Losses from Sophisticated 'Institution Impersonation' Scams Surge

Surpassing Loan Fraud and Messenger Phishing

Post-incident Support from Financial Authorities Is Welcome

"Stronger Preemptive Cooperation Between Ministries and Agencies Needed"

Over the past five years, losses from voice phishing scams impersonating institutions have increased sixfold. While losses from loan fraud and messenger phishing scams have either decreased or their growth has slowed, losses from more sophisticated institution-impersonation scams have surged. Although financial authorities have expressed their commitment to providing relief for victims, experts point out that stronger cooperation between government ministries and agencies is needed to apprehend voice phishing criminals and fundamentally reduce such crimes.

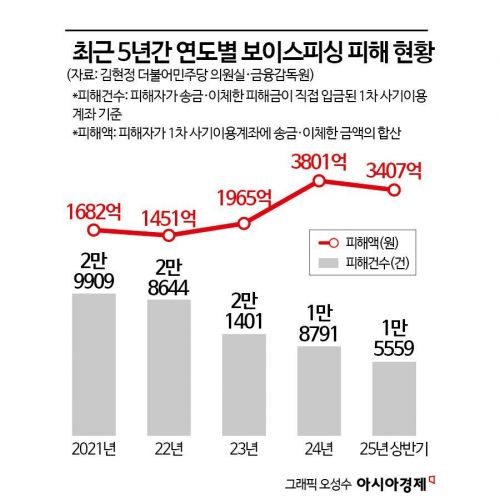

According to data received by Assemblywoman Kim Hyunjung of the Democratic Party, a member of the National Assembly’s Political Affairs Committee, from the Financial Supervisory Service on October 24, the number of voice phishing cases over the past five years was 29,909 in 2021, 28,644 in 2022, 21,401 in 2023, 18,791 in 2024, and 15,559 in the first half of this year, showing a decline. However, the total amount of losses has sharply increased: 168.2 billion won in 2021, 145.1 billion won in 2022, 196.5 billion won in 2023, 380.1 billion won in 2024, and 340.7 billion won in the first half of this year. In particular, since 2023, the annual losses have doubled each year.

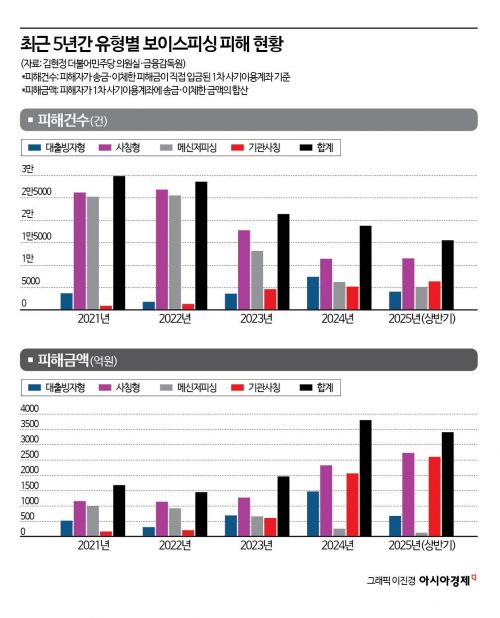

By scam type, losses from impersonation scams were greater than those from loan fraud. Losses from loan fraud scams were 52.1 billion won in 2021, 31.2 billion won in 2022, 69.2 billion won in 2023, 147.5 billion won in 2024, and 67.5 billion won in the first half of this year, remaining at similar levels over the past three years. In contrast, losses from impersonation scams were 116.1 billion won in 2021, 114 billion won in 2022, 127.3 billion won in 2023, 232.6 billion won in 2024, and 273.2 billion won in the first half of this year, more than doubling over three years.

Among impersonation scams, losses from institution-impersonation scams were much larger than those from messenger phishing. Losses from messenger phishing scams declined somewhat over the past three years, recording 66.2 billion won, 26.3 billion won, and 12.9 billion won, respectively. However, losses from institution-impersonation scams increased two- to threefold each year, reaching 61.1 billion won, 206.3 billion won, and 260.3 billion won, respectively. The data shows that while the public has become somewhat accustomed to tricks involving fake loan offers, they remain highly vulnerable to the 'advanced techniques' of scammers who persistently impersonate the Financial Supervisory Service, prosecutors, or police.

According to crime experts, institution-impersonation scams are far more sophisticated and elaborate than traditional loan fraud. These scams are characterized by inducing feelings of pressure and intimidation in victims, making them more susceptible to being deceived and increasing the scale of losses. During the impersonation process, scammers make multiple false statements, easily manipulating victims' psychology and leading them to transfer money.

Experts argue that post-incident support from individual government ministries and agencies in their respective areas is not enough to reduce the scale of losses, calling for closer inter-agency and inter-ministerial cooperation. For example, the previous day, Financial Services Commission Chairman Lee Eogwon announced plans to allow voice phishing victims to receive debt adjustment support from the Credit Counseling & Recovery Service. While this is a positive response, it is merely a post-incident measure within the financial sector and is insufficient to eradicate livelihood crimes.

Lee Unghyuk, professor of police studies at Konkuk University, stated, "Protecting victims is a secondary issue; the priority should be proactively rooting out voice phishing rings in advance." He added, "There needs to be large-scale crackdowns on accounts used for illegal transactions and international cooperation, as well as the establishment of a tight-knit cooperation system among relevant ministries and agencies in advance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.