Japan's Three Major Banks Actively Expand Overseas to Overcome Low Growth

Overseas Profit Share Surpasses 70% Last Year, Now the Largest Source of Earnings

"Korean Banks Should Also Expand Overseas with a Focus on Profitability"

Japan's three major banks, known as megabanks, have significantly improved their profitability by actively expanding into overseas markets to avoid domestic economic stagnation, according to recent analysis. As South Korea is also experiencing an economic downturn, there are calls for domestic banks to pursue more proactive overseas expansion.

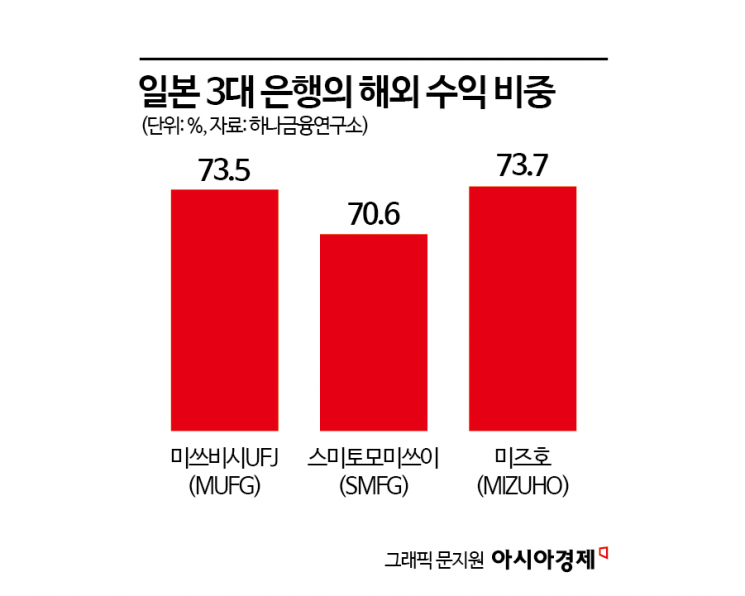

Japan's Top Three Banks: Overseas Revenue Share Exceeds 70%

According to Hana Institute of Finance on October 31, Japan's prolonged economic recession led to decreased corporate demand for funds, which in turn severely undermined bank profitability. The Bank of Japan's long-term low interest rate policy further narrowed the interest margin between deposits and loans, causing significant difficulties for banks.

In response, Japan's major banks began looking abroad in the early 2000s, targeting markets in the United States, Europe, and Southeast Asia to recover profitability. The overseas share of total assets at Mitsubishi UFJ Financial Group (MUFG), Japan's largest bank, rose from 24% in 2004 to 35.5% last year. Another major bank, Sumitomo Mitsui Financial Group (SMFG), increased its overseas loan ratio from 15.5% at the end of March 2008 to 42.3% at the end of March this year, while Mizuho Bank also expanded its overseas loans from 15.5% to 38.3% during the same period.

The proportion of total revenue coming from overseas operations grew even more sharply. As of last year, the overseas revenue share was 73.5% for MUFG, 70.6% for SMFG, and 73.7% for Mizuho.

The overseas investments of Japan's megabanks have not been limited to banking, but have also included non-banking sectors through various means such as mergers and acquisitions (M&A) and equity investments. During the 2008 global financial crisis, they focused investments in the U.S. market, and since then, have expanded into Southeast Asian markets to further boost profits.

Domestic Banks Should Pursue Overseas Expansion with a Focus on Profitability

The Hana Institute of Finance suggested that, as the foundation of South Korea's mid- to long-term economy is weakening, financial companies should actively consider expanding overseas. South Korea's working-age population peaked in 2019 and has since begun to decline, with both the contribution of labor input to growth and the potential growth rate also trending downward. Given the country's economic structure, it is highly likely that the profitability of domestic banking operations will continue to fall.

However, the report pointed out that Korean banks have weaker funding competitiveness compared to Japanese megabanks, making it realistically difficult to expand overseas assets through increased lending. In Japan, banks can essentially raise funds at 'zero interest rates' in the domestic market, allowing them to expand overseas based on interest rate competitiveness. For example, Japanese banks supply funds raised domestically at low interest rates to overseas markets, profiting from the interest rate differential.

In contrast, Korean banks find such arbitrage difficult, so rather than focusing on short-term asset growth, it is advised that they pursue overseas expansion based on tailored strategies for each country or region and a focus on profitability. The report also recommended considering entry into various financial sectors beyond banking, such as the stock market and payment settlement market. For example, in countries like Indonesia and Vietnam, where the stock market is active among younger generations, banks could enter the capital market, while in India, where the growth rate of non-banking financial companies is high, related industry entry could be explored.

Lee Jongsu, a research fellow at the Hana Institute of Finance, emphasized, "Unlike Japanese banks, which can raise funds at low interest rates, Korean financial companies have weak funding competitiveness, making it difficult to quickly raise the overseas asset ratio to the level of megabanks. Therefore, they should focus on profitability and take into account regional characteristics when entering various businesses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)