[Hyundai Motor, Over the Mobility] (37)

Analysis of Competitors: Toyota, Tesla, BYD, and More

BYD Achieves No. 1 EV Market Share

with Chinese-Style Innovation in Technology, Production, and Price

Challenges Remain for Overseas Expansion,

In

The scene at the BYD Brand Launch Media Showcase for the Chinese electric vehicle brand held last January at Incheon Sangsang Platform. Incheon Photo by Kang Jinhyung

The scene at the BYD Brand Launch Media Showcase for the Chinese electric vehicle brand held last January at Incheon Sangsang Platform. Incheon Photo by Kang Jinhyung

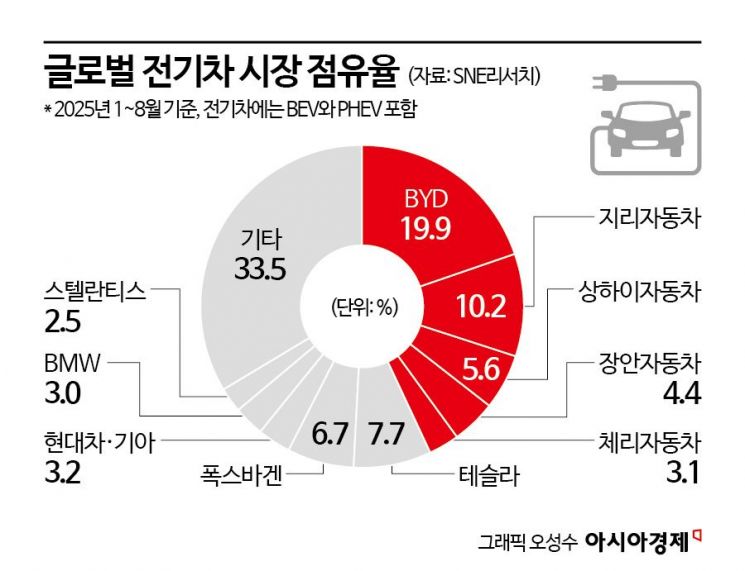

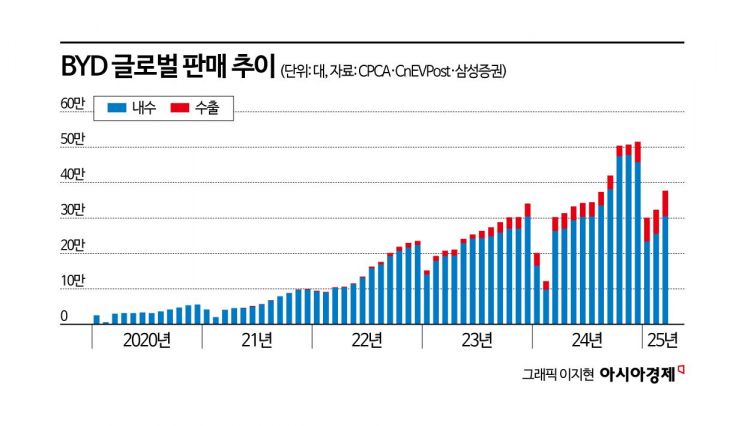

BYD is the fastest-growing company in the global electric vehicle market. It is the top seller of electric vehicles worldwide, with a market share approaching 20% as a single brand. Last year, its global sales increased by 43% compared to the previous year, marking double-digit growth for four consecutive years. This rapid growth can be largely attributed to the Chinese market. In fact, six out of every ten electric vehicles sold globally last year were purchased in China, making it the world's largest electric vehicle market. As electric vehicles have quickly become widespread in this massive market of 1.4 billion people, China's leading brand naturally rose to become the global leader.

This trend has continued into this year. As of August, Chinese brands accounted for 43% of the global electric vehicle market. This is due to two independent factors: the rise of patriotic consumption among Chinese consumers after the COVID-19 pandemic, and the rapid improvement in the technological and design competitiveness of local electric vehicle brands. The Chinese market has now become an "impregnable fortress" for foreign brands. At one point, Hyundai Motor and Kia had a combined market share in China exceeding 10%, but now it has dropped to around 1%.

