FSS Provides Guidance on Everyday Insurance Fraud Cases and How to Respond

It has been revealed that insurance fraud, where individuals deliberately cause accidents to claim insurance payouts, continues to be rampant. The Financial Supervisory Service has provided guidance on major cases and response strategies, urging the public to report any suspected cases of insurance fraud.

On November 4, the Financial Supervisory Service provided information on new types of insurance fraud schemes involving automobile insurance and others, as well as response measures. The agency noted that recently, scams targeting vulnerable groups such as young people have been increasing on social networking services (SNS). Fraudsters use tactics such as suggesting that people can easily make money through their existing insurance policies.

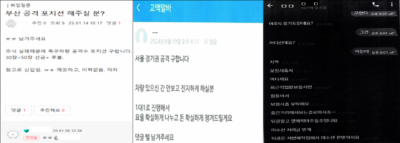

First, people should not participate in colluding to stage car accidents online, including through SNS. Scammers use slang terms such as "deokkung," "subi," "gonggyeok," "boheom," and "telegram" to encourage people to take on "short-term high-paying part-time jobs."

This method involves dividing roles as the perpetrator and victim of a traffic accident, staging an accident, and then claiming insurance payouts. Even if a person does not participate in the fraud, simply posting about it on SNS or making fraudulent offers through online loan consultations is considered illegal activity.

People should also beware of insurance fraud involving forged medical certificates posted on SNS. Scammers approach victims by offering help with loans or employment, then demand a portion of future insurance payouts as a commission, providing fake medical certificates needed to file insurance claims.

Fake patients print out forged certificates for conditions such as stroke, as well as admission and discharge certificates provided by brokers, create counterfeit stamps, and submit these documents to insurance companies to claim payouts. The Financial Supervisory Service recently detected a case in which individuals fraudulently obtained 1.48 billion won in insurance payouts using forged certificates from brokers and reported them to the police for suspected fraud.

The Financial Supervisory Service warned that not only brokers who orchestrate the fraud but also those who aid or participate are considered accomplices and will face criminal penalties. Even those who embezzle only small amounts of insurance payouts will be punished.

Since the amendment of the Special Act on the Prevention of Insurance Fraud on August 14 last year, the Financial Supervisory Service and the insurance industry have requested investigations into 3,677 individuals suspected of arranging or enticing insurance fraud. The total amount of insurance payouts illegally obtained by these individuals is approximately 93.9 billion won.

The Financial Supervisory Service conducted five planned investigations targeting individuals who posted insurance fraud advertisements on online communities, referring 848 suspects to the police. The amount of insurance payouts illegally obtained in these cases is about 1.5 billion won.

The industry itself identified 2,829 suspects (with approximately 92.4 billion won in illegally obtained payouts) through internal investigations into brokerage activities and requested investigations.

Those caught arranging or enticing insurance fraud can face up to 10 years in prison or fines of up to 50 million won. If document forgery, such as creating false medical certificates, is recognized, offenders can be sentenced to up to 5 years in prison or fined up to 10 million won under the Criminal Act.

On July 1, the Supreme Court revised sentencing guidelines, allowing for life imprisonment to be recommended for fraud offenders. For example, if a person commits organized fraud involving more than 30 billion won, life imprisonment can be recommended. If professionals such as those in the insurance industry participate in the crime, this is considered an aggravating factor for sentencing.

A Financial Supervisory Service official stated, "Going forward, the Financial Supervisory Service will not only continue its insurance fraud prevention activities but will also actively respond to ensure strict punishment for fraudulent acts," adding, "We will work closely with related agencies such as the police and the National Health Insurance Service to eradicate increasingly sophisticated and organized insurance fraud."

The Financial Supervisory Service urged the public to report any unreasonable insurance fraud proposals or suspicious cases to the Insurance Fraud Reporting Center. If a report is confirmed as insurance fraud, the General Insurance Association of Korea or the insurance company will pay a reward of up to 2 billion won according to their reward payment standards.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.