Secondary Battery Stocks Become More Sensitive to Positive News

Technical Rebound and Anticipation of ESS Demand Recovery Reflected

Further Upside Hinges on Electric Vehicle Market Recovery

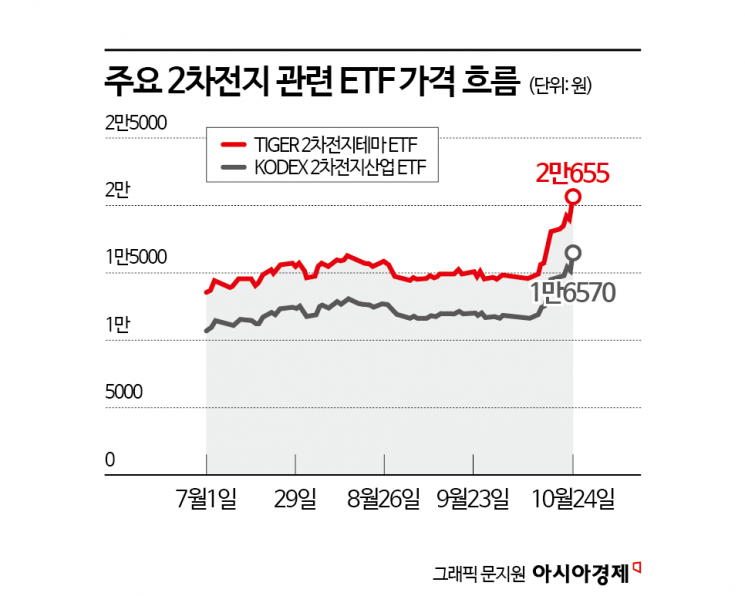

Recently, exchange-traded funds (ETFs) related to secondary batteries have been rebounding rapidly in the domestic stock market. The KODEX Secondary Battery Industry ETF and the TIGER Secondary Battery Theme ETF, both of which have assets under management (AUM) exceeding 1 trillion won, have risen by about 40% over the past month. Expectations for a recovery in the industry, the restructuring of global supply chains, and increasing demand for energy storage systems (ESS) are cited as the main drivers of this rebound.

According to the financial investment industry on October 27, the KODEX Secondary Battery Industry ETF and the TIGER Secondary Battery Theme ETF recorded one-month returns of 40.4% and 40.0%, respectively. Their AUM surpassed 1.6 trillion won and 1.27 trillion won, respectively.

The KODEX Secondary Battery Industry ETF is an ETF that allows for diversified investment in domestic listed companies involved in various segments of the secondary battery value chain, such as raw materials, equipment, components, and manufacturing. Major investment targets include LG Energy Solution, Samsung SDI, LG Chem, POSCO Holdings, Ecopro BM, POSCO Future M, Ecopro, SK Innovation, Enchem, and L&F.

The TIGER Secondary Battery Theme ETF also invests across the secondary battery value chain, with a focus on LG Energy Solution, LG Chem, SK Innovation, POSCO Holdings, POSCO Future M, Samsung SDI, and Ecopro BM.

The investment targets of the two ETFs are largely similar, and differences in returns are due to the varying allocation ratios for each stock.

Since the beginning of this month, the share prices of secondary battery-related stocks such as L&F and POSCO Future M have surged in the domestic stock market, drawing increased attention to leveraged secondary battery ETFs. The KODEX Secondary Battery Industry Leveraged ETF recorded a one-month return of 89.0%. Its AUM has reached 600 billion won. Domestic institutional investors have recorded a cumulative net purchase of 53.6 billion won so far this month.

Kang Jin-hyuk, a researcher at Shinhan Investment Corp., stated, "The enthusiasm for secondary batteries has been intense this month. After a two-year downturn that began on July 26, 2023, secondary battery stocks started to rebound in May this year, and October has seen an explosive upward trend." He continued, "After a prolonged period of neglect, these stocks have become more sensitive to positive news than negative factors, and the sharp rally appears to be driven by rotational buying. Many secondary battery companies that began to rebound have broken through the 100-day and 200-day moving averages, which had previously served as resistance, and are now finding support near the 200-day line."

In addition to technical rebound factors, expectations for a recovery in secondary battery demand in the ESS sector are also having an impact. Jang Jeong-hoon, a researcher at Samsung Securities, analyzed, "As investment in artificial intelligence (AI) data centers increases, demand for ESS battery installations will also rise. The market is expected to grow from 35 GWh in 2024 to 76 GWh by 2030."

However, he added, "The energy policy of U.S. President Donald Trump is affecting the pace of renewable energy adoption, and the growth of electric vehicle demand has also become limited following the repeal of mandatory electric vehicle requirements in the United States. Therefore, increased ESS demand related to AI alone may not be enough to significantly improve utilization rates in North America."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)