Samsung Electronics Hits Another All-Time High, Climbing to 105,800 Won Intraday

Samsung C&T, Samsung SDI, and Samsung Heavy Industries Also Set New Intraday Highs

Solid Third-Quarter Earnings Add Momentum

Group Stocks Enter a Phase of Simu

As Samsung Electronics continues its record-breaking run, surpassing 100,000 won and reaching all-time highs, other companies within the Samsung Group are also hitting new peaks and showing strong performance. Solid earnings and favorable developments are supporting this simultaneous rally among Samsung Group stocks.

Samsung Electronics Chairman Jay Y. Lee is attending the Nvidia GeForce Gamer Festival held at COEX in Gangnam-gu, Seoul on the 30th. 2025.10.30 Photo by Cho Yongjun

Samsung Electronics Chairman Jay Y. Lee is attending the Nvidia GeForce Gamer Festival held at COEX in Gangnam-gu, Seoul on the 30th. 2025.10.30 Photo by Cho Yongjun

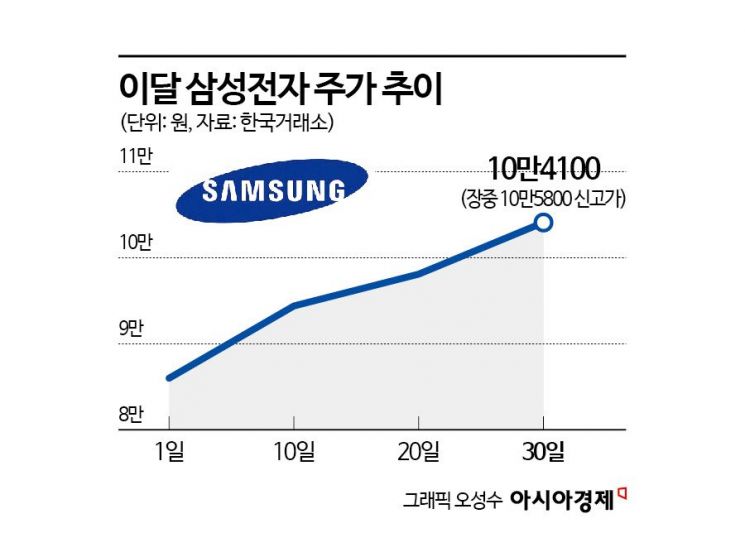

According to the Korea Exchange on the 31st, Samsung Electronics closed at 104,100 won on the previous day, up 3,600 won (3.58%) from the previous session. During the trading day, the stock climbed as high as 105,800 won, setting a new all-time high. After two consecutive days of sharp gains, Samsung Electronics has firmly established itself above the 100,000 won mark.

Other group affiliates have also joined in the record-setting trend. Samsung Heavy Industries rose for the fifth consecutive day, reaching 32,500 won during trading and setting a new 52-week high. Samsung SDI also hit a 52-week high, rising to 349,500 won during the session, while Samsung C&T climbed to 233,000 won, marking a new all-time high.

Previously, Samsung Electro-Mechanics set an intraday all-time high on the 29th, and Samsung Biologics did the same on the 28th, indicating that stock price upgrades are occurring across the group.

This strong performance is being driven by robust earnings and a variety of favorable factors. On the previous day, Samsung Electronics announced its finalized results for the third quarter of this year. On a consolidated basis, the company posted sales of 86.1 trillion won and operating profit of 12.2 trillion won for the third quarter. Sales increased by 8.7% and operating profit by 31.8% compared to the same period last year, achieving the highest quarterly sales ever recorded.

Samsung Electro-Mechanics also achieved its highest-ever quarterly sales, recording 2.889 trillion won in the third quarter, up 10.5% year-on-year. Operating profit increased by 15.7% to 260.3 billion won, exceeding market expectations. Lee Changmin, a researcher at KB Securities, analyzed that Samsung Electro-Mechanics achieved its best performance in three years due to a rebound in demand for IT components driven by seasonal effects in the multilayer ceramic capacitor (MLCC) and packaging substrate divisions, continued strong demand for components for artificial intelligence (AI) servers and automotive electronics, and solid results from the camera module division.

Samsung Biologics also reported its highest-ever quarterly results since its founding. In the third quarter, the company posted consolidated sales of 1.6602 trillion won and operating profit of 728.8 billion won, representing increases of 39.8% and 115.2%, respectively, compared to the same period last year. Lee Heeyoung, a researcher at Daishin Securities, stated, "Despite the higher consensus (average analyst forecasts), the company delivered a surprise performance. The full operation of Plant 4, favorable exchange rates, and the reflection of some batch sales deferred from the second quarter maximized operating leverage. Notably, the quarterly operating margin for Biologics on a standalone basis exceeded 50% for the first time, indicating that Samsung Biologics' large-scale production capacity and optimized processes are translating into high profitability."

Despite weak third-quarter results, Samsung SDI is seeing renewed expectations for a rebound driven by energy storage system (ESS) performance. Securities firms have raised their target prices for Samsung SDI following its earnings announcement, reflecting optimism about ESS growth. NH Investment & Securities raised its target price for Samsung SDI to 410,000 won. Juminwoo, a researcher at NH Investment & Securities, explained, "Given the growth potential of ESS and the announcement of new capacity expansions, ESS's profit contribution is expected to surpass that of electric vehicles (EVs). While the outlook for 2026 still requires further downward revisions due to sluggish EV performance, we expect consensus for 2027, when ESS contributions become significant, to be revised upward." KB Securities also raised its target price from 240,000 won to 400,000 won, stating that ESS will make a significant contribution to Samsung SDI's overall performance improvement in the future. Shinhan Investment & Securities increased its target price from 312,000 won to 350,000 won, and SK Securities raised its target from 250,000 won to 400,000 won.

In addition, favorable factors such as AI momentum and the MASGA (Make American Shipbuilding Great Again) project are also contributing to the strength of Samsung Group stocks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)