"Just Sell the Samsung Electronics Stake" vs. "It Would Destabilize Samsung"

Stake Bought with Participating Insurance Premiums Grew from 500 Billion Won to 46 Trillion Won

Sale Expected to Impact Samsung Group's Governance Structure

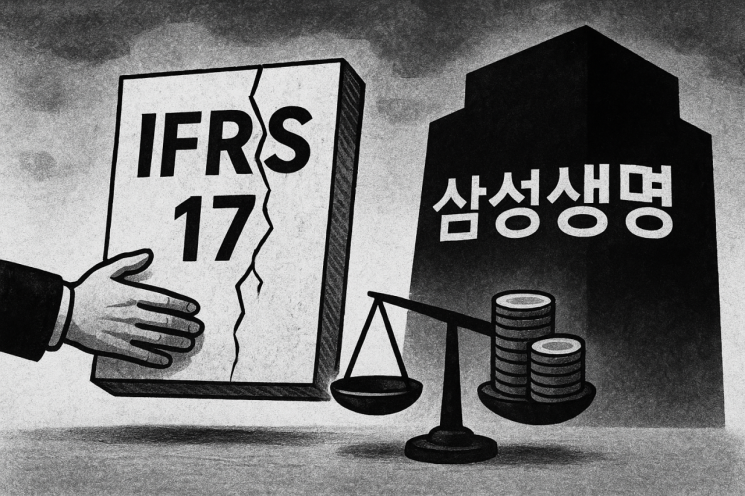

Recently, the so-called "Samsung Life Law" (an amendment to the Insurance Business Act) was proposed, and with the head of the Financial Supervisory Service publicly announcing plans to normalize the issue, the controversy over Samsung Life Insurance's "deviant accounting" has been reignited. Critics point out that, despite the value of Samsung Electronics shares purchased with policyholders' premiums from participating insurance products increasing by about 85 times, the profits have neither been distributed nor accounted for as liabilities, but instead have been used for decades to stabilize the group's governance structure.

On October 2, the Korea Corporate Governance Forum held a seminar titled "How Can Samsung Become a Better Company? - Focusing on Samsung Life Insurance's Accounting Practices and Other Governance Issues" at the Korea Economic Daily Association building in Yeouido, Seoul, to discuss these matters.

The Spark of Participating Insurance Began in the 1980s

The controversy over Samsung Life Insurance's deviant accounting began in the 1980s, when the company used premiums from participating insurance policyholders to purchase shares of Samsung Electronics. Participating insurance is a product in which a portion of the profits generated from investing premiums is returned to policyholders in the form of dividends. Although the premiums are relatively high, policyholders can expect additional returns through dividend payments. While such participating products remain common overseas, they are now almost nonexistent in Korea.

At the time, Samsung Life Insurance used the collected premiums to acquire approximately 540.1 billion won worth of Samsung Electronics shares, representing an 8.44% stake. As of the previous day's closing price, this stake is now worth nearly 46 trillion won. Even though the value of these shares has increased 85-fold, Samsung Life Insurance did not share the gains with participating insurance policyholders. The company maintains that since the shares have not been sold, the gains are unrealized and can be distributed after realization. Additionally, the valuation gains on these shares were recorded in a separate account called "policyholder equity adjustment," rather than as "insurance liabilities" to be returned to customers.

Policyholders of Samsung Life Insurance's participating insurance products have filed multiple lawsuits demanding a distribution of these valuation gains, but the courts have consistently sided with Samsung Life Insurance. The courts determined that it is appropriate to distribute profits only after the shares are sold and the gains are realized. Samsung Life Insurance was able to postpone dividends by claiming that management had determined it was not yet time to sell the shares.

Reignited by New Accounting Standards and the Samsung Life Law

The controversy resurfaced with the introduction of the new accounting standard "IFRS 17" in 2023. IFRS 17 requires that amounts to be paid to policyholders in the future be calculated at fair value and reflected as insurance liabilities. At the end of 2022, ahead of the IFRS 17 implementation, Samsung Life Insurance inquired with the Financial Supervisory Service about whether it could continue to use the policyholder equity adjustment account, rather than insurance liabilities, as before. The Financial Supervisory Service granted this exception, which marked the beginning of Samsung Life Insurance's "deviant accounting."

