Easing of Lending Limits for Non-Metropolitan Areas a Boon

Local Savings Banks to See Expanded "Business Space"

Expectations High for Adjustment of Individual Borrower Credit Limits

The savings bank industry has welcomed the government's announcement of the "Activation of Local Preferential Finance" policy, particularly the easing of lending limit regulations for areas outside the metropolitan region, viewing it as a positive development for the management of regional savings banks. The policy to expand the individual borrower credit limit is also expected to benefit the lending business of local savings banks.

Lee Eog-weon, Chairman of the Financial Services Commission (right), discussed the vision to support regional growth through the transition to "Local Preferential Finance" with local financial demanders, including policy financial institutions, the Korea Federation of Banks, Busan Bank, Busan City, and seven startups, small, and medium-sized enterprises located outside the metropolitan area, at the Busan Bank headquarters in Nam-gu, Busan on the morning of the 22nd. Financial Services Commission

Lee Eog-weon, Chairman of the Financial Services Commission (right), discussed the vision to support regional growth through the transition to "Local Preferential Finance" with local financial demanders, including policy financial institutions, the Korea Federation of Banks, Busan Bank, Busan City, and seven startups, small, and medium-sized enterprises located outside the metropolitan area, at the Busan Bank headquarters in Nam-gu, Busan on the morning of the 22nd. Financial Services Commission

On October 23, the savings bank industry expressed optimism that several measures announced by the Financial Services Commission the previous day-including the relaxation of lending limit regulations for non-metropolitan areas, preferential treatment for non-metropolitan regions when applying individual borrower credit limits, and the conversion of SB NPL Loan, a specialized non-performing loan (NPL) subsidiary of the Korea Federation of Savings Banks, into an asset management company-would all support the lending business of regional savings banks.

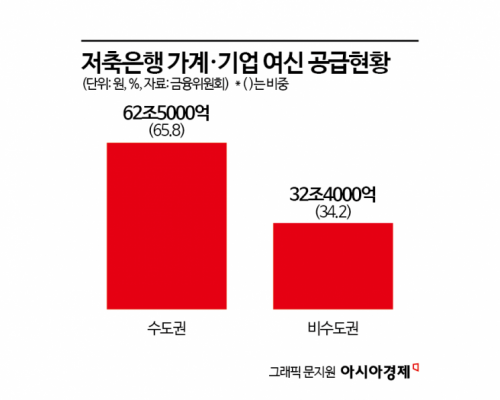

Currently, the polarization between metropolitan and non-metropolitan savings banks has become severe due to the economic downturn in regional areas and management difficulties faced by local small and medium-sized enterprises. According to the Financial Services Commission, as of the end of June, out of the total 94.9 trillion won in loans supplied by savings banks, only 32.4 trillion won (34.2%) was supplied to non-metropolitan areas, while 62.5 trillion won (65.8%) went to the metropolitan area.

The industry expects that the policy of differentiating loan weighting by business area-metropolitan versus non-metropolitan-will increase the supply of loans from savings banks to non-metropolitan regions.

Savings banks with multiple business areas, both metropolitan and non-metropolitan, will, after the grace period ends in the first half of next year, be subject to a loan weighting of 90% for metropolitan loans and 110% for non-metropolitan loans when calculating the loan ratio within their business areas. In this calculation, the denominator (total loan supply in all regions) remains unchanged, but the numerator (total loan supply provided by the savings bank) will give a 10% weighting advantage to non-metropolitan loans. This effectively expands the lending space for non-metropolitan regions.

The policy of adjusting individual borrower credit limits to favor regional borrowers is also a positive factor for non-metropolitan savings banks. The Financial Services Commission designed the policy to increase the loan limit per borrower for non-metropolitan savings banks, which tend to have relatively smaller asset sizes.

Currently, under the Mutual Savings Bank Act, savings banks with assets of less than 1 trillion won (47 banks, accounting for 59.5% of the total nationwide) have individual borrower credit limits of 5 billion won for sole proprietors and 10 billion won for corporations. For savings banks with assets of 1 trillion won or more (32 banks, 40.5%), the limits are 6 billion won for sole proprietors and 12 billion won for corporations. According to the Korea Federation of Savings Banks, 31 out of 38 non-metropolitan savings banks nationwide (81.6%) have assets of less than 1 trillion won. In contrast, 18 out of 23 Seoul-based savings banks (78.3%) and 8 out of 18 Incheon and Gyeonggi-based savings banks (44.4%) have assets of 1 trillion won or more.

If SB NPL Loan is converted into an asset management company, it will be able to handle NPLs without the current cap of 100 billion won based on book value. Asset management companies are not subject to the regulation limiting purchases to ten times their capital. In addition, they will be able to undertake debt collection assignments exclusively for savings bank non-performing loans. By handling debt collection assignments, SB NPL Loan will be able to earn collection fee income.

An industry official stated, "The government's easing of non-metropolitan lending regulations will provide much-needed relief for regional savings banks with assets under 1 trillion won and will also help alleviate the polarization among savings banks. At a time when the real economy in local areas is stagnating, the government has signaled to the market that finance should play a priming role, and regional savings banks have gained an opportunity to contribute to this effort."

An official from the Financial Services Commission explained, "These measures are a further elaboration of the 'Plan to Enhance the Role of Savings Banks' announced in March, and are intended to encourage lending to non-metropolitan areas. The conversion of SB NPL Loan into an asset management company will require an amendment to the Mutual Savings Bank Act, while the differentiated loan weighting policy by business area will require a revision of the supervisory regulations for mutual savings banks (a notice by the Financial Services Commission). Both measures are targeted for implementation next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)