Ecopro Jumps 15%, Leading Secondary Battery Rally

Anticipation Builds for AI-Driven ESS Demand Boom

However, Most Securities Firms Maintain 'Neutral' Ratings

On the occasion of its 27th anniversary, Ecopro, the eldest of the "Ecopro Trio," drew attention by recording a double-digit increase in its share price, standing out amid a pause among large-cap stocks. While investor sentiment has improved on expectations of an industry rebound, securities firms are issuing conservative investment opinions, warranting caution.

According to the Korea Exchange on the 23rd, Ecopro closed at 87,400 won the previous day, up 15.15%. It was the only stock among the top 10 companies by market capitalization on the KOSPI and KOSDAQ to post a double-digit gain. Ecopro BM and Ecopro Materials also rose by 3.38% and 7.42%, respectively. Ecopro is the holding company of Ecopro BM, a producer of cathode materials, a key component for secondary batteries, and Ecopro Materials, a precursor manufacturer for cathode materials.

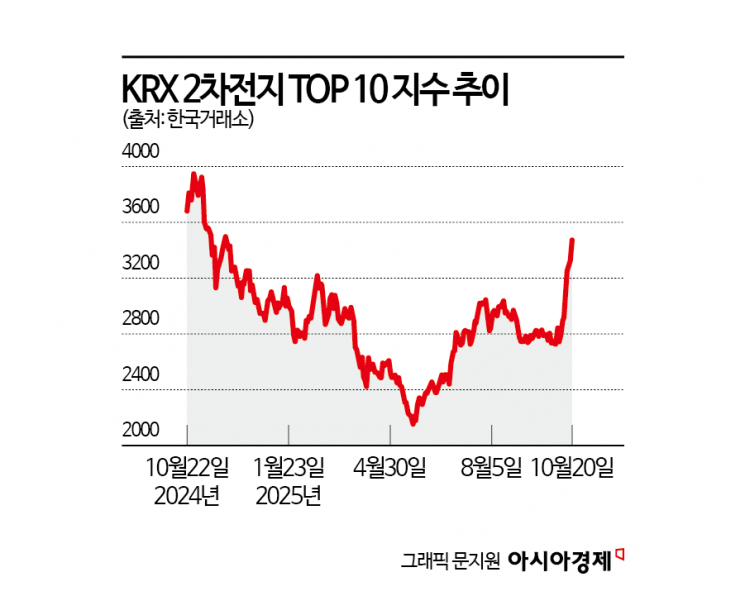

After being trapped in a slump due to the prolonged downturn in the petrochemical industry, secondary battery stocks have been on a sharp upward trajectory since the beginning of this month. The "KRX Secondary Battery TOP 10 Index," which includes the Ecopro Trio, Samsung SDI, LG Energy Solution, and other leading battery stocks, jumped 27.35% from October 1 to 22, recording one of the highest increases among Korea Exchange indices. Among domestic exchange-traded funds (ETFs), "KODEX Secondary Battery Industry Leverage" (+61.31%) has ranked first in one-month returns, and seven secondary battery ETFs have made it into the top 10 for returns in the past month.

Despite a temporary demand stagnation in the global electric vehicle market, the secondary battery sector's surge has been driven by the artificial intelligence (AI) boom. As major U.S. tech giants pour astronomical sums into data centers for AI development, demand for energy storage systems (ESS) has soared. Global investment bank JP Morgan forecasts that the global ESS market will grow by more than 80% this year and by over 30% in 2026.

Yongwook Lee, a researcher at Hanwha Investment & Securities, said, "Concerns over downward earnings revisions in the domestic secondary battery sector, which had weighed on share prices since the reduction of U.S. electric vehicle subsidies, are now giving way to renewed expectations for ESS. Robust electric vehicle demand in Europe and export controls on Chinese battery materials and technology are also having a positive impact on the domestic secondary battery industry." In fact, LG Energy Solution, a leading battery stock on the KOSPI, posted an operating profit of 601.3 billion won in the third quarter of this year, up 34.1% year-on-year, fueling optimism.

However, experts remain cautious about buying secondary battery stocks. Notably, of the six securities firms that issued investment opinions on Ecopro BM this month, only one recommended "buy," while the other five suggested a "neutral" stance. Although ESS has emerged as a breakthrough to overcome the downturn, the outlook for a meaningful improvement in EV demand-which accounts for the absolute scale of operating results-remains uncertain. The low-price offensive from Chinese LFP (lithium iron phosphate) batteries has also been cited as a concern.

Jeonghun Jang, a researcher at Samsung Securities, said, "As market liquidity has flowed into secondary battery stocks, which had previously been weak, investor sentiment appears to be focused on the Ecopro Trio, which has experienced the slowest share price recovery compared to its 2023 peak. In the case of Ecopro BM, annual operating profit will turn positive year-on-year, but the core business environment remains challenging. Unless electric vehicle sales by key customers recover significantly and utilization rates become more visibly improved, share price movements are likely to remain sluggish."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)