Furthermore, global automakers are extremely wary of "Chinese-style innovation." Despite being latecomers, Chinese companies have implemented a new innovation model that combines technological, production, and price competitiveness. Failing to capture the world's largest market, China, means the dream of becoming number one globally will remain out of reach. So, where does the power of "Chinese-style innovation"-which has even made global competitors nervous-come from? We examine its meaning and driving force through BYD.

Chinese-Style Innovation: Prioritizing Image Over Profit

Chinese-style innovation pursues the "image of innovation" itself, rather than profit. In the automotive marketing industry, there is a saying: "American consumers buy performance, European consumers buy brands, and Chinese consumers buy innovation." Chinese consumers tend to seek out new technologies and novel features-in other words, "innovation itself." They prefer cars that are packed with technological freshness and differentiation over those that simply offer safety, durability, or quality. For them, a car is not just a means of transportation, but a "total embodiment of innovation."

BYD was the first to ignite the "innovation race" in the midst of fierce technological competition. Its main stage is the battery sector, where BYD is most confident. The next-generation electric vehicle platform "Super e Platform," unveiled in March, is a symbolic achievement. BYD equipped this platform with an ultra-high output and high-voltage system, boasting a maximum output of 1000kW and a maximum voltage of 1000V. This shocked the industry by achieving charging speeds comparable to refueling a gasoline car.

Until then, Hyundai Motor had the fastest charging technology. In 2021, Hyundai introduced its dedicated E-GMP platform, supporting 350kW output and 800V voltage, to its mass-produced vehicles. This enabled "ultra-fast charging," allowing the battery to be charged from 10% to 80% in just 18 minutes.

BYD surpassed this record in just four years, introducing a new technology that enables "400km of driving range with a 5-minute charge." Both the output and voltage (1000kW, 1000V) exceeded Hyundai Motor's (350kW, 800V), and it even outperformed Tesla's fourth-generation Supercharger, which recently debuted with a maximum 500kW charging capability.

An electric vehicle equipped with BYD's 'Super e Platform' being charged at a 1000kW ultra-fast charger located in Longhua District, Shenzhen, China. Photo by Woo Suyeon

An electric vehicle equipped with BYD's 'Super e Platform' being charged at a 1000kW ultra-fast charger located in Longhua District, Shenzhen, China. Photo by Woo Suyeon

In June, at BYD's headquarters in Shenzhen, China, a demonstration of the "Super e Platform" charging was conducted. After opening the charging port of the flagship electric sedan "Han L" and connecting the charger, the car instantly absorbed power. It took just 4 minutes and 49 seconds for the range displayed on the dashboard to jump from 15km to 400km.

This was clear proof that BYD's claim of "400km of range with a 5-minute charge" was not an exaggeration. When BYD first unveiled its ultra-fast charging technology, the industry was skeptical, citing concerns over heat generation and durability. BYD reportedly addressed these issues by adopting high-stability LFP (lithium iron phosphate) battery technology and strengthening thermal management systems to minimize heat problems.

Additionally, the industry anticipated that the high cost of building ultra-fast charging infrastructure would delay the commercialization of this technology for some time. However, BYD placed greater value on maintaining its image as an "innovation leader" than on the speed of commercialization or immediate profit. Its strategy is to solidify the brand's image as a technological leader by claiming the title of "world's first."

From Battery to Finished Vehicle: Vertical Integration and Speed

Another strength of BYD is its vertically integrated parts supply chain. From batteries, motors, drive components, power electronics, automotive semiconductors, body and platform, to final vehicle assembly, BYD internally develops and manufactures most of the automotive value chain. Although BYD does not officially disclose the exact figure, industry analysis suggests that BYD itself produces 75-80% of the parts needed for each vehicle. This structure is rare even among global automakers.

This system stems from BYD's origins as a "manufacturer that started as a battery company." Founded in 1995 by Chairman Wang Chuanfu, BYD was originally a battery cell production company. It grew by supplying batteries for mobile phones and nickel/lithium-ion batteries, and when it entered the automotive business in 2003, it applied its existing battery technology to electric vehicle production.

