Stock Price Surges 68% This Month

Analysts Divided After Q3 Earnings Announcement

SK and Daol Securities Raise Target Price to 300,000 Won

Hana and Hanwha Securities Urge Caution Amid Sharp Rally

There are mixed outlooks in the securities industry regarding Posco Future M, whose stock price has risen by 70% this month. Some analysts, after reviewing Posco Future M's third-quarter results for this year, have concluded that despite the improved performance, the potential for further gains is limited. In contrast, SK Securities and Daol Investment & Securities have raised their target price to 300,000 won, citing significant benefits from the ongoing conflict between the United States and China.

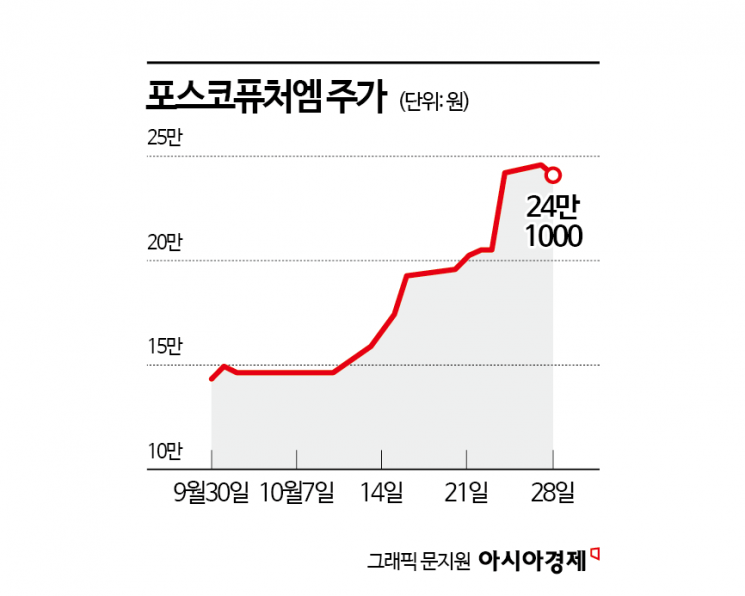

According to the financial investment industry on October 29, Posco Future M's stock price rose by 67.9% this month through the previous day. This surpasses the 53.8% increase recorded by Ecopro BM over the same period. Posco Future M's market capitalization has expanded to 21.43 trillion won.

On a consolidated basis, Posco Future M posted sales of 874.8 billion won and operating profit of 66.7 billion won in the third quarter of this year. Compared to the same period last year, sales decreased by 5.2%, but operating profit surged by 4,775.0%.

Choi Boyoung, a researcher at Kyobo Securities, stated, "The company achieved results exceeding the market expectation of 25.7 billion won in operating profit," and explained, "Shipments of high-nickel cathode materials (N86, N65) increased due to customers' move away from China and the impact of carbon dioxide regulations." He added, "The total cathode material volume is estimated to have increased by about 86% compared to the previous quarter. Operating profit rose, reflecting improved fixed costs per unit due to higher utilization rates and inventory valuation provisions resulting from rising lithium prices."

Each securities firm's research center released reports after reviewing Posco Future M's third-quarter results. Park Hyungwoo, a researcher at SK Securities, said, "For anode materials, the company secured price competitiveness over Chinese competitors due to U.S. tariffs on Chinese goods," and added, "We expect Posco Future M to secure an advantage based on qualified precursors and anode materials as the U.S.-China dispute continues."

Yoo Jiwoong, a researcher at Daol Investment & Securities, analyzed, "We have confirmed a full-fledged trend of profit improvement from energy storage systems (ESS)," and stated, "We are raising our 2027 earnings per share (EPS) estimates to reflect changes in assumptions regarding ESS orders." He emphasized, "We expect a sharp increase in demand for cathode materials based on qualified precursors from the fourth quarter of this year onward."

On the other hand, some have advised a more cautious approach, considering the rapid rise in the stock price recently. Kim Hyunsoo, a researcher at Hana Securities, analyzed, "The stock price jumped by 70% in just 10 trading days after the holiday this month, fully reflecting all the factors driving the rally," and added, "The target price of 198,000 won is based on a price-to-earnings ratio (PER) of 322 times next year's expected earnings, which means there is no compelling valuation-based rationale for buying."

He pointed out, "The rise in market capitalization to around 20 trillion won can be explained by fundamental logic," but also noted, "Any further increase from here would push the stock into a somewhat burdensome price range."

Lee Yongwook, a researcher at Hanwha Investment & Securities, also stated, "Expectations for a turnaround to profitability in the secondary battery sector and anticipated benefits from the U.S. policy of decoupling from China have combined to drive Posco Future M's stock price up by 90% from its September low," and cautioned, "Given the increased uncertainty in next year's performance, a prudent approach is necessary following this short-term rally."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)