Kurly Officially Launches U.S. Direct Purchase Service

"48-Hour Delivery" Promised, But Actual Shipping Takes 3?7 Days

High Prices Due to Air Freight and Customs Clearance Costs

Local Consumers Say Service "Falls Short of Expectations"

Consumer complaints are mounting against Kurly, the overnight delivery company that ambitiously entered the U.S. direct purchase market. The main issues are that key products are priced three to four times higher than in Korea, and, contrary to the initial promise of "48-hour delivery," shipping is taking an average of three to seven days. Additionally, many customers are disappointed by the limited number and variety of products available for sale each day.

According to industry sources on October 27, Kurly announced via social media on October 16 that it had converted its U.S. direct purchase service, KurlyUSA Mall, from a closed pre-open format to a public online store. Previously, users had to register and receive approval to access the site, but now products can be purchased without an approval process. The number of products has been greatly increased to around 9,300 compared to the pre-open period, and shipments are dispatched only three times a week-on Mondays, Tuesdays, and Wednesdays. Ordered items are shipped from the logistics center in Pyeongtaek, Gyeonggi Province, pass through Incheon International Airport, and are delivered directly to all 50 U.S. states by air.

However, a week after the official launch, consumers are expressing disappointment that the service has not met their expectations. In the early days, Kurly limited daily order quantities to ensure stable service operations, and the website was closed once the daily order cap was reached. Orders for the next day opened at 3 a.m. Pacific Time and 6 a.m. Eastern Time, but sometimes sold out in the morning hours. Some customers commented, "I tried to order early in the morning, but it was already sold out," and "In Korea, I can purchase hours after opening, but here it's difficult to buy anything."

Kurly has launched 'KurlyUSA,' a dedicated direct purchase platform for the United States. KurlyUSA SNS screenshot

Kurly has launched 'KurlyUSA,' a dedicated direct purchase platform for the United States. KurlyUSA SNS screenshot

The biggest barrier is the high prices. For example, the "Eogeumteo Boneless Grilled Mackerel" sells for 4,050 won on Kurly in Korea, but is priced at about 14,100 won ($9.8) on the KurlyUSA site. Similarly, Apple House chewy noodles cost 6,900 won in Korea but are priced at about 22,220 won ($15.5) on KurlyUSA. This means the same products are roughly three to four times more expensive than when sold in Korea. Product prices on KurlyUSA Mall include customs duties, so customers do not have to pay additional tariffs, but even considering this, consumers still find the prices burdensome.

A Kurly representative explained, "The daily sales quantity varies by product, so it's difficult to provide a total number," adding, "Restock timing also differs by brand and product." Regarding pricing, the company stated, "Customs duties and clearance fees are reflected in the product prices, so prices may be higher than those of Korean products."

The initial target audience for KurlyUSA Mall was mainly the Korean expatriate community in the U.S. Unlike in Korea, Korean grocery stores in the U.S. are often far away and less accessible, but demand for K-foods such as gimbap and tteokbokki remains high among both Korean-Americans and locals, which was a key factor in Kurly's overseas expansion. While Kurly had previously sold some products through Korean grocery stores in a business-to-business (B2B) format, this is the first time the company is directly operating a U.S. service.

When news of KurlyUSA's pre-opening broke, there was a great deal of anticipation in local Korean communities and on social media. However, regarding the newly launched Kurly direct purchase service, consumers have commented, "The prices are too high, so I'm hesitant to buy," and "Unless you live in an area without a Korean grocery store, there's no real advantage at these prices."

Within the industry, there is considerable concern about Kurly's entry into the U.S. market. While Kurly in Korea offers 40,000 to 50,000 products, KurlyUSA Mall only carries about 9,300 items. Moreover, it appears difficult to replicate the "Saetbyeol Delivery"-Kurly's overnight delivery service, where orders placed by midnight are delivered by dawn-which was a key factor in its Korean success. In fact, although Kurly initially aimed to deliver orders within 48 hours across the U.S., actual delivery times are reported to average three to seven days.

