While KOSPI Rose 27% and KOSDAQ 15%,

Double-Digit Gains Were Rare Among Pharma and Biotech Stocks

Among the Top 10, Only "Earnings-Focused" Companies Like Samsung Biologics and SK Biopharmaceuticals Saw Strong Rallies

However, Companies with High Technology Transfer Potential

May See a Turnaround in the Second Half

Although the KOSPI index has surpassed the 4,000 mark, the pharmaceutical and biotech sectors have not fully benefited from the ongoing rally. As large-cap stocks, particularly in semiconductors and secondary batteries, continue to dominate the market, capital has been concentrated in stocks with visible earnings. In contrast, biotech stocks, which require more time for their pipelines to yield tangible results, have been pushed down the priority list in terms of capital inflow.

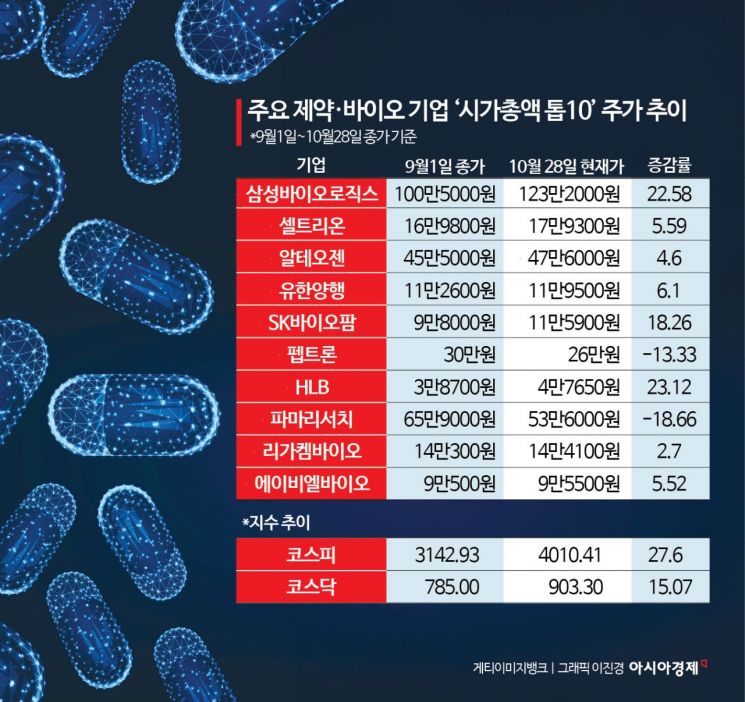

According to The Asia Business Daily's analysis of the stock price trends of the top 10 pharmaceutical and biotech companies by market capitalization, nine out of ten underperformed the KOSPI and KOSDAQ indices. This means that even pharmaceutical and biotech companies considered to have strong growth potential failed to match the average rate of increase during this unprecedented bull market. Using the period from September 1, when the indices saw the steepest gains, to October 28 as a reference, the KOSPI index rose by 27.6% from 3,142.93 to 4,010.41, and the KOSDAQ index increased by 15.07% from 785.0 to 903.30 during the same period.

By individual stock, Samsung Biologics, a large-cap KOSPI stock, rose by 22.58%, Celltrion by 5.59%, SK Biopharmaceuticals by 18.26%, and Yuhan Corporation by 6.1%. In contrast, KOSDAQ-listed companies such as Peptron (-13.33%) and PharmaResearch (-18.66%) experienced corrections. Alteogen (4.6%), Ligochem Bio (2.7%), and ABL Bio (5.52%), which are considered leaders in biotech technology platforms, also significantly underperformed the index's rate of increase. Only HLB, which had seen a sharp decline before September due to issues related to US Food and Drug Administration (FDA) clinical trials, rebounded by 23.12%, outpacing the index. Most of the leading pharmaceutical and biotech companies by KOSDAQ market capitalization failed to achieve even double-digit growth rates.

Samsung Biologics and SK Biopharmaceuticals, which recorded double-digit gains, stand out for having proven themselves as "profitable biotechs" through their earnings. In the third quarter of this year, Samsung Biologics posted sales of 1.6602 trillion won and operating profit of 728.8 billion won, marking its highest-ever quarterly performance. Analysts attribute the stock's rise to the company's expanding share in the global contract development and manufacturing organization (CDMO) market and expectations for a "pure CDMO" following a corporate spin-off. SK Biopharmaceuticals has also been setting new quarterly records, driven by soaring US sales of its epilepsy drug, Cenobamate.

Industry insiders interpret this trend not as a simple sector rotation, but as a reflection of the structural nature of the current rally. The phenomenon of large-scale funds, such as pension funds and institutional investors, focusing exclusively on large-cap export stocks with high earnings visibility in sectors like semiconductors and secondary batteries, is seen not as a recovery of the market's overall fundamentals, but rather as a "concentrated rally" targeting specific sectors such as artificial intelligence (AI) and electric vehicles. Since the KOSPI reclaimed the 3,000 mark on June 20, large-cap stocks (top 100 by market capitalization) have risen by 40.83%, mid-cap stocks (ranks 101-300) by 13.98%, and small-cap stocks (below rank 301) by 1.13%. This indicates that the large-cap rally has driven the "4,000-point era."

There is also a sense that the "neglect" of pharmaceuticals and biotech is a short-term phenomenon. As the season for global pharmaceutical companies' partnerships and technology transfer agreements begins in earnest for the remainder of the year, there is considerable anticipation that even a single major technology transfer deal could shift market sentiment.

Lee Ji-won, a researcher at Heungkuk Securities, predicted, "When interest rate cuts emerge as a policy tool to counter concerns about economic slowdown, the biotech sector could stand out as an attractive investment alternative, given its defensive characteristics and growth potential." Jung Heeryeong, a researcher at Kyobo Securities, added, "Unlike in the past, when expectations and disappointments over clinical data repeatedly drove stock price fluctuations, the domestic biotech industry is now leveling up based on technology platforms."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)