Six Months After Short Selling Resumption, Foreign and Institutional Dominance Persists

Retail Investors Channel Bearish Bets into Inverse ETFs

It has been six months since short selling was fully resumed in the domestic stock market, but the participation rate of individual investors remains low. Instead, retail investors, often referred to as "Donghak Ants," have dumped 17 trillion won worth of stocks on the Korea Exchange and satisfied their desire to bet on a market decline by purchasing over 1 trillion won in "Geopverse" products.

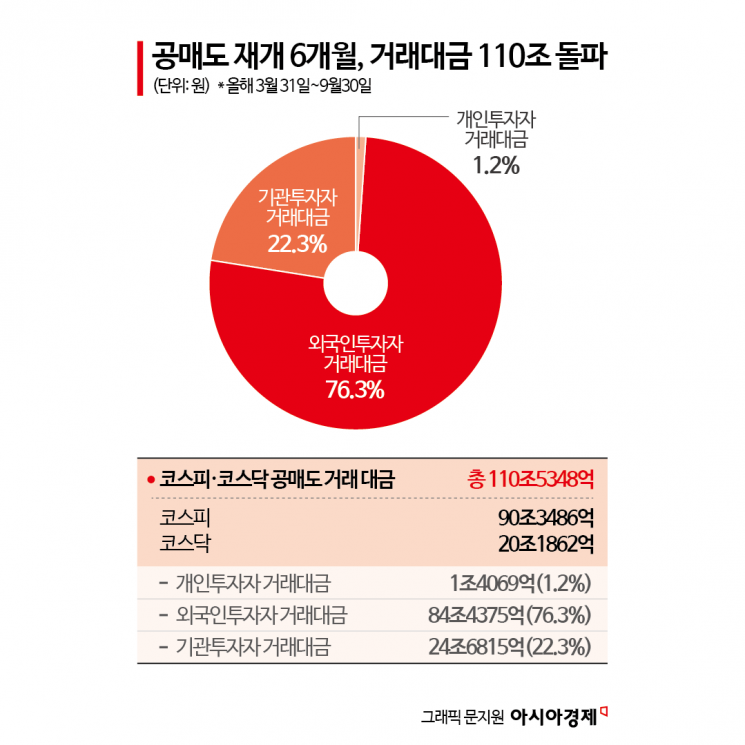

According to the Korea Exchange on October 1, from March 31, when short selling was resumed, to September 30, the total short selling transaction amount for both KOSPI and KOSDAQ reached 110.5348 trillion won (KOSPI: 90.3486 trillion won; KOSDAQ: 20.1862 trillion won) over approximately six months. The average daily short selling transaction amount for KOSPI and KOSDAQ was about 877.2 billion won, which is about 6% higher than the average daily transaction amount (825.3 billion won) during the six months immediately before the full ban on short selling (November 6, 2023).

The biggest expectation in the market regarding the resumption of short selling was the return of foreign investors. Foreign funds typically use a long-short strategy, utilizing short selling to hedge against the risk of a decline in the value of their stock holdings. The ban on short selling had been identified as a barrier to foreign capital inflow. Considering that foreign investors have made net purchases of over 5 trillion won in the Korea Exchange over the past six months since the resumption of short selling, it is assessed that this objective has been achieved.

The issue, however, is that participation in short selling remains heavily concentrated among certain groups. Of the total 110.5348 trillion won in short selling transactions across both markets over the past six months, individual investors accounted for only 1.4069 trillion won, representing just 1.2% of the total. In contrast, foreign investors traded 84.4375 trillion won, accounting for 76.3% of all short selling transactions during the same period. Institutional investors also held a significant share at 22.3% (24.6815 trillion won).

An official at a securities firm pointed out, "Short selling has been criticized as a 'level playing field tilted in favor of foreigners and institutions.' Although there have been some improvements, such as standardizing the repayment period and collateral ratio with individuals, it remains the exclusive domain of foreigners and institutions, who still have advantages in information and funding." In fact, as of September 29, the balance of securities lending transactions, considered a leading indicator of short selling, surpassed 101 trillion won, while the balance of margin loans used by individual investors stood at only 58.2 billion won.

It is also noted that the most popular exchange-traded fund (ETF) among retail investors is "KODEX 200 Futures Inverse 2X," which tracks twice the inverse of the daily KOSPI index return. This is seen as being closely linked to the concentration of short selling among certain groups. The desire of individual investors to bet on a market decline, which cannot be satisfied through short selling, is being channeled into the purchase of so-called "Geopverse" products. Since the resumption of short selling, retail investors have sold 17 trillion won worth of stocks on the KOSPI and, during the same period, purchased approximately 1.3384 trillion won of KODEX 200 Futures Inverse 2X, maintaining a "Sell Korea" stance. During this period, it ranked first in net purchases among all ETFs.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)