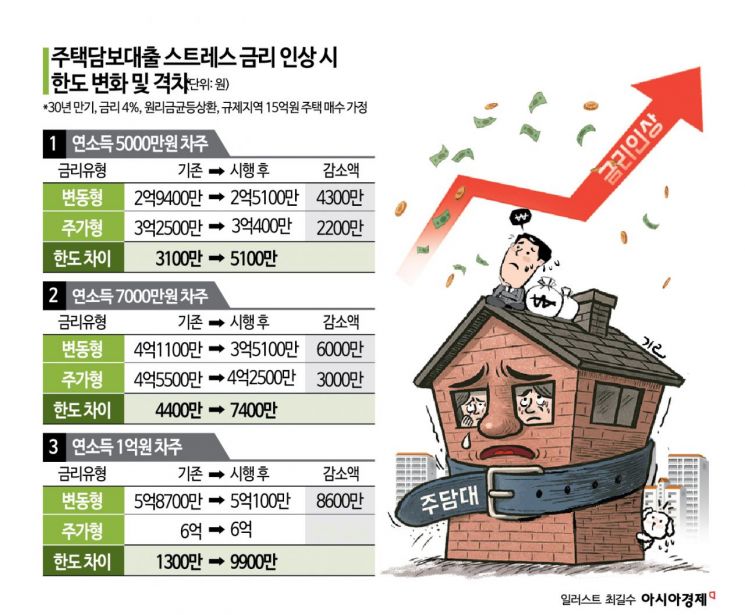

Loan Limits Shrink in Regulated Areas Due to Higher Stress Rates

Gap Between Fixed and Variable Rate Loans More Than Doubles

For Borrowers with 100 Million Won Annual Income, Difference Grows from 13 Million to 99 Million Won

"Demand for Fixed-Ra

The government has reduced the mortgage loan limits in regulated areas of the Seoul metropolitan region in an effort to cool down the overheated housing market in Seoul, resulting in the gap between fixed-rate and variable-rate loan limits widening by more than twice. Under the three-stage stress-based Debt Service Ratio (DSR) system implemented since July, the maximum difference in loan limits was around 50 million won. However, with the effective implementation of a 'fourth-stage DSR,' this gap now expands to as much as 99 million won. As both supply and demand for loans are expected to remain limited, there are forecasts that the preference for fixed-rate loans will become even stronger.

According to government and banking sector sources on October 17, with the implementation of the strengthened stress-based DSR under the October 15 real estate measures, the difference in loan limits between fixed-rate (periodic) and variable-rate mortgages now ranges from at least 53 million won up to 99 million won (assuming the purchase of a 1.5 billion won home in a regulated area). Previously, the government raised the minimum stress DSR rate applied to regulated areas, including all of Seoul and 12 other locations in the metropolitan area, from 1.5% to 3%.

Under these tightened measures, if a borrower with an annual pre-tax income of 50 million won purchases a 1.5 billion won apartment in a regulated area of Seoul or the metropolitan region, the difference in loan limits between periodic (five-year fixed) and variable-rate loans widens to 53 million won. Under the previous three-stage DSR, the gap was 31 million won. These figures assume an annual loan interest rate of 4%, a 30-year maturity, equal principal and interest repayment, and no other outstanding loans.

The loan limit varies significantly depending on annual income. Under the same conditions, a borrower with an annual income of 70 million won sees the difference in loan limits by loan type expand from 44 million won to 74 million won. For a borrower with an annual income of 100 million won, the difference was previously only 13 million won, but with the new regulations, it increases to 99 million won. If the borrower chooses a periodic fixed-rate loan, the maximum loan limit of 600 million won is maintained. However, under the same conditions, the limit for variable-rate loans is reduced to 501 million won.

The widening of the gap in loan limits by loan type is due to the three-stage stress-based DSR implemented since July. Starting with the three-stage DSR, the government applied differentiated stress rate application ratios, allowing higher loan limits for longer-term fixed-rate loans. For variable-rate loans, the stress rate is applied at 100%, while for hybrid loans (five years fixed, then six months variable), it is applied at 40-80%, and for periodic loans, only 20-40% is applied.

With the minimum stress rate reflected in the stress-based DSR itself doubling from 1.5% to 3%, variable-rate loans, which have the highest application rate, have been hit the hardest. As all of the increased stress rate is now reflected, the reduction in loan limits has become even greater. According to commercial bank simulations, for periodic loans, the maximum loan amount available to a borrower with an annual income of 50 million won (purchasing a 1.5 billion won home, 4% annual interest, 30-year maturity, equal principal and interest repayment) decreases from 325 million won to 303 million won, a reduction of about 22 million won. In contrast, under the same conditions, the loan limit for variable-rate loans decreases from 294 million won to 251 million won, a reduction of 43 million won, meaning the decrease is even larger.

A banking sector official said, "With this increase in the stress rate, the loan limit for periodic loans will decrease by an average of around 6-7%, while for variable-rate loans, it will decrease by about 15%. In terms of loan limits, choosing a fixed-rate loan is now more advantageous than a variable-rate loan."

Meanwhile, when purchasing a home priced between 1.5 billion won and 2.5 billion won, the loan limit is reduced to 400 million won, resulting in the gap between periodic and variable-rate loan limits actually narrowing in this price range. For example, if a borrower with an annual income of 100 million won purchases a 1.7 billion won apartment under the same conditions, the previous difference in loan limits was 13 million won, but with the new regulations, both loan types are now subject to the 400 million won cap, eliminating the gap. In this case, the choice of loan type will be more influenced by the interest rate.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)