KOSPI Holds Above 4,000 Despite 1.7 Trillion Won Net Sell-Off by Foreign Investors

The Korean stock market, which had been rising sharply for several days, showed signs of taking a breather. Despite foreign investors offloading shares worth 1.8 trillion won, the KOSPI managed to hold above the 4,000 mark, while the KOSDAQ closed slightly higher in the 900 range.

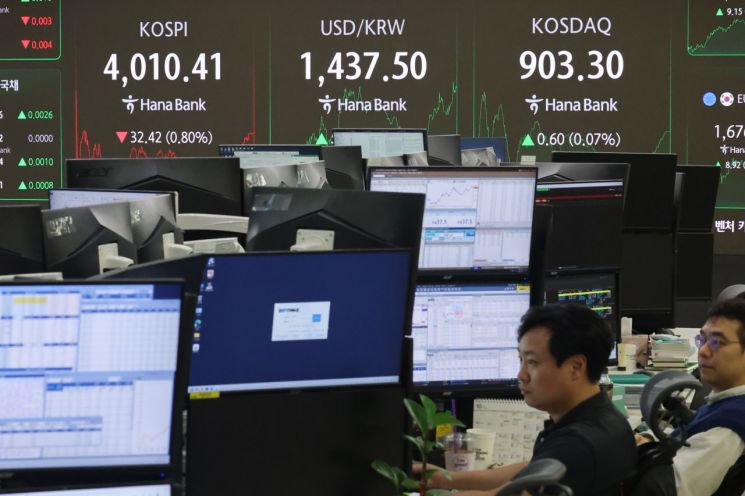

On the 28th, the KOSPI ended regular trading at 4,010.41, down 0.80% from the previous day. At 10:21 a.m., it had dropped as much as 1.74% to 3,972.56 compared to the previous day, but quickly recovered to surpass the 4,000 level. The index managed to stay in the 4,000 range despite continued selling by both foreign investors and institutions.

On this day, foreign investors recorded a net sell of 1.7954 trillion won, marking the largest daily sell-off since April 9 (2.1668 trillion won). Institutions also net sold 207 billion won, while individual investors net bought 2.1057 trillion won.

More sectors declined than advanced. There were several sectors that fell by more than 1%, including transportation equipment and parts (-2.28%), distribution (-1.66%), and electrical and electronics (-1.25%). On the other hand, electric and gas (1.97%), machinery and equipment (1.47%), and pharmaceuticals (1.11%) saw gains.

Among the top 10 companies by market capitalization, the results were mixed. Doosan Enerbility (5.4%), Samsung Biologics (2.6%), and LG Energy Solution (2.4%) each rose by more than 2%. In contrast, HD Hyundai Heavy Industries (-4.8%), Hanwha Aerospace (-3.9%), SK Hynix (-2.6%), Samsung Electronics (-2.1%), Hyundai Motor (-1.3%), KB Financial Group (-1.1%), and Kia (-1.0%) each fell by more than 1%.

The KOSDAQ closed at 903.30, up 0.07%. After opening slightly higher above 900, it dipped to 896.36 but managed to rebound.

In the KOSDAQ market, only foreign investors recorded a net sell of 178.1 billion won. Individual and institutional investors net bought 201.5 billion won and 12.5 billion won, respectively.

Sector performance was mixed. Construction (3.86%), finance (2.10%), other manufacturing (2.06%), and publishing and media reproduction (1.03%) rose, while non-metallic minerals (-1.51%), transportation equipment and parts (-1.41%), textiles and apparel (-1.37%), and machinery and equipment (-1.00%) declined.

Among the top 10 companies by market capitalization, Ecopro posted the largest gain at 3.3%, followed by HLB (2.8%), ABL Bio (1.0%), PharmaResearch (0.3%), Ecopro BM (0.2%), and Rainbow Robotics (0.2%). On the other hand, Peptron (-5.1%), Samchundang Pharm (-3.1%), and Alteogen (-1.4%) declined.

On the 28th, the status board in the dealing room of Hana Bank's headquarters in Jung-gu, Seoul, displayed the KOSPI, the won/dollar exchange rate, and the KOSDAQ index. Photo by Yonhap News Agency

On the 28th, the status board in the dealing room of Hana Bank's headquarters in Jung-gu, Seoul, displayed the KOSPI, the won/dollar exchange rate, and the KOSDAQ index. Photo by Yonhap News Agency

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.