The booth of BYD, participating for the first time at 'InterBattery 2025' held at COEX in Gangnam-gu, Seoul last March. Photo by Yonhap News

The booth of BYD, participating for the first time at 'InterBattery 2025' held at COEX in Gangnam-gu, Seoul last March. Photo by Yonhap News

Internalizing battery technology has become BYD's core competitive edge. Through its subsidiary "FinDreams," BYD independently produces battery cells, modules, and packs. In this process, it developed proprietary technologies such as the "Blade Battery," which is regarded as setting a new standard for LFP batteries in terms of safety and durability. Furthermore, BYD is also securing mining rights for key minerals such as lithium and cobalt to ensure a stable supply of raw materials.

This structure of developing and producing key components in-house yields three simultaneous benefits: ① cost reduction, ② supply chain stability, and ③ technological independence. Because BYD has low dependence on external parts suppliers, it suffered relatively little during the global semiconductor shortage or maritime logistics delays. Directly designing and manufacturing core parts accelerates technological development and ultimately helps reinforce its "innovative brand image." By assembling and producing all parts in its own factories, BYD can also flexibly adjust production speed in response to market demand changes.

BYD's rapid pace of innovation is not solely the result of its corporate system. The unique social and cultural environment in China also plays a significant role. In just a few years, BYD has built more than ten factories around the world (nine in China and about five overseas). Even for overseas factories, the average time from groundbreaking to operation is only 12-16 months-about half the time required for a typical global automaker's plant (which usually takes two to three years).

This clearly demonstrates the speed of Chinese-style innovation. The saying that "China has caught up with Korea's past industrialization speed" is no exaggeration. Unlike the Korean or European models, where production flexibility is limited by regulations such as the 52-hour workweek and powerful labor unions, China can drastically shorten the lead time from decision to groundbreaking to operation thanks to flexible working hours, policy support, and swift administrative approvals. Of course, this structure is not necessarily worker-friendly. However, from the perspective of companies that prioritize "innovation and speed" above all else, such a social environment is undoubtedly one of the core drivers of "Chinese-style innovation."

On the 9th, Wang Chuanfu, Chairman of BYD (left in the photo), handed over the 14 millionth eco-friendly vehicle 'Song Pro' produced by BYD to Luiz In?cio Lula da Silva, President of Brazil. Provided by BYD

On the 9th, Wang Chuanfu, Chairman of BYD (left in the photo), handed over the 14 millionth eco-friendly vehicle 'Song Pro' produced by BYD to Luiz In?cio Lula da Silva, President of Brazil. Provided by BYD

BYD Faces Barriers in Europe and the US: The Next Challenge

Even BYD, which had been growing rapidly, has recently begun to show its limits. While it maintained the top market share in the Chinese electric vehicle market (about 42% in the first quarter of 2025), the pace of growth has slowed due to increasingly fierce domestic competition. As the overall growth of the Chinese electric vehicle market has moderated, concerns over excessive investment in production facilities have also grown. There are now warnings that the aggressive expansion of production capacity during the boom could become a burden.

For these reasons, BYD and other Chinese electric vehicle manufacturers are turning their eyes overseas. Of the 1 million vehicles BYD sold globally in the first quarter of 2025, 200,000 were exported to overseas markets such as Europe, South America, and Southeast Asia. Starting at the end of this year, BYD's Hungarian plant, with an annual production capacity of 800,000 units for local European production, will begin full-scale operations.