The controversy flared up again in February when Cha Kyugeun, a lawmaker from the Innovation Party for the Motherland, proposed the so-called Samsung Life Law. After a change in administration, the new head of the Financial Supervisory Service, Lee Chanjin, also stated in early September that the deviant accounting issue would be normalized in accordance with International Financial Reporting Standards (IFRS).

At the seminar, Assemblyman Cha pointed out, "Samsung Life Insurance grew rapidly using funds from participating insurance policyholders and became a core affiliate in the Samsung Group's governance structure, but Samsung has ignored the dividend issue for years."

The Samsung Life Law proposed by Assemblyman Cha requires insurance companies to value affiliate shares at market value rather than acquisition cost, and limits holdings to 3% of total assets. In this case, Samsung Life Insurance's stake in Samsung Electronics would exceed 40 trillion won. As of the end of last year, Samsung Life Insurance's total assets amounted to 275 trillion won. The company would need to sell a significant portion of its Samsung Electronics shares and distribute part of the gains to participating insurance policyholders.

Namwoo Lee, chairman of the Korea Corporate Governance Forum, is giving a welcoming speech at a seminar held on the 2nd at the Korea Economic Daily Association building in Yeouido, Seoul.

Namwoo Lee, chairman of the Korea Corporate Governance Forum, is giving a welcoming speech at a seminar held on the 2nd at the Korea Economic Daily Association building in Yeouido, Seoul.

"Deviant Accounting Due to Succession" vs. "Burden of Selling Shares Is Too High"

Lee Hansang, a professor at Korea University Business School and head of the Korea Accounting Standards Board, argued that Samsung Life Insurance insists on deviant accounting because of the succession of Samsung Electronics Chairman Lee Jae-yong. By blocking the sale of Samsung Electronics shares through deviant accounting, the company aims to maintain the group's governance structure, which links Lee Jae-yong, Samsung C&T, Samsung Life Insurance, and Samsung Electronics.

Professor Lee warned, "Samsung Life Insurance's claim that there is no cash outflow because there are no plans to sell the shares, and therefore no need to record insurance liabilities, is contradictory. This is a deliberate act to nullify participating insurance policyholders' rights, constituting a breach of good faith and potentially subject to class action lawsuits."

Jonathan Pines, senior manager at the UK asset management company Hermes, criticized, "Samsung Life Insurance's practice of recording Samsung Electronics shares at cost on its financial statements is no different from arbitrarily inserting random numbers. The excessive proportion of Samsung Electronics shares relative to Samsung Life Insurance's total assets is also problematic, and being tied up as an affiliate used as a governance tool for the Samsung Group prevents the company from selling Samsung Electronics shares at the most advantageous time in theory."

Shin Byungo, executive director at Deloitte Anjin, who attended the seminar at Samsung Life Insurance's recommendation, countered that there were misunderstandings about the facts. Shin stated, "The interest rate on participating insurance products sold in the 1980s was 7%, and considering compound interest and additional premiums from new policyholders, the reserves would amount to about 50 trillion won. These products are actually generating losses rather than positive cash flow, and since half of the policyholders are under 50, paying dividends would create a continuous burden."

He also argued that disposing of assets to pay dividends could harm Samsung Life Insurance's financial soundness and business stability. Shin stated, "Korean insurers, including Samsung Life Insurance, have applied deviant accounting through communication and inquiries with supervisory authorities, and global accounting firms have also found no issues with the application of deviant accounting by Korean insurers. The true economic substance of a particular company is best assessed from an external perspective, so the auditor's judgment should be respected."

In response, Professor Lee emphasized, "The Samsung Electronics shares acquired by Samsung Life Insurance were clearly purchased solely with premiums from participating insurance policyholders in the 1980s, amounting to 540.1 billion won. Even recently, global accounting experts gathered in London unanimously viewed Samsung Life Insurance's deviant accounting as abnormal."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)