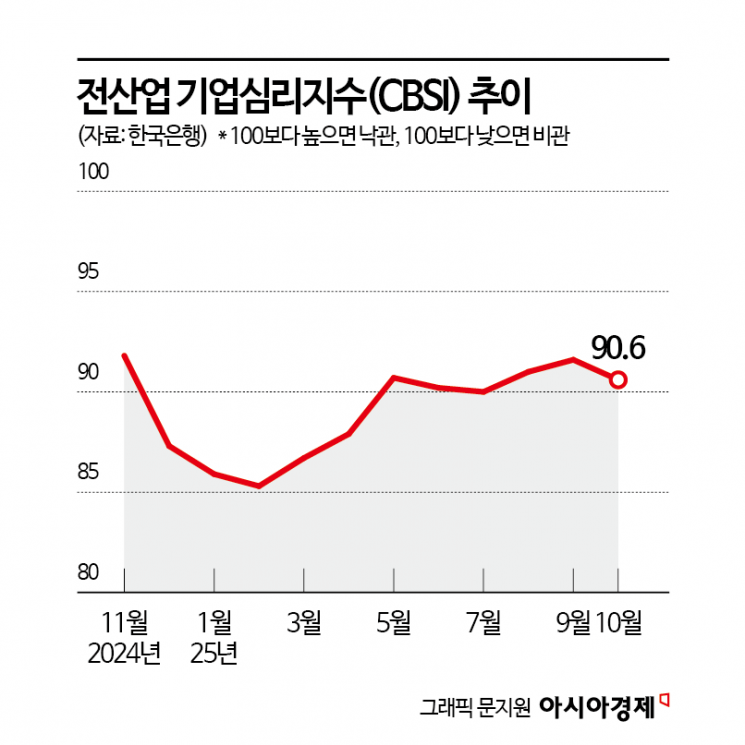

Composite Business Survey Index (CBSI) for All Industries Falls to 90.6, Down 1.0 Points

Outlook Improves for Next Month, Driven by Expectations of US Auto Trade Deal and Other Factors

In October, business sentiment among companies turned downward for the first time in three months. This was due to a reduction in the number of business days during the long Chuseok holiday, as well as an increase in raw material procurement costs caused by the rising exchange rate.

According to the "October Business Survey Index Results and Economic Sentiment Index (ESI)" released by the Bank of Korea on the 29th, the Composite Business Sentiment Index (CBSI) for all industries this month was 90.6, down 1.0 points from the previous month. The CBSI is a business sentiment indicator calculated using major indices from the Business Survey Index (BSI). A reading above 100 indicates that companies are more optimistic about the economic situation compared to the past, while a reading below 100 suggests pessimism.

This month, the manufacturing CBSI recorded 92.4, down 1.0 points from the previous month. In manufacturing, declines in production (-0.8 points) and product inventory (-0.6 points) were the main factors behind the decrease.

Manufacturing performance worsened, especially in primary metals, fabricated metals, and rubber and plastics. The primary metals sector was affected by rising raw material prices and the Carbon Border Adjustment Mechanism (CBAM). The CBAM, which will be implemented by the European Union (EU) starting in January next year, imposes the same level of carbon costs on carbon-intensive products imported from countries with less stringent carbon regulations as those incurred by companies within the EU. The fabricated metals sector was impacted by sluggish demand in the construction industry, which is a downstream sector, as well as increased raw material costs due to the rising exchange rate. For rubber and plastics, the decrease in the number of business days and reduced demand from downstream industries such as automobiles and home appliances contributed to the decline in performance.

The non-manufacturing CBSI also fell by 1.0 points to 89.5. In the non-manufacturing sector, tighter financial conditions (-1.0 points) and lower profitability (-1.0 points) were the main factors behind the decline. Non-manufacturing performance deteriorated mainly in wholesale and retail trade and information and communications. The wholesale and retail sector was affected by factors such as the pull-forward of holiday demand, fewer business days, and increased cost burdens due to the rising exchange rate. The information and communications sector saw a decline, particularly among video production and broadcasting companies.

The business sentiment outlook for next month was surveyed at 91.1, up 2.6 points from the previous month. Manufacturing is expected to rise by 3.2 points to 92.6, while non-manufacturing is projected to increase by 2.3 points to 90.2. The November manufacturing outlook is expected to improve, particularly in automobiles, chemicals and chemical products, and electronic, video, and communications equipment. Next month’s non-manufacturing outlook is expected to improve mainly in wholesale and retail trade, electricity, gas, and steam supply.

Lee Hyeyoung, head of the Economic Sentiment Survey Team at the Economic Statistics Department 1 of the Bank of Korea, commented on the improved business sentiment outlook, saying, "In manufacturing, the recovery in the number of business days and expectations for a trade agreement with the United States in the automobile sector have been reflected." She added, "In the steel sector, expectations for a decrease in import volume and a rise in prices due to the imposition of anti-dumping duties have also played a role." As for non-manufacturing, she explained that, except for seasonally slow sectors such as arts, sports, leisure-related services, and accommodation, most industries responded positively.

The ESI, which combines the BSI and the Consumer Sentiment Index (CSI), rose by 3.1 points from the previous month to 94.4. The cyclical variation, which removes seasonal factors, stood at 93.6, up 0.7 points from the previous month.

Meanwhile, this survey was conducted from October 14 to 21, targeting 3,524 incorporated companies nationwide. Of these, 1,831 were manufacturing companies and 1,455 were non-manufacturing companies, with a total of 3,286 companies (93.2%) responding.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)