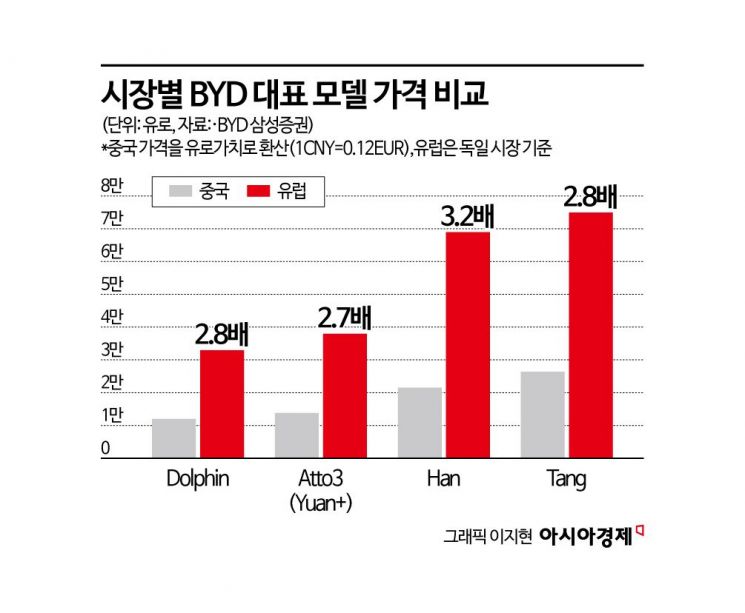

In particular, BYD is accelerating its entry into high value-added markets such as Europe. This is because the average selling price of vehicles in the European market is more than three times higher than in China, even for the same model. For example, BYD's entry-level electric vehicle "Dolphin Surf (2025 model)" starts at 22,990 euros (about 38 million won) in Germany, while the "Seagull," a domestic model on the same platform, starts at 56,800 yuan (about 1.06 million won) in China. In other words, a car that sells for about 10 million won in China is sold for over 30 million won in Europe. Even though it is more than three times more expensive, it still has a price advantage compared to European brand electric vehicles. For instance, the starting price of Volkswagen's small electric vehicle ID.3 in Germany is over 50 million won (about 29,760 euros).

To counter China's price competitiveness, there have been claims in Europe that "Chinese brands sell electric vehicles at excessively low prices thanks to Chinese government subsidies," which violates fair competition. In response, the European Union imposed anti-dumping tariffs of up to 45.3% on Chinese electric vehicles starting in October 2024, citing concerns that Chinese electric vehicles threaten the competitiveness of European manufacturing. The situation is even tougher in the United States. Due to escalating US-China tensions, the US has imposed a 25% high tariff on Chinese electric vehicles, strengthened requirements for parts origin and data management, and excluded them from subsidy eligibility. This has effectively blocked Chinese automakers from entering the US market. BYD also considered indirect exports via Mexico but ultimately abandoned the plan.

Recently, BYD announced the expansion of its autonomous driving assistance system "God's Eye" to all its models. By spreading a technology previously limited to premium vehicles to mid- and low-priced models, BYD aims to popularize autonomous driving technology. This move is intended to strengthen its leadership in the global autonomous driving competition by leveraging technological accessibility. In June, during a test drive in Shenzhen, China, BYD's premium brand "Yangwang" flagship SUV "U8" autonomously handled navigation, traffic signal recognition, and parking-all the driver had to do was enter the destination. The entire driving process on the road was completed without driver intervention, giving the impression that BYD's autonomous driving technology is already a step ahead of its competitors.

BYD's rise sends a clear message to Hyundai Motor Group. First, Hyundai Motor must secure dominance in the US market, where Chinese electric vehicle companies find it difficult to enter. The US is the world's second-largest auto market after China and the main stage where global automakers compete in technology and brand power. Being recognized in this market means proving both brand trust and profitability. Hyundai Motor should proactively establish its position while Chinese brands like BYD are unable to enter, in order to gain an edge in the upcoming global electric vehicle market share competition.

Second, fierce competition between Korean and Chinese electric vehicle makers in emerging markets such as India, Southeast Asia, Central and South America, and the Middle East is inevitable. In these regions, price competitiveness is the key factor influencing purchase decisions rather than brand power. Hyundai Motor, BYD, MG (SAIC Motor), and Geely are cited as companies capable of producing highly cost-competitive electric vehicles. Ultimately, these emerging markets will become "battlefields for low-cost electric vehicles," and the companies that survive here are most likely to become the final winners in the global electric vehicle market.

BYD's premium brand Yangwang's flagship SUV U8 features the brand's advanced driver assistance system, Divine Eye, in its highest specification. It supports semi-autonomous driving functions, traffic light recognition, and automatic parking. Photo by Woo Suyeon

BYD's premium brand Yangwang's flagship SUV U8 features the brand's advanced driver assistance system, Divine Eye, in its highest specification. It supports semi-autonomous driving functions, traffic light recognition, and automatic parking. Photo by Woo Suyeon

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.