Bank of Korea's "Weighted Average Interest Rates of Financial Institutions for September"

Deposit Rates Rise as Market Rates Increase... Up by 0.04 Percentage Points

Mortgage Loan Rates Hold Steady, While Credit and Corporate Loan Rates Fall

The deposit interest rates offered by banks have risen for the first time in a year. This is due to an increase in market interest rates, such as the benchmark rate for bank bonds. In contrast, despite the rise in market rates, the interest rates for mortgage loans remained steady, as some banks' reductions in additional interest rates during August and September were reflected with a time lag.

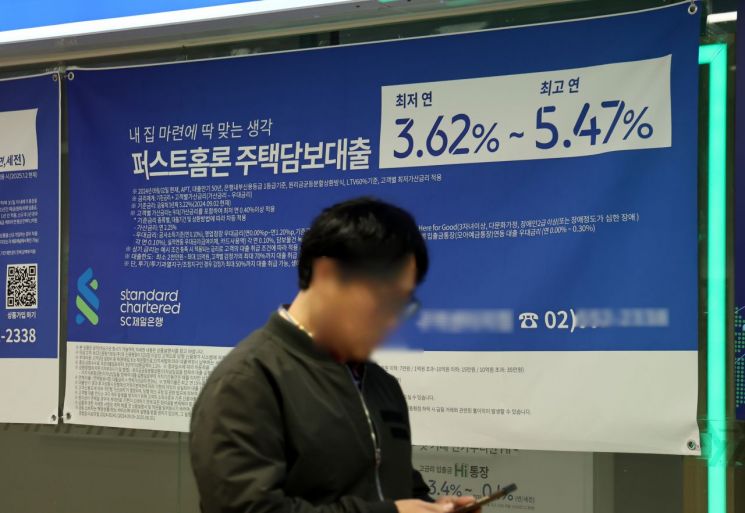

A banner advertising mortgage loans is hung in front of a commercial bank in downtown Seoul. Photo by Yonhap News Agency

A banner advertising mortgage loans is hung in front of a commercial bank in downtown Seoul. Photo by Yonhap News Agency

According to the "Weighted Average Interest Rates of Financial Institutions in September" released by the Bank of Korea on October 31, the savings deposit interest rate (based on new deposits) at deposit banks last month was 2.52%, up 0.03 percentage points from the previous month. This is the first increase in the savings deposit rate in a year, since September last year (3.41%).

More specifically, the interest rate for pure savings deposits, mainly fixed deposits, rose by 0.04 percentage points to 2.52% per annum. The market-based financial products rate, centered on certificates of deposit (CDs) and financial bonds, increased by 0.02 percentage points to 2.54%.

Kim Minsu, Head of the Financial Statistics Team at the Economic Statistics Department 1, explained, "As market interest rates rose for the first time in a year, deposit rates also increased." In fact, six-month and one-year bank bond rates each rose by 0.03 percentage points in September, marking a larger increase compared to the previous month. Regarding the rise in market rates, Kim noted, "There has been a reduction in expectations for a benchmark rate cut in the market," adding, "Since September, instability in the housing market and increased exchange rate volatility have also contributed, which seems to have been reflected in short-term interest rates."

On the other hand, household loan interest rates remained at 4.17% per annum, unchanged from the previous month, despite upward pressure from rising market rates.

Mortgage loan rates also remained at 3.96%, the same as the previous month. After rising to 4.27% in January this year, mortgage loan rates declined for four consecutive months starting in February, then turned upward in June and July, and have since remained steady in August and September.

Specifically, both fixed-rate (3.94%) and variable-rate (4.08%) mortgages remained unchanged from the previous month. Kim explained, "Although benchmark rates have risen, some banks lowered their additional interest rates or expanded their preferential rates between mid-August and early September," adding, "It appears that some banks with room to meet their annual targets reduced their additional rates."

The average mortgage loan rate in October may rise. Kim predicted, "While the impact of banks lowering their additional rates could be more fully reflected with a time lag in October, the benchmark five-year bank bond rate is rising significantly," adding, "Considering this, there is a possibility that interest rates will increase." The five-year bank bond rate rose by 0.09% in October.

Jeonse loan rates fell by 0.02 percentage points from the previous month to 3.76% per annum, marking the first decline in four months since June (3.71%).

General credit loan rates also dropped by 0.1 percentage points over the same period, to 5.31% per annum. This marks the first reversal in three months since July (5.34%), when rates had been rising. The Bank of Korea explained that this was also due to some banks lowering their additional interest rates, despite the rise in benchmark rates.

Including these, household loans remained at 4.17% per annum, unchanged from the previous month. Kim commented, "The share of general credit loans, which have higher interest rates, has increased because their new issuance has not decreased as much as other loans such as mortgages."

Corporate loan rates fell by 0.04 percentage points to 3.99% per annum, marking four consecutive months of decline since June this year. Despite a rise in short-term market rates such as short-term bank bonds, increased policy financing led to lower interest rates for both large corporations and small and medium-sized enterprises. Rates for large corporations fell by 0.08 percentage points to 3.91% per annum, while rates for small and medium-sized enterprises dropped by 0.01 percentage points to 4.05%.

The loan-deposit interest rate spread (based on new transactions) was 1.51 percentage points, down 0.06 percentage points from the previous month. The spread based on outstanding balances remained unchanged from the previous month at 2.19 percentage points.

Meanwhile, the proportion of fixed-rate household loans was 62.1%, down 0.1 percentage points from the previous month. The proportion of fixed-rate mortgages rose by 3.0 percentage points to 91.5%, marking the first increase in four months since June (90.6%).

The deposit interest rates for one-year term deposits at non-bank financial institutions, including savings banks, credit unions, mutual finance, and community credit cooperatives, all declined. Lending rates (based on general loans) also fell across the board.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.