Life Insurance CEOs Request Easing of Credit Extension Regulations from Lee Eogwon, FSC Chairman

Surging Demand for Nursing Care, but Additional Investments and Infrastructure Expansion Hindered

"Regulations Should Be Relaxed Specifically for the Nursing Care Business"

Domestic insurance companies are facing difficulties expanding into the nursing care business due to credit extension regulations. As the country enters a super-aged society and demand for nursing care rises, there is a need to expand infrastructure through additional investment, but progress is slow due to regulatory constraints.

According to the financial sector on November 3, chief executive officers of domestic life insurance companies affiliated with financial holding groups recently requested Lee Eogwon, Chairman of the Financial Services Commission, to ease credit extension regulations. These regulations are stipulated in Article 48, Paragraph 2 of the Financial Holding Companies Act (Restrictions on Activities of Subsidiaries, etc.). The key point is that when subsidiaries within a financial holding group extend credit to each other, they must secure an appropriate level of collateral. The amount of collateral is set according to the type of collateral, such as stocks or real estate, and must be within 150 percent of the credit extension amount.

The problem is that life insurers are required to own land and buildings to build nursing facilities with more than 10 people, making it difficult to secure adequate collateral assets at the start of the business. For example, suppose a life insurer under Woori Financial Group establishes a nursing care subsidiary, Company A, and purchases land near the Seoul metropolitan area to build a nursing facility. While it would be easier to obtain a loan from Woori Bank, an affiliate, the company must secure appropriate collateral due to inter-subsidiary credit extension regulations. However, as a newly established company, Company A lacks suitable collateral. As a result, it must obtain unsecured loans from banks under other financial holding groups, such as KB Kookmin Bank or Shinhan Bank. Only after the facility is built can it use the completed building as collateral to obtain a loan from Woori Bank and repay the existing debt. Although capital increases are another option, this places a significant burden on the parent company.

The financial authorities have implemented these regulations to prevent risk contagion within the same financial group. If affiliates freely extend credit to each other and one entity experiences insolvency, the risk could spread like dominoes throughout the group.

However, life insurers unanimously state that the strict regulations are causing significant costs in the process of pursuing the nursing care business. A representative from one life insurer explained, "When we obtain loans from banks affiliated with other financial holding groups, we incur various costs such as credit evaluation and business feasibility assessment," adding, "Due to these burdens, many are currently reluctant to make additional investments in nursing care facilities." Another representative from a life insurer stated, "Currently, in some parts of the Seoul metropolitan area, the waiting period for admission to nursing care facilities is several months due to high demand," and added, "While we understand the purpose of the regulations, it is necessary to lower the hurdles somewhat to shorten the facility construction period."

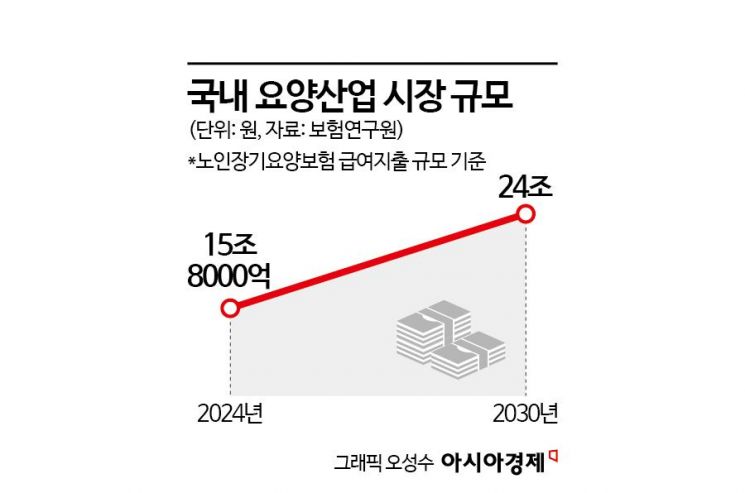

Currently, among domestic life insurers, those that have established subsidiaries and entered the nursing care business in earnest include KB Life, Shinhan Life, Hana Life, and Samsung Life. KB Life has the largest number of nursing care facilities at eight, followed by Shinhan Life and Samsung Life, each with one facility. The industry agrees that the current number of facilities is far from sufficient to meet the growing demand. According to statistics from the Korea Insurance Research Institute, the domestic nursing care industry was valued at 15.8 trillion won last year based on long-term care insurance benefit expenditures, and is expected to reach 24 trillion won by 2030. As of December 23 last year, the proportion of the population aged 65 and over in Korea exceeded 20 percent, signifying that the country has already entered a super-aged society.

Lee Juyeol, Professor of Health Administration at Namseoul University, stated, "Korea's nursing care industry relies on small individual operators, which has caused various problems," and added, "Easing credit extension regulations, at least for insurance companies' nursing care businesses, would be a positive step."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)