Q3 Reported FDI: $20.65 Billion, Arrivals: $11.29 Billion

Greenfield Up 23%, U.S. Investment Up 59%

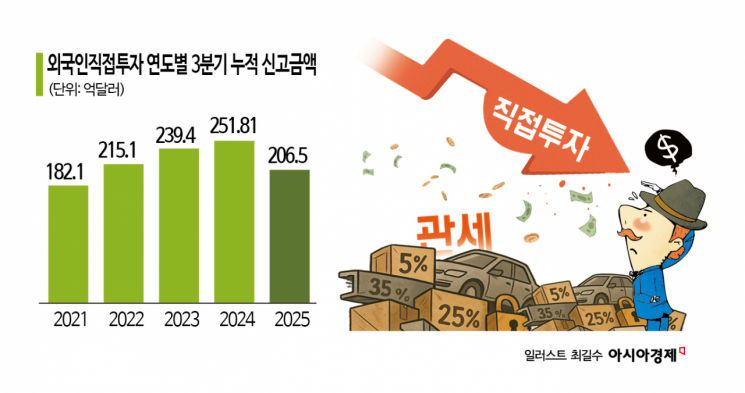

Amid weakened investment sentiment due to the United States' high tariff measures and the spread of global protectionism, foreign direct investment (FDI) in Korea dropped to the low 20 billion dollar range in the first three quarters of this year. The decline was attributed to a combination of the base effect from last year's record-high performance and uncertainties surrounding U.S. trade policy.

According to the "2025 Third Quarter Foreign Direct Investment Trends" report released by the Ministry of Trade, Industry and Energy on October 15, the total amount of foreign investment filings in Korea for the first to third quarters of this year reached 20.65 billion dollars, down 18.0% from the same period last year. The actual amount of investments received was 11.29 billion dollars, a decrease of 2.0% year-on-year.

The decline was further exacerbated by a combination of the base effect from last year's record-high results in the first to third quarters, uncertainties in U.S. trade policy, and the rise in exchange rates.

By investment type, greenfield (direct entry) investments totaled 17.77 billion dollars, down 6.1%, while mergers and acquisitions (M&A) amounted to 2.88 billion dollars, a sharp drop of 54.0%. The contraction of the M&A market and a steep decline in large-scale acquisitions were identified as the main drivers of the overall decrease.

By industry, manufacturing received 8.73 billion dollars, a decrease of 29.1%, and the service sector saw a 6.9% decline to 11.11 billion dollars. In manufacturing, investments in transportation equipment (880 million dollars, up 27.2%) and other manufacturing (200 million dollars, up 93.4%) increased, while electrical and electronics (2.85 billion dollars, down 36.8%) and chemicals (2.43 billion dollars, down 13.8%) declined.

In contrast, the service sector saw increased filings centered on distribution (2.08 billion dollars, up 122.5%) and information and communications (1.79 billion dollars, up 25.7%). Investments in information and communications, particularly in AI data centers, autonomous driving software, and robotics, remained steady. However, finance and insurance (4.126 billion dollars, down 43.6%) and transportation and warehousing (356 million dollars, down 9.4%) declined.

By country, investment from the United States surged to 4.95 billion dollars, up 58.9%, mainly in chemicals, distribution, and information and communications. In contrast, investments from the European Union (2.51 billion dollars, down 36.6%), Japan (3.62 billion dollars, down 22.8%), and China (2.89 billion dollars, down 36.9%) all decreased.

On an arrival basis, the total was 11.29 billion dollars, down 2.0%, which is similar to the third quarter of last year (11.51 billion dollars). By type, greenfield investments were 8.21 billion dollars, up 23.0%, while M&A investments were 3.07 billion dollars, down 36.5%.

By country of arrival, investments from the United States (2.99 billion dollars, up 99.7%) and China (450 million dollars, up 35.5%) increased, while those from the European Union (2.48 billion dollars, down 41.8%) and Japan (450 million dollars, down 60.5%) decreased.

By industry, manufacturing dropped to 2.97 billion dollars, down 25.5%, while the service sector rose to 7.86 billion dollars, up 10.3%. Notably, investments were concentrated in distribution (1.54 billion dollars, up 210.3%) and information and communications (1.08 billion dollars, up 24.1%).

The Ministry of Trade, Industry and Energy stated, "Although uncertainties such as strengthened U.S. tariffs and a global contraction in M&A persist, investments in information and communications and AI sectors remain robust. Foreign investors' confidence in the fundamentals of the Korean economy is being maintained."

Going forward, the Ministry plans to expand the foundation for attracting foreign capital by: ▲ strengthening overseas investor relations (IR) targeting advanced industries such as AI, semiconductors, materials, components, and equipment; ▲ conducting regional IR tours to identify additional investments from foreign-invested companies already operating in Korea; and ▲ providing close project-by-project support through the "FDI Implementation Support Team."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)