Japanese Alcohol Imports Set to Hit All-Time High This Year

Travel-Driven Consumption Loop... Seeking the Tastes Enjoyed in Japan

Canned Alcohol and Highball Boom Captivates the MZ Generation

Premium Demand Absorbed by Sake and Whiskey

While the domestic alcoholic beverage market is experiencing an overall slump, Japanese alcoholic beverages are on the verge of reaching a record-high import value, continuing their strong performance. The main factors behind Japanese alcohol's resurgence in Korean consumers' glasses, after a period of stagnation during the "No Japan" movement, are the "domestication of travel experiences" and a vast portfolio that ranges from value-for-money options to premium offerings.

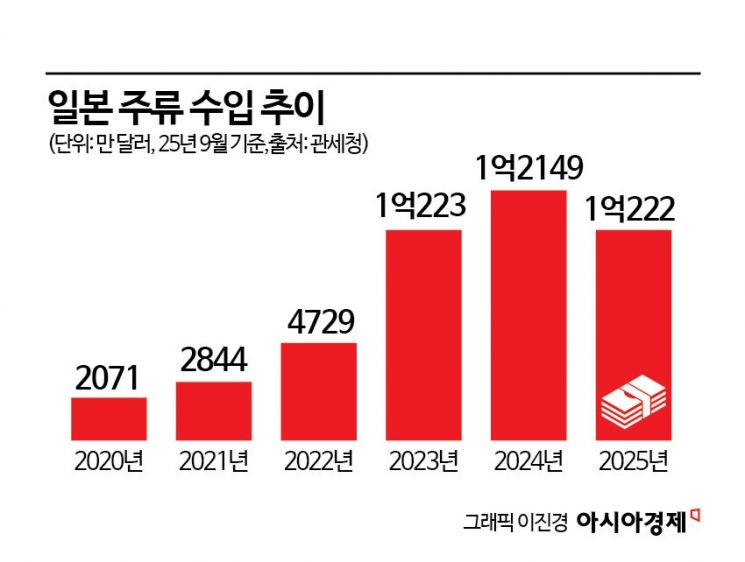

According to the Korea Customs Service on November 3, the import value of Japanese alcoholic beverages this year reached $102.22 million (approximately 146 billion won) as of September, a 13.4% increase compared to the same period last year ($90.18 million).

‘Solo Upward Curve’ Amid Stagnation... Most Categories See Double-Digit Growth

After hitting rock bottom in 2020 due to the boycott of Japanese products, imports of Japanese alcoholic beverages began to recover the following year, surging more than twofold year-on-year to $102.23 million in 2023. This marked a successful comeback, with the $100 million mark being surpassed for the first time in five years since 2018. Last year, the market grew by nearly 20%, and this year, strong demand is expected to set a new all-time high.

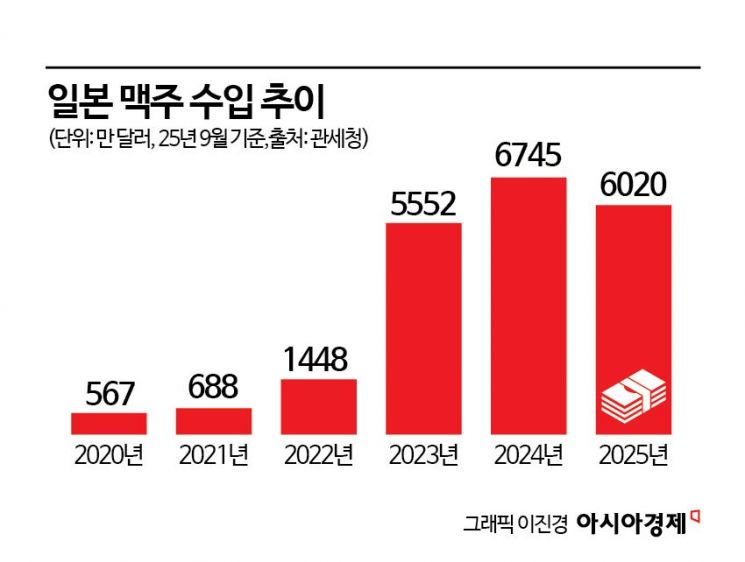

Beer is leading the growth in imports. This year, Japanese beer imports reached $60.2 million (about 86 billion won), up 20.4% from the same period last year ($50.02 million), outpacing overall growth. The increase in Japanese beer imports is even more pronounced when compared to other countries: it is 2.5 times higher than the United States ($24.35 million), the second-largest source, and nearly four times higher than China ($15.81 million), the third-largest. With the peak season in the fourth quarter still ahead, this year’s annual import value is expected to easily surpass the previous record of $78.3 million set in 2018.

