Surging Home Prices and Exchange Rate Volatility: "Financial Stability Comes First"

Housing Prices and Transaction Volume Must Stabilize... Need to Confirm the Effect of the October 15 Measures

350 Billion Dollar US Investment Uncertainty... Exchang

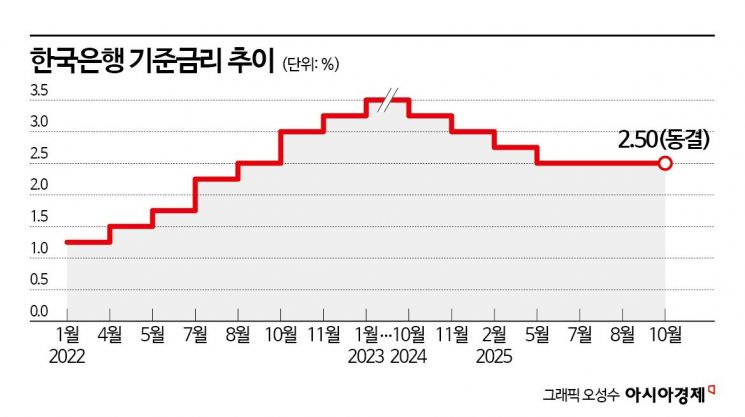

On October 23, the Monetary Policy Committee of the Bank of Korea decided to keep the base interest rate unchanged at 2.50% per annum. This decision, which places greater emphasis on financial stability, comes right after the announcement of the October 15 real estate measures aimed at curbing the surging housing prices in Seoul, as well as amid growing exchange rate volatility due to uncertainties surrounding the 350 billion US dollar investment in the United States. The Bank of Korea plans to maintain the current rate this month while assessing the effects of the October 15 measures and monitoring the progress of Korea-China and Korea-US tariff negotiations around the Asia-Pacific Economic Cooperation (APEC) summit.

Lee Changyong, Governor of the Bank of Korea, is attending the Monetary Policy Committee plenary meeting held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 23rd, striking the gavel. Photo by Joint Press Corps

Lee Changyong, Governor of the Bank of Korea, is attending the Monetary Policy Committee plenary meeting held at the Bank of Korea in Jung-gu, Seoul, on the morning of the 23rd, striking the gavel. Photo by Joint Press Corps

Housing Prices and Transaction Volume Must Stabilize... Need to Confirm the Effects of the October 15 Measures

The Monetary Policy Committee announced at its policy meeting held at the Bank of Korea headquarters in Jung-gu, Seoul, that the base interest rate will remain at 2.50% per annum. This marks the third consecutive freeze following July and August, in line with market expectations. In a prior survey conducted by The Asia Business Daily, all 15 experts predicted a rate freeze this month. In its policy statement, the committee said, “Given the need to further examine the impact of the real estate measures on the housing market and household debt in the Seoul metropolitan area, as well as exchange rate volatility and overall financial stability, it is appropriate to maintain the current level of the base interest rate.”

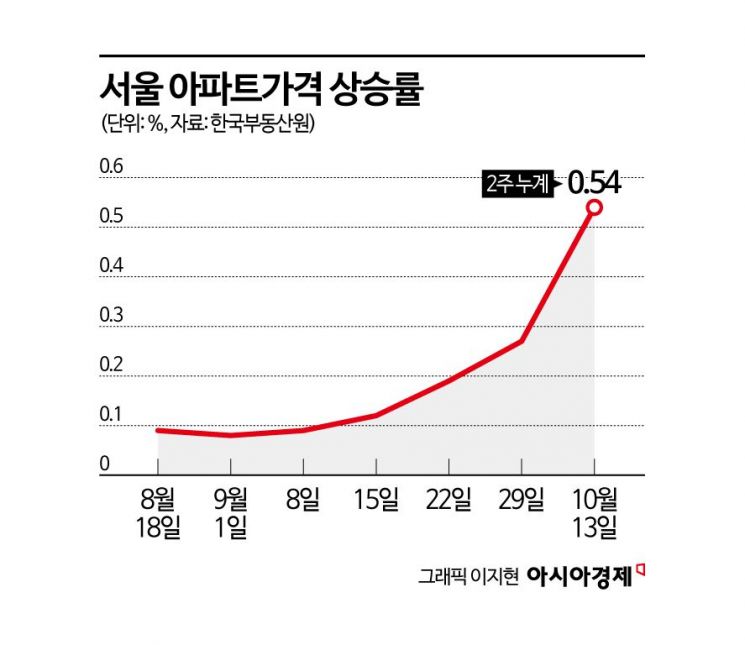

The primary reason for this month’s rate freeze is overheating in the real estate market. In Korea, where asset concentration in real estate is pronounced, heightened expectations for rising home prices, increased transaction volume, and growing household debt all pose significant constraints on monetary policy. According to the weekly apartment price trends released by the Korea Real Estate Board, apartment prices in Seoul surged by 0.54% over the two weeks including the Chuseok holiday as of October 13. The upward trend was especially notable in the Han River belt areas such as Seongdong-gu (1.63%), Gwangjin-gu (1.49%), and Mapo-gu (1.29%), where demand for gap investment (purchasing with existing tenants) surged amid expectations that these districts would soon be designated as regulated areas. Preferred areas in the southern region of Gyeonggi Province also saw a larger increase in prices. According to the Seoul Real Estate Information Plaza, the number of apartment transactions in Seoul in September reached 8,090 as of October 23, approaching the levels seen in May (7,439) and June (11,023), when transaction volumes spiked.

