Taxation Based on Face Value of Mobile Gift Certificates

Small Business Owners Pay Taxes on "Nonexistent Sales"

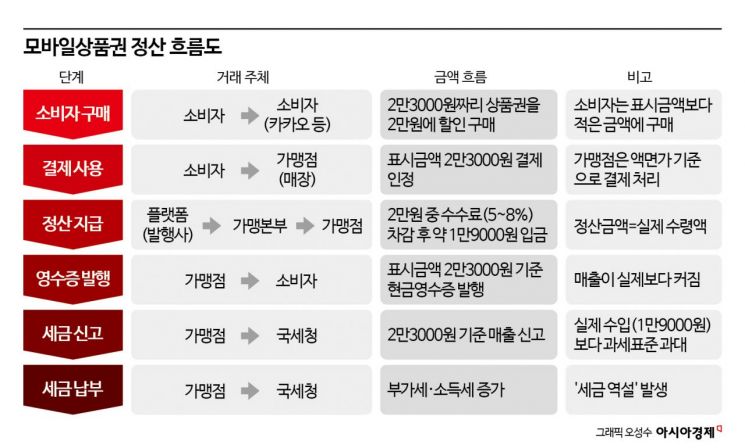

Small business owners are voicing concerns about excessive tax burdens arising from the use of gifticons (mobile gift certificates) as a payment method. Currently, gifticons are classified as "securities," and taxes are imposed based on the face value indicated to consumers. However, franchisees actually receive a much smaller settlement amount after deducting discounts and platform fees from the gifticon’s face value. Furthermore, since the tax base under tax law is supposed to be calculated on the actual amount received, confusion is mounting.

According to industry sources on the 17th, Park, a 52-year-old franchise chicken restaurant owner in Gumi, North Gyeongsang Province, recently contacted the National Tax Service’s consultation center about taxes. This was because, when a customer paid with a gifticon worth 23,000 won, he was instructed to issue a cash receipt based on the face value. The problem is that, after deducting platform fees, the actual amount received by the franchisee is less than 20,000 won. Park lamented, “Although the customer paid 23,000 won, I only receive about 19,000 won in reality,” adding, “It feels like I’m paying taxes on sales I never made.”

Customer pays 23,000 won, store owner’s revenue is 19,000 won

Most mobile gift certificates are distributed at a discounted price through various platforms. For example, a consumer may purchase a 23,000 won gift certificate for 20,000 won via KakaoTalk’s gifting service. When this is used at a store, the franchisee receives a settlement of about 19,000 won after deducting a 5-8% platform fee from the 20,000 won received from the issuer or headquarters. The 3,000 won discount is typically split evenly between the headquarters and the franchisee.

However, cash receipts must be issued based on the 23,000 won face value shown to the consumer. The National Tax Service’s system records sales as 23,000 won, but the actual amount received by the franchisee is about 15% less. As a result, not only value-added tax but also comprehensive income tax is calculated based on “phantom sales.”

This structure increases the tax burden. Value-added tax is calculated as 10% of the sales amount (supply value). If calculated based on the face value (23,000 won), the supply value is about 20,900 won and the VAT is 2,100 won. Based on the actual amount received (19,000 won), the supply value is 17,270 won and the VAT is only 1,730 won. This creates a difference of about 370 won per transaction. If there are 1,000 transactions per month, franchisees end up paying an extra 400,000 to 500,000 won in VAT annually.

As sales increase, the burden of comprehensive income tax also rises along with VAT. If cash receipt sales are overstated in the system, total annual sales are inflated during year-end tax settlement, which can push the taxpayer into a higher tax bracket and increase income tax payments. Ultimately, small business owners are forced to pay taxes on sales they never actually made.

The National Tax Service told Park, “The value-added tax base should be calculated based on the actual amount received.” However, since the cash receipt issuance system is designed around the face value, the gap between tax law interpretation and on-the-ground practice has widened. It is difficult for store owners to arbitrarily adjust the receipt amount in practice. As a result, taxation based on the “actual amount received” is virtually impossible under the current system.

Mobile gift certificate market reaches 10 trillion won... Taxes remain a blind spot

The root of this confusion lies in the legal nature of mobile gift certificates. Last year, the Fair Trade Commission clarified that “mobile and electronic gift certificates are a type of security representing the right to receive goods or services.” This means that, just like paper gift certificates, the amount indicated on the certificate guarantees the right of exchange.

However, tax law takes a different approach. The tax base is determined by the substance of the transaction, so the actual amount received by the store owner should be recognized as sales. Even if classified as securities, the taxable event is not the issuance of the gift certificate itself, but the monetary transaction that occurs when goods or services are provided in exchange for it.

According to the Anti-Corruption and Civil Rights Commission, the mobile gift certificate market has more than tripled in five years, reaching a size of 10 trillion won. The Ministry of Science and ICT and the Korea Communications Commission reported that last year’s mobile phone micro-payment market reached 6.6938 trillion won, a significant portion of which is used for “gifting.” Annual gifting transaction volumes on major platforms such as Kakao, Coupang, and Naver are estimated to exceed 5 trillion won. Kakao’s “Talk Biz” (gifting, Talk Store, etc.) revenue alone was 2.219 trillion won last year.

Although the market has grown rapidly, the tax system remains stuck in the framework of the old offline gift certificate era. There is still no clear, unified standard regarding platform fees, settlement timing, or tax base calculation. An industry official commented, “Now that the legal status as a security is clear, the tax system must also be updated to reflect current market realities.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)