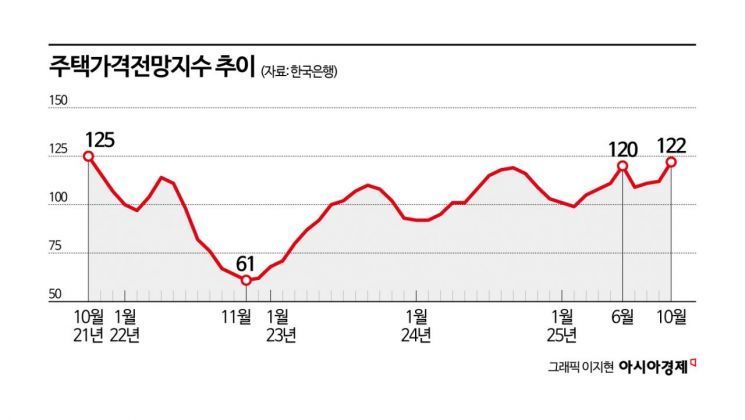

Housing Price Outlook Index at 122 in October

Soars to "Panic Buying" Levels of 2021

"Back Up to Pre-June 27 Measures"

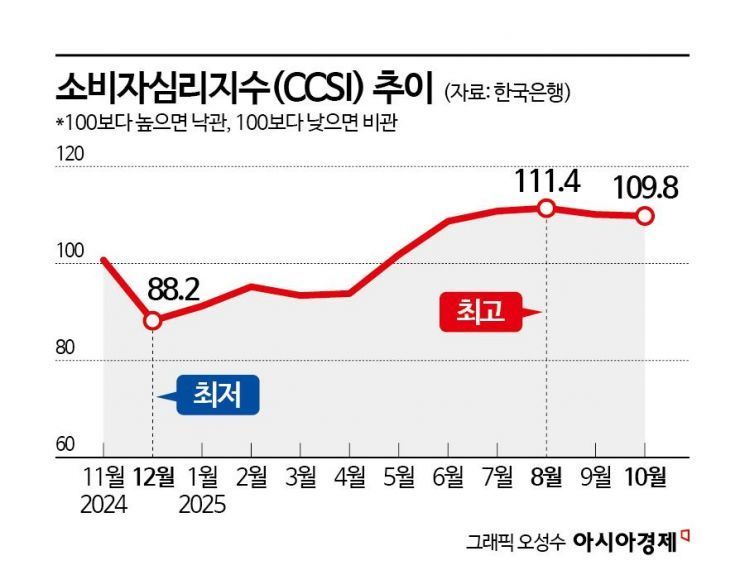

Consumer Sentiment Index Falls for Second Month... 109.8

Expectations for rising home prices have reignited. As apartment prices in Seoul and the greater metropolitan area climb steeply, sentiment has surged to the level seen in October 2021, when "panic buying" was rampant. Despite a series of policy measures, including the government's household loan regulations announced on June 27, expectations for higher home prices, which seemed to have paused, have proven difficult to subdue.

Housing Price Outlook Index Rises 10 Points in a Month... "Higher Than in June"

According to the "October 2025 Consumer Survey Results" released by the Bank of Korea on the 28th, this month's Housing Price Outlook CSI reached 122, up 10 points from the previous month. This is the highest level in four years since October 2021 (125), when even those in their 20s and 30s joined the panic buying, and it far exceeds the long-term average of 107. The increase is also the largest in three years, since April 2022 (a 10-point rise).

The Housing Price Outlook CSI reflects consumer expectations for home prices one year from now. When the index exceeds the baseline of 100, it indicates that more respondents expect home prices to be higher a year later than they are now.

This index has been rising steadily since February this year, soaring to 120 in June. After the household debt management measures announced on June 27, it dropped sharply by 11 points, but began climbing again from August. While it rose only 3 points in total over the past two months, this time the increase is significant, surpassing even the level in June, when authorities expressed concern over an overheated housing market.

Lee Hyeyoung, head of the Economic Sentiment Survey Team at the Economic Statistics Department 1, explained, "The expansion of the rise in apartment sale prices nationwide, centered on the metropolitan area, has had an impact," adding, "Consumers' expectations for home prices appear to have returned to the level before the June 27 measures."

With expectations for home prices once again overheating, some point out that the government's three rounds of strong real estate measures have either lost their effectiveness or even fueled expectations further. Notably, the survey period overlapped with the announcement of the October 15 measures, as it was conducted from October 14 to 21.

Regarding this, Lee said, "Since 75% of responses were collected on the 14th, before the real estate measures were announced, it is difficult to say that consumer opinions on the measures were fully reflected," adding, "A more in-depth analysis of the policy effects is needed."

Consumer Sentiment Index Falls for Second Month... "Due to Trade-Related Uncertainty"

This month's Composite Consumer Sentiment Index (CCSI) stood at 109.8, down 0.3 points from the previous month. The CCSI is calculated using six key indices that make up the Consumer Survey Index (CSI), providing a comprehensive picture of consumers' economic sentiment. With the long-term average set at 100, a reading above 100 is considered optimistic, while below 100 is pessimistic.

The CCSI had risen for five consecutive months from April this year, suggesting a recovery in consumer sentiment that had been subdued since the declaration of martial law in December last year. However, it has now fallen for two consecutive months since September. Lee explained, "The slight decline was due to trade-related uncertainty, such as the prolonged South Korea-U.S. trade negotiations and renewed U.S.-China trade tensions."

By category, the Current Economic Assessment CSI, which compares the present situation to six months ago, remained at 91, unchanged from the previous month. While this is below the baseline of 100, it is higher than the long-term average (2008-2024) of 72. The Future Economic Outlook CSI, which forecasts economic conditions six months ahead, fell 3 points from the previous month to 94. This index has declined for four consecutive months since July.

The expected inflation rate for the next year (2.6%) rose by 0.1 percentage points from the previous month, due to concerns over a wider increase in consumer prices and a rising won-dollar exchange rate. The expected inflation rates for three and five years ahead also both increased by 0.1 percentage points to 2.6%. Among the items expected to have the greatest impact on consumer prices over the next year, agricultural, livestock, and fisheries products accounted for 53.8%, public utility charges for 38.7%, and industrial products for 32.2%. The proportion of respondents citing rent also rose from 11.8% to 15.8%, up 4 percentage points from the previous month.

Meanwhile, this survey was conducted from October 14 to 21 among 2,500 households in urban areas nationwide, with 2,274 households responding.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)