Third Quarter Investment Reaches 2.4 Trillion Won

Exceeds Total Amount for the First Half of the Year

Rebellions Raises 340 Billion, FuriosaAI 170 Billion

"Clear Trend of Capital Concentration in a Few Companies"

The South Korean venture investment market is recovering from a prolonged downturn. As the deployment of accumulated dry powder increases, there have been a series of large-scale investments exceeding 100 billion won. However, the trend of investors focusing their funds on proven companies-essentially a process of "separating the wheat from the chaff"-continues.

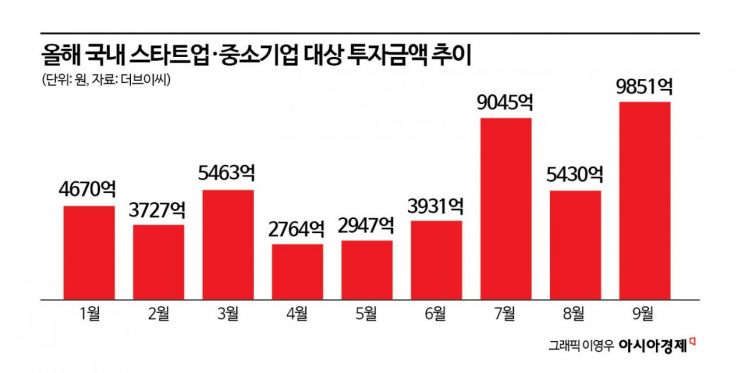

According to startup statistics specialist The VC, there were 296 investment deals targeting domestic startups and small and medium-sized enterprises (SMEs) in the third quarter of this year (July to September). This represents a 42.3% increase compared to the previous quarter. The total investment amount also surged to 2.4326 trillion won, significantly higher than the 1.386 trillion won in the first quarter and 964.2 billion won in the second quarter, surpassing the 2 trillion won mark in a single quarter for the first time since the fourth quarter of 2023. Notably, investments in July (904.5 billion won) and September (985.1 billion won) each approached 1 trillion won, driving a turnaround in sentiment for the second half of the year.

A senior official at a venture capital (VC) firm explained, "The dry powder that had accumulated due to cautious investment in the first and second quarters is now being actively deployed in the third quarter." The official added, "From next year, the effects of the government's policies to support venture and startup investment will become more visible, injecting further vitality into the market."

There were also three large-scale investments (big deals) exceeding 100 billion won. Domestic artificial intelligence (AI) semiconductor company Rebellions recently completed a successful Series C funding round, raising 340 billion won. This is the largest investment in an unlisted startup or SME in South Korea over the past three years. The company's valuation more than doubled compared to its Series B round in January last year, reaching 1.9 trillion won. In the same sector, FuriosaAI raised a total of 170 billion won in a Series C bridge round in July, earning a valuation of over 1 trillion won. Oral scanner company Medit also secured approximately 140 billion won in its recent Series B round, ranking among the top rounds by investment size.

In addition, there were 11 investments exceeding 50 billion won and 64 investments exceeding 10 billion won, indicating an active environment for large-scale deals. The VC noted, "A series of big deals drove the increase in investment volume in the third quarter," and pointed out, "Just like the global investment market, in South Korea, there is a clear trend of capital concentrating on a select group of verified companies."

By investment round, mid-stage (Series B to C) investments stood out, accounting for 68.1% of total investment-a figure more than 20 percentage points higher than the first quarter (45%) and the second quarter (40.6%). In addition to Rebellions, FuriosaAI, and Medit, companies such as ESOL (Series B, 74 billion won), Markvision (Series B, 70 billion won), and Upstage (Series B, 62 billion won) raised funds through mid-stage rounds. In contrast, late-stage investments accounted for 24% in the first half of the year, but shrank to 10.8% in the third quarter, due in part to a decrease in pre-IPO deals.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)