8 out of 10 See Health Functional Foods as an Investment in Health and Self-Care

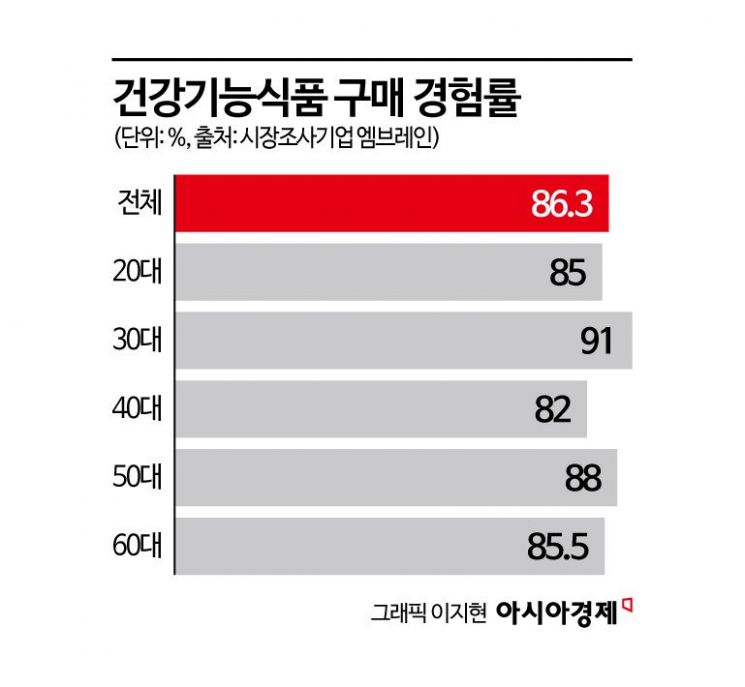

86% Across All Generations Have Purchased Health Functional Foods

Those in Their 20s and 30s Prefer Gummies and Chewables... High Interest in Convenience Store and

More than 8 out of 10 adults perceive health functional foods as an investment in their health and self-care. What was once considered the domain of middle-aged consumers is now becoming a widespread "consumer trend" across all generations.

According to a survey conducted on November 8 by market research firm Embrain, which polled 1,000 men and women aged 19 to 69 on "health functional food consumption patterns and low-priced/small-quantity products," 84.5% of respondents answered that health functional foods are an investment in health and self-care. This reflects the recent perception that health management has emerged as an important part of one's lifestyle, making health functional foods a part of daily routines and a symbol of self-management.

7 out of 10 Take Health Functional Foods Regularly Every Day

Interest in health management was high across all age groups (20s: 95.0%, 30s: 95.0%, 40s: 92.5%, 50s: 98.5%, 60s: 99.0%). Among those who have experience taking health functional foods, 71.4% (multiple responses) reported taking them regularly every day. The most common reason for consumption was "for routine health management and maintenance" (55.6%, multiple responses).

Furthermore, 84.1% of respondents felt that more young people are becoming proactive about health management. Notably, younger generations were less likely to associate health functional foods with "middle age" or "aging" (20s: 20.5%, 30s: 24.0%, 40s: 28.0%, 50s: 35.0%, 60s: 41.0%). Unlike in the past, when health management was seen as the preserve of middle-aged and older adults, the importance of proactive health management is now spreading among younger generations.

It was found that 9 out of 10 respondents (86.3%) had purchased health functional foods. The most common purchasing channels were online shopping malls such as Coupang, 11st, and Gmarket (70.0%, multiple responses). This was followed by large supermarkets (36.5%), pharmacies (34.8%), and home shopping channels (27.9%). Among younger consumers, purchasing channels were more diverse, including overseas direct purchases, H&B stores, and Daiso.