There is also an interpretation that the rate freeze is intended to align with government policy. With the upward trend in Seoul housing prices reignited after the June 27 measures, and the October 15 measures now in place, there is no reason for the Bank of Korea to lower rates and reignite the market, which would run counter to policy efforts. Ahn Yeha, a researcher at Kiwoom Securities, analyzed, “Given the strength of the new regulations, the Bank of Korea is also participating in policy coordination by freezing the rate.” Governor Lee Changyong also emphasized during the National Assembly’s Strategy and Finance Committee audit on October 20, “From the Bank of Korea’s perspective, we do not want to further increase liquidity and fuel the real estate market.” The committee is expected to pay close attention to market conditions over the next month, until the next rate decision in November, to assess whether the housing market is stabilizing.

Korea-US Tariff Negotiations, $350 Billion US Investment Uncertainty... Exchange Rate Instability 'A Burden'

Recent exchange rate volatility has also been a burden. The won-dollar exchange rate has risen to around 1,430 won, amid uncertainties surrounding investment negotiations with the United States and renewed concerns about a US-China trade war. Lowering the base rate in such circumstances could further weaken the won. With the real estate market showing little sign of cooling and concerns about increased volatility in the foreign exchange market, calls for caution on rate cuts have grown stronger.

Kim Jeongsik, Professor Emeritus of Economics at Yonsei University, explained the background of the October rate freeze: “Real estate prices remain unstable, and while there is a high possibility that the Korea-US tariff negotiations will be concluded, the details are not yet known. In addition, the rise in the yen-dollar exchange rate has increased the likelihood that the won-dollar rate will also rise, which likely influenced the decision.”

Concerns about the economy persist. US tariffs, slowing consumption, and sluggish domestic construction are all factors adding downward pressure to the economy. However, since the near-zero growth in the first half of the year, policies to stimulate consumption and rallies in the domestic asset market have driven private consumption growth, while weak international oil prices and a boom in the semiconductor sector have supported strong exports, reducing pressure for a rate cut, according to market assessments.

The committee stated, “Domestic demand continues to recover, led by consumption, and exports are expected to remain strong for the time being, thanks to the boom in the semiconductor sector. However, the impact of US tariffs is expected to gradually increase. This year’s and next year’s growth rates are expected to be broadly consistent with the August forecasts (0.9% and 1.6%, respectively).” The committee also noted that uncertainties, both upward and downward, have increased regarding Korea-US and US-China trade negotiations, the semiconductor cycle, and the pace of domestic demand improvement.

Park Sanghyeon, a researcher at iM Investment & Securities, said, “This year’s growth rate is expected to be around 1%, as the recovery in domestic demand is delayed due to sluggish construction investment, but the supplementary budget and stronger-than-expected exports will support growth. Next year, growth in the upper 1% range is possible, thanks to the base effect, a semiconductor supercycle, strong exports, and a recovery in domestic demand.” Yoon Yeosam, a researcher at Meritz Securities, added, “Growth is expected to improve next year, with the addition of expansionary fiscal policies such as the National Growth Fund.”

Lee Changyong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee plenary meeting at the Bank of Korea headquarters in Jung-gu, Seoul on the morning of the 23rd. Photo by Joint Press Corps

Lee Changyong, Governor of the Bank of Korea, is presiding over the Monetary Policy Committee plenary meeting at the Bank of Korea headquarters in Jung-gu, Seoul on the morning of the 23rd. Photo by Joint Press Corps

The Final Monetary Policy Committee Meeting of the Year in November: Rate Cut Depends on 'Housing Prices and Exchange Rate Trends'

Amid these circumstances, market opinions are divided over the timing of the next rate cut. While most expect a cut in November, an increasing number of experts believe the cut could be delayed until the first or second half of next year. Some even argue that the rate cut cycle has effectively ended, given ongoing instability in the real estate market and improved export prospects for next year.

Kang Sungjin, Professor of Economics at Korea University, commented on the timing of the next rate cut: “Once the Korea-US tariff negotiations are concluded, the US may also move to cut rates, but ultimately, rates can only be lowered if the real estate market stabilizes to some extent. While a cut in November is possible, if the real estate market continues as it is now, the cut may have to be postponed until next year.” Professor Kim also pointed out, “Even if the Korea-US tariff negotiations are concluded, if real estate prices remain unstable, it is unlikely that the Bank of Korea will decide to inject more liquidity into the market.”

On the other hand, Park Jeongwoo, an economist at Nomura Securities, analyzed, “Instability in the real estate market is due to structural factors such as a shortage of supply, so current demand-focused policies like loan regulations will only have a short-term effect. Export prospects are also likely to be revised upward next year. I believe the rate cut cycle has effectively ended.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)