Food and Beverage Sector Remains Undervalued Compared to KOSPI

Preference for Companies with High Overseas Exposure, Such as Samyang Foods and KT&G

While the domestic stock market continues its upward trend, the food and beverage sector has been relatively sluggish. However, companies within the sector with a high proportion of overseas sales are exceptions. Analysts attribute the decisive factor driving stock price increases to the global popularity of "K-Food."

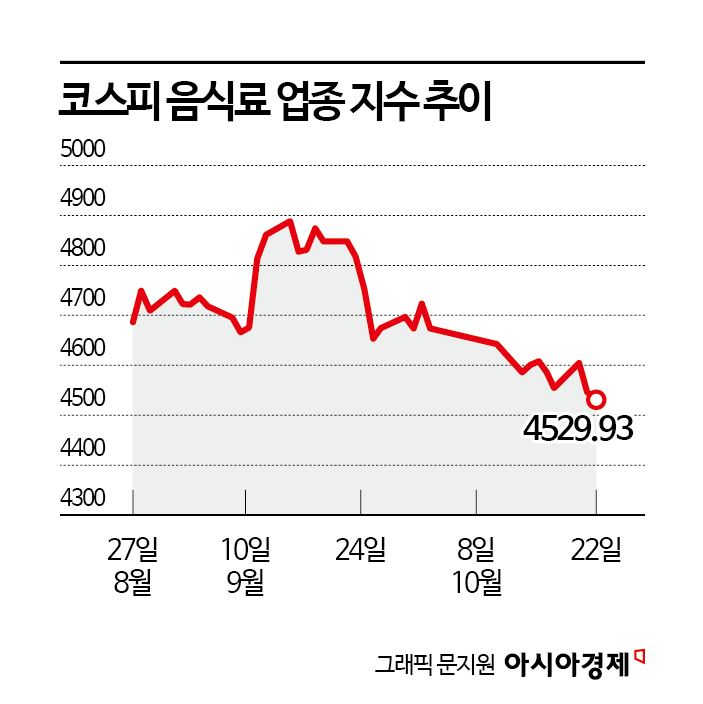

According to an analysis by Yuanta Securities on October 23, the 12-month forward price-to-earnings ratio (PER) for the food and beverage sector this year remains at an average of 9.8 times, excluding Samyang Foods. This is because, while the KOSPI has risen by about 60% compared to the beginning of the year, the average stock price of the food and beverage sector has increased by only about 20%, leaving it relatively undervalued.

Nevertheless, the stocks that have shown a clear upward trend within the sector are those with a high proportion of overseas sales. The recent global popularity of K-Food has moved beyond a short-term trend and entered a phase of structural growth. In the case of ramen, cumulative export value for the third quarter increased by 25% year-on-year, setting a new quarterly record, while exports of major processed foods also grew by 13%. By region, there has been strong growth in the United States (7%) and China (33%).

Samyang Foods, with an overseas sales ratio of 80%, is a representative example. Leading the K-Food boom in the global ramen market with its "Buldak Bokkeum Myun" brand, Samyang Foods is expanding exports, particularly in the United States, China, and Southeast Asia. It is estimated to account for about 70% of total ramen exports. To meet growing global demand, the company recently expanded its Miryang Plant 2 and plans to establish a local production system in China by operating a new plant there in 2027.

KT&G is also considered a stable investment destination within the sector, thanks to robust overseas sales. KT&G is expected to post sales of 1.8 trillion won and operating profit of 452.9 billion won in the third quarter of this year, up 10.2% and 8.4%, respectively, from the same period last year. The market expects these results to exceed consensus. This is due to continued high growth in its core tobacco business and improving performance both domestically and overseas.

Park Sangjun, a researcher at Kiwoom Securities, stated, "Starting next year, Samyang Foods is expected to significantly expand its presence in Costco stores in the United States, and the demand during the Chinese Lunar New Year season will further strengthen its first-quarter performance momentum. KT&G also offers high investment appeal due to strong growth in overseas cigarette sales, enhanced shareholder return policies, and potential interest rate cuts."

Although concerns have been raised about food and beverage exports due to tariff issues raised by U.S. President Donald Trump, some analysts believe the actual impact will be limited. While there may be a temporary increase in costs for certain product categories in the third quarter of this year, it is assessed that margin recovery is possible through price hikes and passing on higher prices to consumers.

Son Hyunjung, a researcher at Yuanta Securities, predicted, "For Samyang Foods, which has a high proportion of sales in the United States, Buldak Bokkeum Myun has strong pricing power, ramen itself has a low average selling price, and customer loyalty and supply shortages persist, so concerns about demand decline due to price increases are limited."

She added, "Market participants are assigning differentiated corporate value based on 'overseas contribution,' and the correlation between overseas sales growth rates and valuation premiums is expected to strengthen further next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)