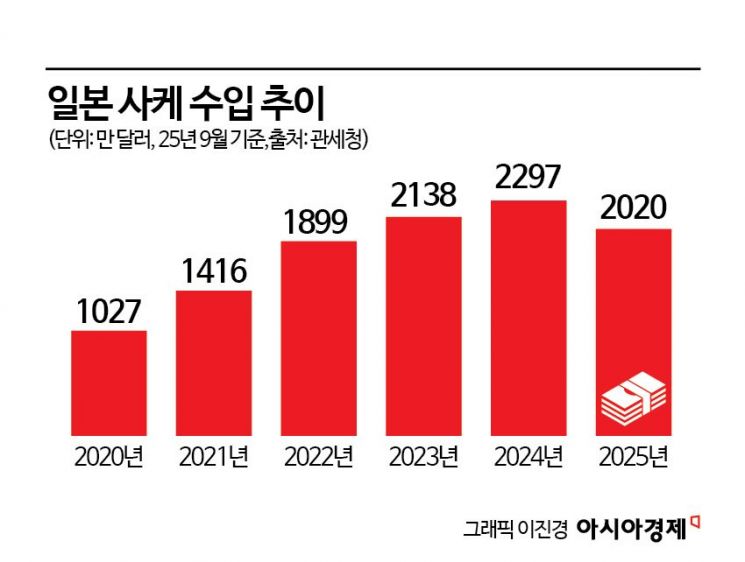

Alongside beer, sake (rice wine) imports are also showing a notable increase. By September, sake imports reached $20.2 million (about 29 billion won), up 18.1% from the same period last year ($17.11 million). Sake imports, which stood at around $10 million in 2020, surpassed the $20 million mark for the first time in 2023, more than doubling in three years. This year, imports are expected to approach $30 million, indicating steady and stable growth in demand.

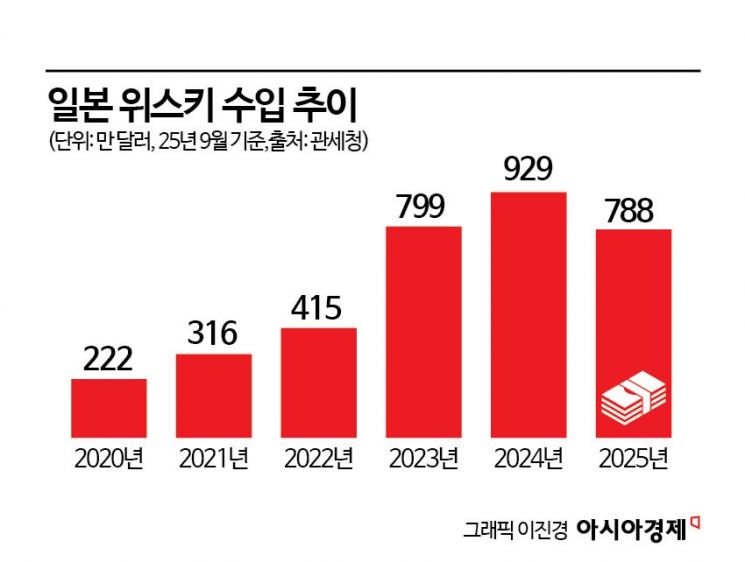

Additionally, whiskey imports totaled $7.88 million (approximately 11.3 billion won), an 8.2% increase from the same period last year ($7.28 million). While the scale and growth rate of whiskey imports are relatively small compared to beer or sake, it is a noteworthy figure considering that Scotch whisky from Scotland (United Kingdom), the world’s largest producer, has seen three consecutive years of decline since 2023. Furthermore, given that whiskey is the most frequently purchased Japanese liquor by Koreans through direct purchases and travel, actual demand is estimated to be even higher.

From Value-for-Money to Premium... Japan’s Comprehensive Portfolio

The continued growth of Japanese alcoholic beverages amid a market downturn is underpinned by a vast portfolio that caters to a diverse range of consumers. While most countries specialize in certain types of alcohol, causing import volumes and performance to fluctuate depending on the popularity of those categories, Japan produces and exports a full lineup of beverages, from affordable value-for-money products to high-end premium offerings.

Japan is also at the center of one of the latest trends in the alcoholic beverage market: low-alcohol and highball products. As the number of Koreans traveling to Japan reaches new highs each year, more and more Koreans are experiencing a variety of Japanese alcoholic beverages at convenience stores and other outlets during their trips. Many consumers then seek out the same flavors they enjoyed in Japan once they return home, prompting importers to bring in a diverse range of products to turn travel consumption into domestic re-consumption. As a result, Japanese canned alcoholic beverages such as beer, highballs, chuhai, and sours are rapidly expanding their presence in domestic convenience stores.

An industry insider explained, “These products typically have low alcohol content, a sweet or refreshing taste, and eye-catching packaging. They are also easily accessible and, above all, affordable. This makes them popular among younger consumers and those less familiar with alcoholic beverages, as they can enjoy them without hesitation.”

Conversely, sake and whiskey are meeting the demand for premium products and unique experiences. For example, sake is increasingly viewed by domestic consumers as a value-driven purchase, thanks to its various grades and drinking cultures. In the past, most sake distributed in Korea was low-priced and sold in packs, primarily at casual izakayas. Recently, however, importers have been upgrading and diversifying their lineups, focusing on premium grades such as “Junmai Daiginjo.”

An industry insider commented, “Japanese sake and whiskey are both new and trendy for Korean consumers, while also boasting heritage brands and products. Since supply is not unlimited, especially for higher grades and limited editions, these products also meet the demand for exclusivity.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.