Bank of Korea Releases "August 2025 Balance of Payments (Preliminary)"

28 Consecutive Months of Surplus, Second-Longest Streak Since 2000s

Goods Account Posts Second-Highest August Surplus Despite First Export Decline in Three Months

Steel and Pe

In August, South Korea recorded a current account surplus of $9.15 billion, the highest ever for the month of August. The goods account also posted the second-largest surplus for August on record. Although exports declined for the first time in three months due to weak performance in U.S. tariff-affected items such as steel products, semiconductor exports reached an all-time high. Additionally, imports, especially of raw materials, fell further due to declining energy prices.

It was explained that U.S. tariffs are mainly applied to certain items like steel, so their overall impact has been slow to materialize. The continued increase in semiconductor exports, particularly high value-added products driven by rising demand for generative artificial intelligence (AI) infrastructure, has offset the negative effects of tariffs. Although automobile exports to the United States decreased, strong demand for eco-friendly vehicles in Europe helped maintain overall performance. As a result, this year’s current account is expected to follow the August forecast path (a record-high surplus of $110 billion), but analysts note that variables such as the imposition of semiconductor tariffs should be closely monitored.

Semiconductor Exports Hit Record High vs. Sluggish Steel and Chemical Products... Exports Turn to Decline After Three Months

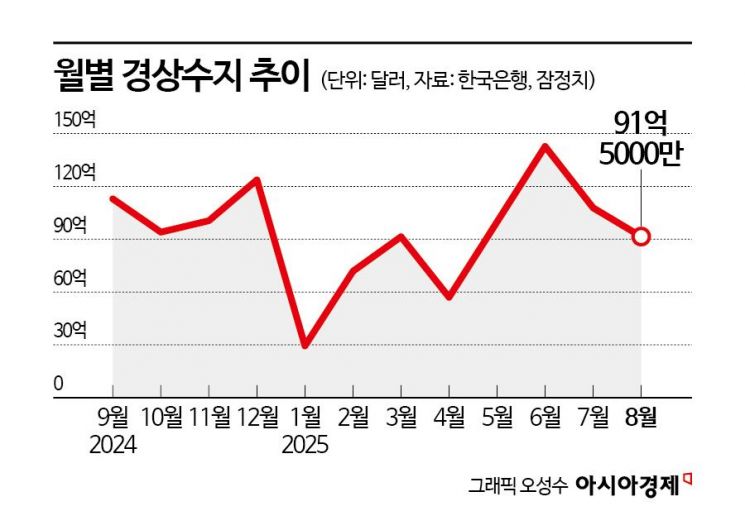

According to the "Provisional International Balance of Payments for August 2025" released by the Bank of Korea on October 2, South Korea posted a current account surplus of $9.15 billion in August, the largest ever for the month. This marks the 28th consecutive month of surplus since May 2023, the second-longest streak since 2000. The surplus increased compared to the same period last year ($6.73 billion) but decreased from the previous month ($10.78 billion).

The goods account, which makes up the largest portion of the current account, posted a surplus of $9.4 billion, the second-highest for August following $10.93 billion in August 2018. The surplus widened from the same month last year ($6.71 billion) but narrowed compared to the previous month ($10.27 billion).

Exports amounted to $56.44 billion, down 1.8% from the same period last year, marking the first decline in three months. While semiconductor exports reached an all-time high and passenger car exports also hit a record for August, weak performance in U.S. tariff-affected items such as steel products, as well as chemical and machinery products, led to the overall decline. According to customs data, semiconductor exports in August reached $15.3 billion, a sharp increase of 26.9% year-on-year. Passenger car exports rose 7.0% to $5.22 billion. In contrast, steel product exports fell 11.7% to $3.56 billion. Chemical products (-11%), wireless communication devices (-11%), and machinery and precision instruments (-8.2%) also declined. By region, exports to the United States (-12%), the European Union (-9.2%), Japan (-5.3%), and China (-3.0%) decreased, while exports to Southeast Asia increased by 13.5%.

Imports totaled $47.04 billion, down 7.3% from a year earlier. While imports of capital and consumer goods continued to rise, imports of raw materials fell due to lower energy prices. In August, imports of raw materials amounted to $24.29 billion, a sharp drop of 10.6% year-on-year. This was mainly due to declines in coal (-25.3%), petroleum products (-20.3%), and crude oil (-16.6%). Gas imports increased by 6.6%. Imports of capital goods rose 3.1% to $18.82 billion, led by information and communication devices (26.4%), semiconductor manufacturing equipment (9.5%), and semiconductors (4.5%). However, imports of transportation equipment plunged by 37.2%. Consumer goods imports also increased by 1.3% to $8.74 billion, with passenger cars (mainly eco-friendly vehicles) up 40.5% and direct consumer goods up 5.2%. On the other hand, imports of grains fell 10.1%, and non-durable consumer goods declined by 6.7%.

Increase in Maritime Transport Revenue Narrows Service Account Deficit Slightly

The service account posted a deficit of $2.12 billion, slightly narrowing from the previous month’s deficit of $2.14 billion. The transport account recorded a surplus of $440 million, driven by increased maritime transport revenue, further widening the surplus. The intellectual property rights account posted a deficit of $60 million. Both income and payments for industrial property rights (patents and trademarks) and copyrights (music and video) increased seasonally, narrowing the deficit.

The primary income account posted a surplus of $2.07 billion, mainly due to dividend income. Although this was down from the previous month’s $2.95 billion, it was the second-largest August surplus on record. The dividend income account posted a surplus of $1.58 billion. Due to seasonal factors such as quarterly dividend payments, the surplus narrowed from the previous month’s $2.58 billion.

Net external assets in the financial account, which subtracts liabilities from assets, increased by $7.88 billion. This was a smaller increase than the previous month’s $11.08 billion. In direct investment, overseas investment by domestic residents rose by $1.44 billion, while foreign investment in Korea increased by $2.15 billion. In securities investment, overseas investment by domestic residents increased by $8.41 billion, mainly in stocks, and foreign investment in Korea increased by $290 million, also mainly in stocks. Derivatives decreased by $500 million. In other investments, assets decreased by $5.98 billion, mainly in cash and deposits, while liabilities decreased by $4.44 billion, mainly in borrowings. Reserve assets increased by $2.52 billion.

U.S. Tariff Impact 'Gradually Reflected'... Variables Such as Record-High Semiconductor Tariffs Remain

With strong semiconductor exports continuing in September, the current account surplus is expected to reach around $10 billion, an increase from August. Song Jaechang, Director General of the Financial Statistics Department at the Bank of Korea, said, "Despite the impact of tariffs, overall, the semiconductor market is strong, inflation is stable, and the primary income account is performing well." He added, "Based on customs data, the trade surplus in September, led by robust semiconductor exports, exceeded that of August. The seasonal impact of quarterly dividend payments, which was reflected in August’s primary income account, will also disappear in September. Taking all this into account, the current account surplus in September is expected to rise to around $10 billion, higher than in August."

Given these trends, analysts believe that achieving the previously forecast current account surplus of $110 billion, presented in the August economic outlook, remains within reach. It is expected that the impact of U.S. tariffs will be fully reflected starting next year. Song stated, "In the third quarter, exports to the United States will continue to decrease, particularly for items subject to tariffs, but the impact will be gradual due to delayed price adjustments. The impact of U.S. tariffs has not been significant so far, but it is expected to become more pronounced next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)