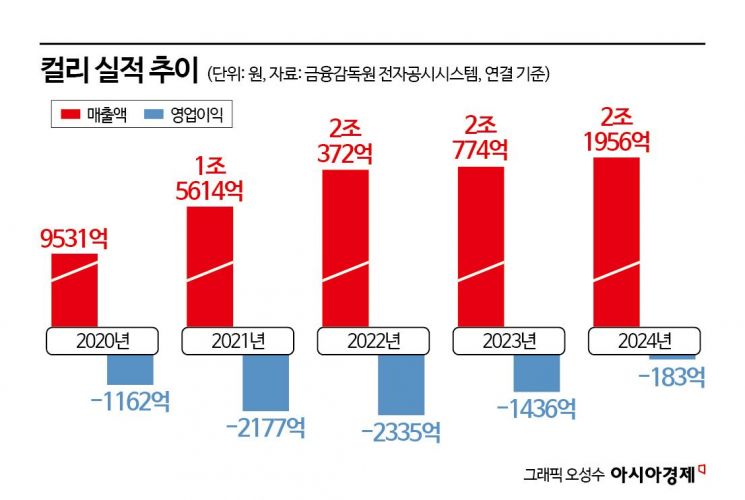

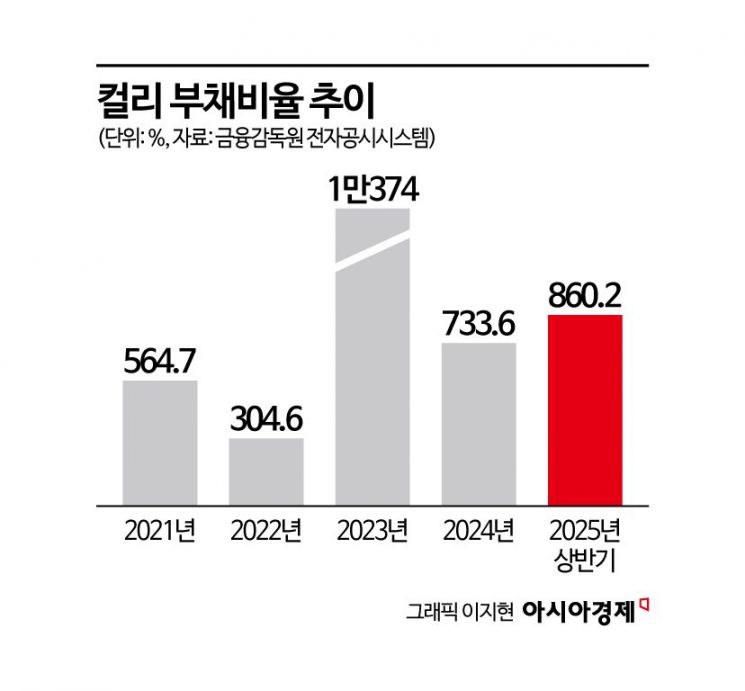

Kurly's weak financial structure is another source of concern. Last year, Kurly's revenue was 2.1956 trillion won, a 6% increase from the previous year, but since 2022, revenue has remained in the 2 trillion won range, indicating stagnant growth. In the first half of this year, revenue was 1.1595 trillion won, up 7.6% year-on-year, and for the first time in its 10-year history, the company achieved an operating profit of 3.1 billion won. However, as of the first half of this year, the debt ratio stood at 860%, limiting the company's ability to attract new investment. The debt ratio indicates the proportion of a company's assets financed by debt, and a ratio below 100% is generally considered financially stable. Kurly reduced its debt ratio from 10,374% in 2023 to 733% last year, but it increased again to 860% in the first half of this year, so the debt burden remains high.

Lee Jongwoo, Professor of Business Administration at Ajou University, commented, "It's positive that Kurly entered the market at a time when K-food is gaining popularity, but to compete with local Korean grocery stores, Walmart, and Costco, Kurly needs price and delivery competitiveness, which is questionable at the moment." He added, "Large-scale investments, such as establishing local logistics centers, are necessary for sustainable business, but after the TMON incident, new investments have dried up, and Kurly does not seem to have the capacity for such investments."

In response, a Kurly representative stated, "There is currently no immediate need for large-scale new investments in terms of operating funds or additional business investment," adding, "KurlyUSA is still in its early stages, so rather than considering large-scale investment right away, we are taking a cautious approach and monitoring progress."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.