Ttaenggyeoyo Sees Rapid Surge in Public Delivery App Users

Driven by Livelihood Recovery Consumption Coupon

Potential to Serve as an Alternative Amid Commission Fee Disputes in Delivery Market

The number of monthly active users (MAU) for the public delivery app 'Ttaenggyeoyo' has surged sharply, surpassing 3 million and closely trailing behind 'Yogiyo.' As conflicts over commission fees persist in the delivery market, there is growing anticipation that if user growth continues, the Ttaenggyeoyo model could become a viable alternative in the industry. However, experts point out that the key issue will be how to retain the users acquired through government support.

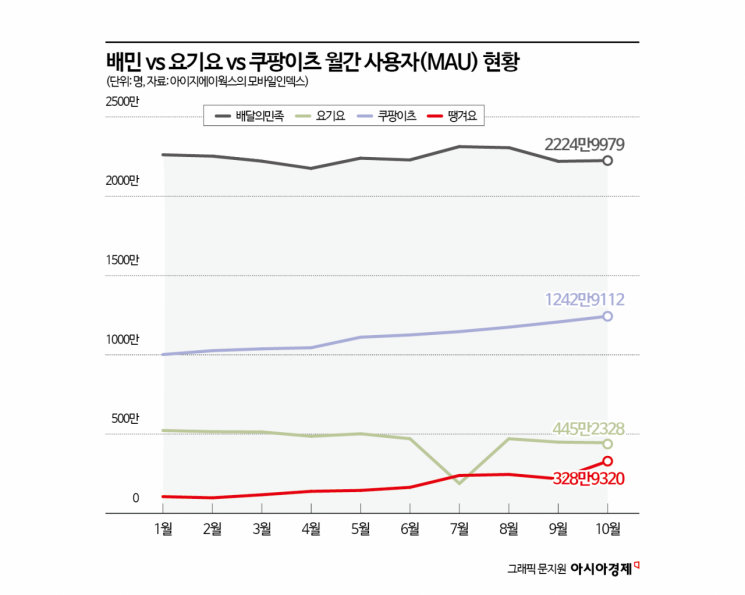

According to Mobile Index, a data platform operated by IGAWorks, Ttaenggyeoyo recorded 3.29 million MAU last month. This represents a 51.1% increase from the previous month. Compared to the beginning of the year, 2.24 million more people used Ttaenggyeoyo, marking a growth rate of 212.2%.

Until June, Ttaenggyeoyo had been recording monthly growth rates in the 10% range. The sharp increase began in July, which analysts attribute to promotions by local governments and the impact of initiatives like the 'Livelihood Recovery Consumption Coupon.' To use these consumption coupons on delivery apps, customers must opt for 'on-site payment.' Ttaenggyeoyo supports local currency payments, allowing users to utilize consumption coupons for both in-app and on-site payments. The Ministry of Agriculture, Food and Rural Affairs also allocated budget for discount coupons as part of its public delivery app activation project. Industry sources estimate that Ttaenggyeoyo's cumulative order volume has surpassed 700 billion won, and last month, its monthly sales likely exceeded 140 billion won, the breakeven point.

Operated by Shinhan Bank, Ttaenggyeoyo is classified as a public delivery app, promoting a strategy of growing together with small business owners through low intermediary fees in the 2% range and free advertising. Until now, while the advantages for participating businesses were clear, the app struggled to attract consumers. If user numbers continue to rise and the Ttaenggyeoyo model becomes established, it could reshape the competitive landscape of the market and spark new perspectives on ongoing disputes and controversies over delivery fees.

The challenge lies in retaining the users acquired through government support. There are limits to support based on budget, and competition for consumer benefits is intensifying as Baemin and Coupang Eats solidify their positions as the two dominant players. Last month, the MAUs for Baemin, Coupang Eats, and Yogiyo were 22.25 million, 12.43 million, and 4.45 million, respectively. Both Baemin and Coupang Eats saw slight increases compared to the previous month.

In particular, Coupang Eats continues its upward momentum. According to an analysis by the office of Democratic Party lawmaker Kim Namgeun, based on Financial Supervisory Service data and payment amounts from eight credit card companies, Coupang Eats overtook Baemin in Seoul in August. Both Baemin, which is being chased, and Coupang Eats, which is in pursuit, are rushing to expand their promotions. An industry insider commented, "To retain delivery app users who have become accustomed to benefits like free delivery, tangible incentives must be provided," adding, "For Ttaenggyeoyo, developing a strategy to retain users who joined after the consumption coupon campaigns has become extremely important."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)