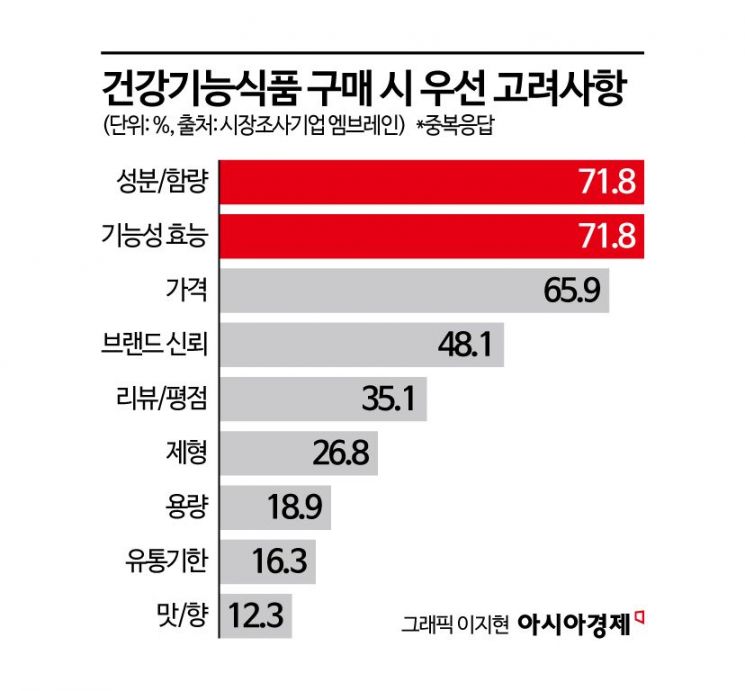

The most important factors considered when purchasing health functional foods were ingredients (71.8%, multiple responses), efficacy (71.8%), and price (65.9%). In terms of dosage form, tablets (70.6%, multiple responses) and capsules (56.2%) were the most preferred. However, those in their 20s and 30s showed a marked preference for tasty and convenient forms such as gummies (20s: 34.1%, 30s: 36.3%, 40s: 24.4%, 50s: 25.0%, 60s: 19.9%) and chewables (20s: 17.1%, 30s: 19.8%, 40s: 16.5%, 50s: 9.1%, 60s: 13.5%). This reflects the attitude of younger generations, who view health functional foods not as "medicine," but as a light, routine part of daily life.

Younger Consumers Take Multiple Health Functional Foods for Well-being

Meanwhile, the majority of respondents (42.5%) said they take about one or two health functional foods. However, the tendency to take multiple products for well-being was more pronounced among younger age groups (20s: 26.5%, 30s: 28.5%, 40s: 15.0%, 50s: 22.5%, 60s: 22.0%). This suggests that younger consumers have a slightly higher demand for managing their health from multiple angles compared to older consumers.

As the importance placed on health functional foods grows, interest is also rising in affordable and small-quantity products. Awareness of "low-priced/small-quantity" health functional foods sold at Daiso or convenience stores was relatively high, but actual purchase experience was still limited (aware and have purchased: 15.1%, aware but have not purchased: 61.3%).

High Purchase Experience of Low-Priced/Small-Quantity Health Functional Foods among Consumers in Their 20s and 30s

However, purchase rates among those in their 20s and 30s were higher than in other age groups (20s: 24.5%, 30s: 21.0%, 40s: 8.0%, 50s: 11.5%, 60s: 10.5%), indicating that the ability to try products without financial burden aligns with the consumption patterns of younger generations.

In fact, low-priced/small-quantity health functional foods in the 5,000 won range were widely seen as a "good price point for trying out" (82.0% agreement) and "appropriate for trying without burden" (80.3%). In addition, 78.3% of respondents agreed that single-serving health functional foods sold at convenience stores or Daiso are valuable as a "trial version" before purchasing the full-priced product. This shows that many consumers use these affordable products as "entry-level" health functional foods.

When asked about the strengths of low-priced/small-quantity health functional foods, price (78.0%, multiple responses) was cited most frequently, followed by accessibility (68.6%) and small-quantity packaging (51.7%). A significant proportion of respondents (68.0%) said they intend to purchase low-priced/small-quantity health functional foods in the future, and 77.2% agreed that it would be good to see a wider variety of health functional foods sold at convenience stores and Daiso.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.