'Seoul Housing Boom' Returns... Heightened Caution as Increases Spread to Surrounding Areas

US-China Tariff Tensions Rekindle... Exchange Rate Returns to May Levels, Adding Pressure

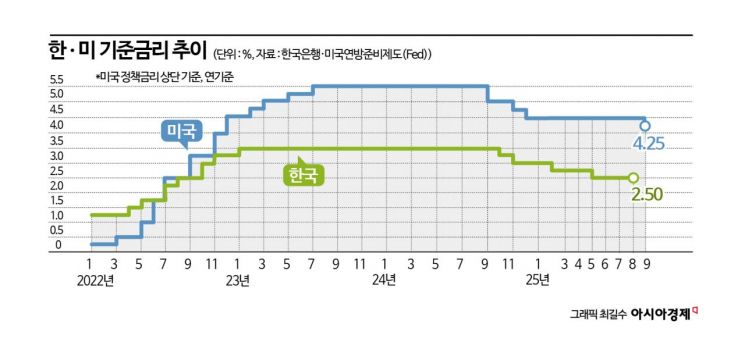

With the Bank of Korea's Monetary Policy Committee set to decide the base interest rate on the 23rd, expectations are leaning toward a 'hold.' Persistently high housing prices in Seoul, the rekindling of U.S.-China tariff conflicts, and soaring exchange rates are all acting as obstacles to continuing the rate-cutting cycle. Some analysts suggest that not only is a rate cut unlikely this month, but it may also be difficult to guarantee a cut at the final rate-setting meeting of the year in November.

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held on August 28 at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

Lee Chang-yong, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee meeting held on August 28 at the Bank of Korea in Jung-gu, Seoul. Photo by Joint Press Corps

Sharp rise in housing prices... Heightened alert as increases spread to surrounding areas

The biggest variable is the surge in housing prices. After the June 27 measures, the market sentiment, which had been subdued for a while, actually strengthened its upward bets following the September 7 supply policy announcement. According to the Korea Real Estate Board, the weekly increase rate for Seoul apartments accelerated from 0.09% on September 8 to 0.27% on September 29.

The housing price statistics reflecting the Chuseok holiday, to be released on the 16th, will be the last housing price indicator before the committee meeting. The prevailing sentiment on the ground is that the upward trend will continue. The market explains that the phenomenon of 'price alignment' is already appearing not only in major areas of Seoul, such as the Hangang Belt, but also in key complexes in surrounding regions. As buying demand continues to flow in before additional regulations are implemented, and with the autumn moving season coinciding, transactions have become more active.

According to the Seoul Real Estate Information Plaza, the number of apartment transactions in Seoul in September was 5,768 (as of October 12), an increase of 37.6% from 4,193 in the previous month. Considering that the reporting deadline for transactions is at the end of this month, the figure could rise further.

The Monetary Policy Committee is likely to wait until the effects of the government's additional housing market measures for price stability become clear before pursuing further rate cuts. The Bank of Korea has previously analyzed that, when the economy is sluggish and housing prices are rising, strengthening macroprudential measures is more effective than lowering the base rate. Additional measures are expected to be announced 'at an appropriate time this week,' so more time is needed to assess their impact. As a result, there is growing caution that not only is a 'preemptive rate cut' in October unlikely, but a cut in November will also depend on how the situation unfolds.

U.S.-China tariff conflict reignites... Exchange rate returns to May levels, adding pressure

In addition to housing prices, external conditions are also putting the brakes on rate cuts. Uncertainty surrounding tariff negotiations between major countries such as China and the United States is increasing, and the won-dollar exchange rate has soared to the 1,420 won level.

As China tightened its export controls on rare earths ahead of the U.S.-China summit, on October 10 (local time), U.S. President Donald Trump responded by announcing that, starting November 1, the U.S. would impose an additional 100% tariff on Chinese products and restrict exports of key software. Although some analysts believe there is still room for easing, characterizing the moves as 'posturing' ahead of the Asia-Pacific Economic Cooperation (APEC) summit, concerns about a renewed tariff war have grown as the U.S.-China tariff truce is set to expire, further increasing global economic uncertainty.

On top of this, the U.S. federal government shutdown has delayed the release of key economic indicators, making it difficult to accurately assess the state of the U.S. economy. The release of the September Consumer Price Index (CPI), originally scheduled for the 15th, has been postponed to the 24th, after the committee meeting.

In this challenging external environment, the continued surge in the won-dollar exchange rate is also a factor tilting expectations toward a rate hold. In the first week of trading after the Chuseok holiday, the won-dollar exchange rate jumped by 21.0 won to 1,421.0 won. This is the highest closing level since April 30, when it also reached 1,421.0 won. In after-hours trading, as the U.S.-China tariff conflict intensified, the rate briefly exceeded 1,430 won before closing at 1,427.0 won. Experts believe that the elevated won-dollar exchange rate will continue to fluctuate in the 1,400 won range for the time being. They note that a significant shift-such as the end of the U.S. government shutdown, signs of easing in U.S.-China trade tensions, or a major breakthrough in Korea-U.S. investment negotiations-would be necessary for the rate to fall back.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)