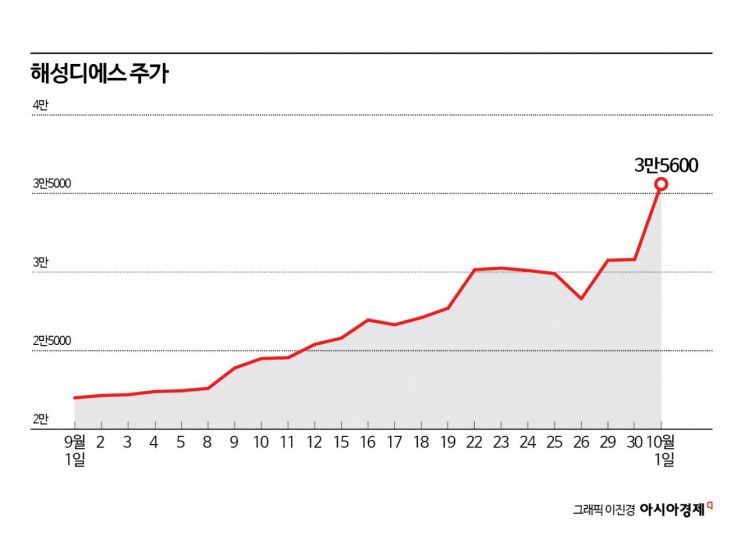

Sharp Rebound Since September... Up 58% from Late August

Third-Quarter Results Expected to Exceed Market Expectations

Profit Surge Anticipated on Rising DDR5-Related Sales

The stock price of Haesung DS, a company that produces packaging materials essential for semiconductor manufacturing, has been rising sharply since last month. Although the company's performance was sluggish until the first half of this year, expectations that results will improve from the third quarter of 2025 have led to a rebound in its stock price.

According to the financial investment industry on October 2, the stock price of Haesung DS jumped 57.9% from 22,450 won at the end of August to 35,450 won. On the previous day, its share price reached 35,900 won during intraday trading, setting a new 52-week high. The company's market capitalization surpassed 600 billion won. Foreign investors have recorded a cumulative net purchase of more than 15 billion won since last month, driving the stock price upward. Foreign investors have achieved a return of 26.7%.

Haesung DS manufactures "lead frames," which are metal substrates used to mount and attach semiconductor chips, as well as "semiconductor substrates," which serve as supports connecting chips to external circuits during the semiconductor back-end process. The company supplies these products to integrated device manufacturers (IDMs) and outsourced semiconductor assembly and test (OSAT) companies. In the first half of this year, Haesung DS recorded cumulative sales of 294.9 billion won and operating profit of 26.9 billion won. Compared to the same period last year, sales decreased by 4.4%, and operating profit dropped by 77.9%.

Although first-half results were weak, the pace of improvement is expected to accelerate from the third quarter of this year. Yang Seungwoo, a researcher at Meritz Securities, explained, "Haesung DS's DDR5 sales will increase rapidly, with the third quarter of this year serving as a turning point. The company's reel-to-reel production method offers advantages for mass production compared to competitors' sheet-based methods."

He added, "However, securing initial yield was difficult, which delayed the transition from DDR4 to DDR5 compared to competitors. This was the reason for the sluggish first-half performance."

Meritz Securities estimates that Haesung DS will achieve consolidated sales of 173 billion won and operating profit of 14.2 billion won in the third quarter of this year. These figures represent increases of 15.8% and 21.0%, respectively, compared to the same period last year. Operating profit is also expected to exceed market expectations by more than 10%.

As the company has resumed supplying domestic clients, DDR5-related sales are driving growth. Supply volumes to Chinese factories of domestic customers and major OSAT companies are increasing. Lead frame sales are also growing steadily, supported by rising demand from European electric vehicle makers and new customers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)