"Need to Create an Environment for Diversifying Funding Sources"

"Ensuring Technology Protection and Information Reliability Is Key to Stable Growth"

Recently, as the institutionalization of Security Tokens (ST) has entered its final stage of discussion in the National Assembly, it is drawing attention as a new funding method for small and medium-sized enterprises (SMEs). However, since the institutional framework is not yet fully established, experts point out that a supportive environment must be created to enable SMEs to raise funds through security tokens in various ways.

Sun Yongwook, Associate Research Fellow at the Korea Small Business Institute, emphasized in his report "Utilization Plans for SMEs Following the Legalization of Security Tokens," released on October 16, that "it is essential to build an environment where startups and small business owners can diversify their funding sources by utilizing security tokens."

According to the Bank of Korea's monetary and financial statistics, as of June this year, the outstanding balance of bank loans to SMEs reached 1,096 trillion won, marking a record high on a monthly basis. This figure represents a 38% increase compared to 795 trillion won in 2020. Amid an economic slowdown, SMEs are finding it increasingly difficult to secure liquidity on their own, leading to a higher reliance on financial sector loans.

Security tokens are digital securities that use distributed ledger technology to convert asset rights into securities as defined by the Capital Markets Act. Unlike traditional physical or electronic securities, security tokens allow for the fractionalization of ownership. Non-traditional assets such as revenue rights or intellectual property (IP) can also be traded as investment products.

Sun explained, "If security tokens are incorporated into the institutional framework, individuals will be able to invest in assets that were previously accessible only to high-net-worth individuals, thereby diversifying funding sources for startups and small business owners."

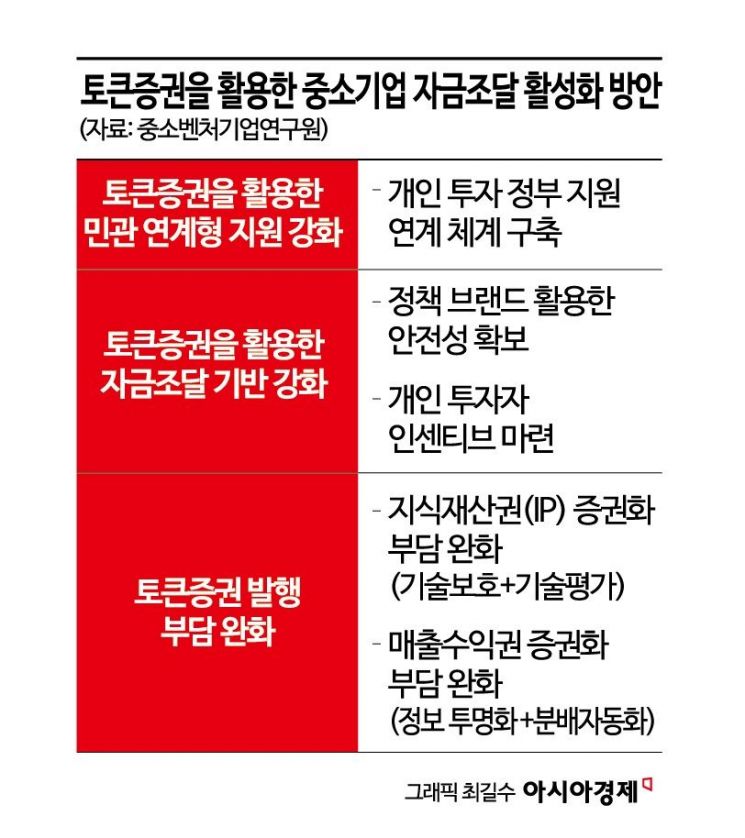

However, he analyzed that three key issues must be addressed for SMEs to make practical use of security tokens: specifically, strengthening public-private partnership support utilizing security tokens, reinforcing the foundation for fundraising, and alleviating the burden of issuance.

Regarding public-private partnership support, he suggested that companies that attract a certain amount of private investment through security tokens should be eligible for government matching loans or commercialization funding. This approach would recognize the issuance of security tokens through individual investments in current programs such as TIPS (Tech Incubator Program for Startup) or LIPS (Local Investment Program for Small Business).

In terms of strengthening the fundraising foundation, he emphasized the need to create a "safe investment market" by leveraging SME policy brands. The plan includes enhancing selective support for promising SMEs and designating a "security token issuance and distribution institution for SMEs (tentative name)" to encourage individual investors to invest through trustworthy platforms.

He also suggested that the burden during the issuance process should be reduced. Sun stated, "Promising startup technologies should be protected and guaranteed through technology escrow and technology valuation systems, and sales information should be transparently recorded on the distributed ledger to enable automatic distribution to investors." He added, "Only when technology protection and information reliability are ensured can the market grow in a stable manner."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)