Hanwha Asset Management stated on October 17 that the announcement of the "Janus Project," which involves installing small modular reactors (SMRs) at U.S. Army bases, is expected to benefit the "PLUS Global Nuclear Value Chain" exchange-traded fund (ETF).

According to financial information provider FnGuide, the period returns for the PLUS Global Nuclear Value Chain ETF, based on net asset value (NAV) as of October 16, were 30.0% for the past month, 50.1% for the past three months, 145.3% for the past six months, and 88.0% since its listing.

The Janus Project, announced by the U.S. Army and the Department of Energy (DOE), aims to install SMRs at all major U.S. Army bases by 2028. The targeted reactors are "microreactors" with a capacity of 1 to 20 MW (megawatts), which can be transported by trucks or aircraft. Following the project announcement, on October 15 local time, shares of NuScale Power (16.7%) and Centrus Energy (10.1%), both components of the PLUS Global Nuclear Value Chain ETF, surged on the New York Stock Exchange.

The Janus Project is interpreted as the "SMR Implementation Plan" under the so-called Nuclear Renaissance executive order announced in May. U.S. President Donald Trump signed the Nuclear Renaissance executive order, which includes plans to quadruple nuclear power generation capacity from 100 GW to 400 GW by 2050.

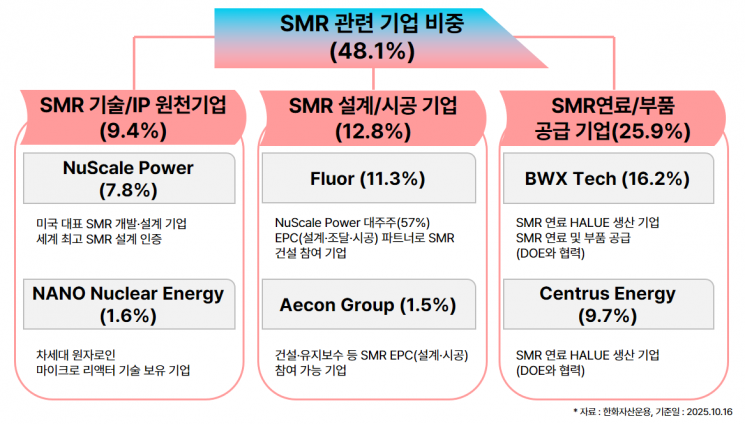

The PLUS Global Nuclear Value Chain ETF invests approximately 50% of its assets in companies related to SMRs, making it well-positioned to benefit from the Janus Project.

The portfolio includes companies with core SMR technology and intellectual property such as NuScale Power (7.8%) and Nano Nuclear Energy (1.6%), companies involved in actual SMR construction and key equipment supply such as BWX Technologies (16.2%), Fluor (11.3%), and Aecon Group (1.5%), and Centrus Energy (9.7%), which has a monopoly on supplying HALEU (high-assay low-enriched uranium) fuel for SMRs.

The PLUS Global Nuclear Value Chain ETF also has strengths in the upstream nuclear ecosystem, investing in uranium physical assets, mining, and refining companies. It invests in companies such as Cameco (19.5%), Uranium Energy (12.0%), Energy Fuels (9.8%), and Denison Mines (5.1%), all of which are involved in uranium mining and refining.

Choi Youngjin, Chief Marketing Officer (CMO) of Hanwha Asset Management, explained, "The Janus Project signals that the U.S. government intends to foster SMRs not just as a technological experiment, but as a national energy security infrastructure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)