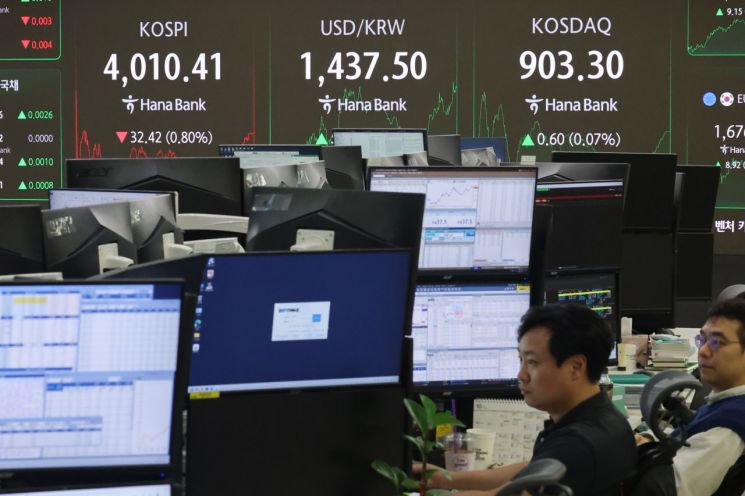

Korea Investment & Securities has set its target for the KOSPI index at 4,600 for next year, following the recent surge past the 4,000 mark and the continuation of the bullish market. The company identified semiconductors and other IT sectors as promising industries. Regarding the government's pledge to join the MSCI Developed Markets Index, which is one of the key promises of the Lee Jaemyung administration, the company predicted that the re-inclusion of Korea on the watch list, which did not materialize this year, is likely to happen next year.

On October 29, Korea Investment & Securities researchers Kim Daejun, Yeom Dongchan, Park Kihun, and Shin Chaelim stated in their report "2026 Investment Strategy: Beyond the Cycle," released to the public, "We expect the KOSPI to rise in the first half of 2026 and move sideways in the second half."

Accordingly, Korea Investment & Securities set its target for next year at 4,600, combining a 12-month forward earnings per share (EPS) of 341 and a 12-month forward price-to-earnings ratio (PER) of 13.5 times. The report stated, "This year's bull market will be maintained for the time being. The record-breaking rally will be supported by various positive factors," citing expectations such as a U.S. benchmark interest rate cut and increased fiscal spending in Korea ahead of the local elections in June next year.

However, the company also observed that uncertainties stemming from former President Trump's influence ahead of the U.S. midterm elections could arise in the second half of the year. The report emphasized, "Ultimately, the first half of 2026 will be the decisive period," adding, "It is strategically important to maintain long positions for the next six months or so."

Semiconductors and other IT sectors were highlighted as promising industries. The overall corporate earnings growth trend is also expected to continue. The report projected, "Existing leading sectors such as semiconductors, shipbuilding, and defense are expected to maintain their upward momentum," and estimated that "earnings forecasts will be revised upward in most sectors." It further advised, "It is also necessary to consider cyclical stocks such as consumer discretionary and financials," and added, "Gradual inflation is positive for cyclical stocks."

The report also noted that artificial intelligence (AI), which was the key theme in the global stock market this year, will continue to be a momentum driver both domestically and internationally next year, and highlighted the upcoming release of the 12th Basic Plan for Electricity Supply and Demand.

The Basic Plan for Electricity Supply and Demand, which is released every two years, comprehensively presents projections for electricity demand over the next 15 years, as well as plans for generation and transmission facilities and the energy mix ratio. The report stressed, "The latest hot topic in AI investment momentum is energy infrastructure bottlenecks," and emphasized that "with new industries such as AI and data centers rapidly expanding, this is the optimal time to assess whether industrial policy is keeping pace with the actual power grid."

Additionally, the report pointed out, "The 11th Basic Plan for Electricity Supply and Demand was based on data as of the end of 2023, so there is a time and policy lag," and suggested, "It is necessary to look for investment momentum in the updated version. Now is the time to pay attention to themes such as high-voltage direct current (HVDC), demand response management, energy storage systems (ESS), and renewable energy infrastructure."

The report also included recommendations to prepare for a more favorable environment for index funds over active funds, and noted that while a passive market is expected to continue next year, the activation of the active fund market through the listing class of public offering funds is also anticipated.

Furthermore, the report projected, "As Korea continues its efforts to improve its MSCI market accessibility assessment, the fastest scenario would see Korea designated as a developed market watch list candidate in 2026 and included in the developed market index in 2027." The report added, "Inclusion in the developed market index could lead to inflows of foreign capital and help resolve the Korea discount, but could also result in net outflows of index funds."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)