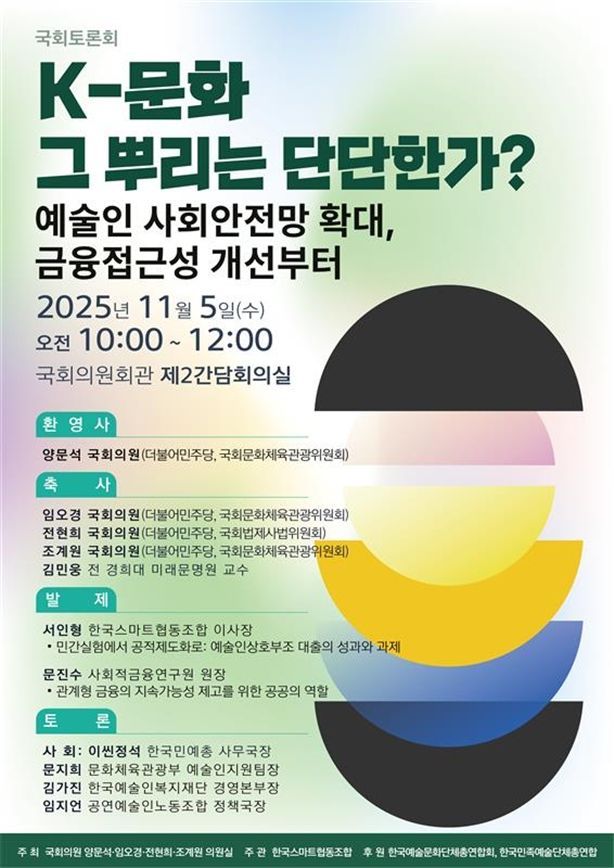

A policy forum aimed at institutionally improving artists' access to financial services was held on November 5 in the Second Conference Room of the National Assembly Members' Office Building.

According to the "2025 Artists' Financial Disaster Report" released by the Korea Smart Cooperative Association on the same day, 84.9% of artists were unable to access loans from primary financial institutions over the past three years. The main reasons identified were irregular income structures and the social stigma of being labeled as "unemployed."

A significant number of artists who could not access bank loans were driven to high-interest private lenders, with 48.6% of respondents reporting that they had experienced ultra-high interest loans with annual rates exceeding 15%.

Additionally, 43% of artists reported having experienced debt collection, and among them, 88.3% stated that they had suspended or reduced their creative activities due to severe anxiety and fear. The report pointed out that "financial problems are not merely individual credit issues but represent a structural risk threatening the sustainability of the artistic ecosystem."

Over the past three years, the Korea Smart Cooperative Association has provided a total of 700 million won to 354 individuals, using "trust from fellow artists" as the basis for support instead of credit scores or income verification. The repayment rate reached 95%. This experimental model of the cooperative is gaining attention as an alternative for financial welfare.

Seo Inhyeong, Chairman of the Korea Smart Cooperative Association, emphasized, "The issue of artists' access to financial services is not a personal failure but a clear social disaster," and stressed the need to establish institutional solutions through public-private partnership models.

Yang Moonseok, a lawmaker from the Democratic Party of Korea, said, "The Ministry of Culture, Sports and Tourism, the Korea Artists Welfare Foundation, and the private sector should collaborate to increase speed and efficacy," adding, "The Korea Smart Cooperative Association is the very institution that can resolve the issue of loan processing speed, which the Korea Artists Welfare Foundation has not been able to address."

Kim Minwoong, former professor at Kyung Hee University's Institute of Future Civilizations, suggested, "Financial institutions should introduce various criteria beyond credit to fulfill their public role."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)