Race for the 200 Trillion Won Market Cap Club After Samsung and SK

LG Leads on Secondary Battery Market Recovery

Hyundai Motor Closes In, Boosted by Korea-U.S. Tariff Deal

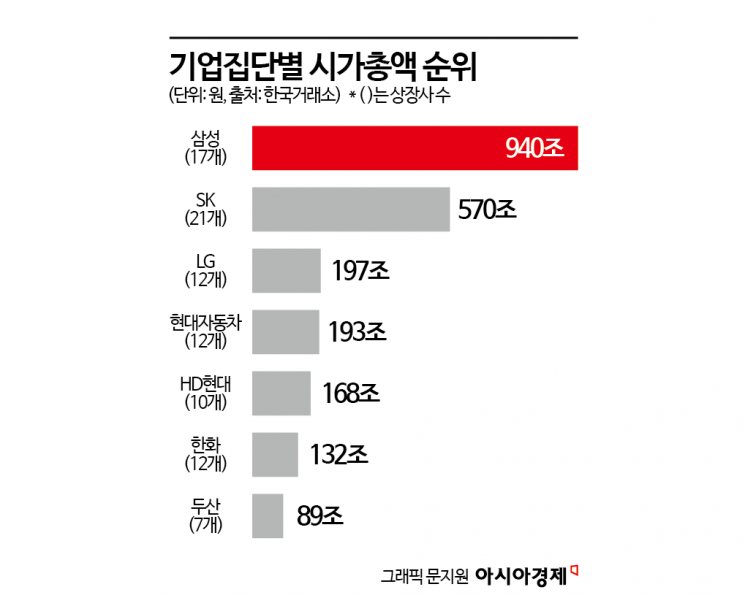

With the recent boom in the domestic stock market, major conglomerates are scaling up, drawing attention to which company will join Samsung and SK as the “Big Three.” LG is on the verge of rejoining the “200 trillion won market capitalization club,” while Hyundai Motor Group, buoyed by the conclusion of the Korea-US tariff negotiations, is expected to fiercely compete for the title.

According to the Korea Exchange on November 4, LG Group’s market capitalization stood at approximately 197 trillion won based on the previous day’s closing price, putting it within reach of surpassing 200 trillion won. On the same day, Hyundai Motor Group finished at 193 trillion won, closely trailing LG. Both groups have 12 listed affiliates, so the gap in market capitalization is not significant. The group that joins the 200 trillion won club will secure the “Big Three” title, following the undisputed leaders Samsung and SK.

The group closest to claiming the title is LG. LG, which surpassed 200 trillion won in market capitalization in 2022 thanks to the listing of LG Energy Solution, fell out of the “200 trillion club” due to a slump in the secondary battery market, but is now rebounding amid expectations of a market recovery.

At the center of this rebound are LG Group’s flagship stocks, LG Energy Solution and LG Chem. After a continuous decline in their share prices since 2023, both companies have seen their stock prices surge by 36% and 60%, respectively, this year, signaling a turnaround. Recently, securities firms have been raising their target prices, and both stocks hit new 52-week highs at the end of last month.

Baek Youngchan, a researcher at SangSangIn Securities, raised the target price for LG Energy Solution from 547,000 won to 645,000 won, stating, “The decline in North American electric vehicle (EV) battery sales can be offset by increased shipments of energy storage systems (ESS), and profitability is expected to continue improving through more active facility utilization.” This is the highest target price among the 10 securities firms that have raised their targets for LG Energy Solution this month.

It is also a positive sign that foreign investors, who have been at the center of this year’s KOSPI rally, are increasing their investment in LG Group affiliates. Last month, foreign investors bought about 5 trillion won in the two main stock markets, with LG Chem (418.4 billion won, third in net purchases), LG Energy Solution (252.5 billion won, sixth), and LG Electronics (215.4 billion won, eighth) ranking high in their portfolios.

While Hyundai Motor Group has not yet joined the “200 trillion won club,” it is rapidly closing the gap with LG Group, thanks to favorable developments among its affiliates, such as Hyundai Rotem’s defense industry rally. In particular, Hyundai Motor, the group’s flagship, had been trading sideways throughout the year, but since last month, expectations for the Korea-US tariff negotiations have pushed its share price close to an all-time high of 299,500 won.

Lee Sanghyun, a researcher at BNK Investment & Securities, raised the target price from 280,000 won to 360,000 won, stating, “With tariffs finalized at 15%, the burden will be reduced compared to before, and the expansion of sales of the highly profitable Palisade Hybrid Electric Vehicle (HEV) will help improve fourth-quarter earnings.” He also noted that the implementation of a shareholder return policy with a total shareholder return (TSR) of over 35% provides strong support for the stock price.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)