BoK Issue Note ? Measures to Promote Green Transition Through the Stock Market

Creating a 'Climate Benchmark' Index Aligned with Global Standards

Returns 5.6 Percentage Points Higher and Carbon Intensity 9 Percentage Points Lower Compared to KOSPI

The Bank of Korea has pointed out that, in order to promote green finance in the stock market, Korea should consider introducing a 'climate benchmark index' aligned with global standards. In fact, when such an index was created and estimated, the carbon reduction effect was greater than that of the KOSPI, and the returns were even higher. This suggests that introducing the index could allow investors to achieve both returns and carbon reduction.

On September 28, the Bank of Korea stated this in its report, "BoK Issue Note - Measures to Promote Green Transition Through the Stock Market: A Review of the Feasibility of Introducing a Korean-Style Climate Benchmark Index."

Domestic green finance has so far grown mainly through the lending and bond markets. This is because, compared to the stock market, related systems and infrastructure-such as the K-Taxonomy in 2021, green bond guidelines in 2022, and green loan management guidelines last year-have been relatively well established. In contrast, the stock market has played a limited role due to insufficient climate-related information infrastructure and performance evaluation systems.

Europe is a leading example of expanding green finance into the stock market. To enable investors to quantitatively assess the climate performance of green investments, Europe introduced the 'EU Climate Benchmark System' and established a low-carbon capital market. Currently, various indices (PAB and CTB indices) and tracking funds reflecting these standards have been launched in the international financial markets. As of the end of June this year, the scale of these tracking funds reached 155.9 billion dollars.

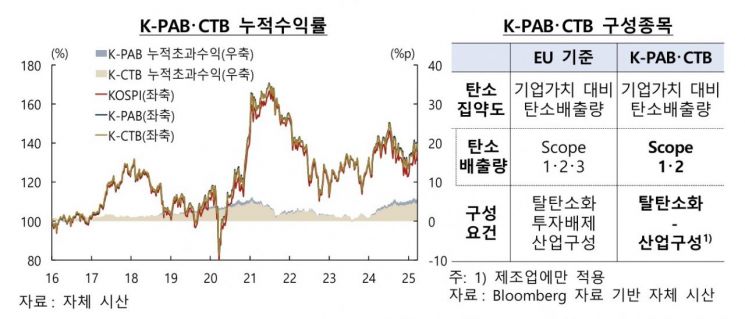

The report examined the feasibility of domestic adoption by creating Korean climate benchmark indices (K-PAB and K-CTB) reflecting EU requirements and estimating their carbon intensity and returns. The results showed that it is possible to maintain financial performance similar to the KOSPI while effectively reducing climate risk in investment portfolios.

Park Sunghoon, Head of the Sustainable Growth Planning Team at the Sustainable Growth Office, explained, "Compared to the KOSPI, the carbon intensity is significantly reduced, and the cumulative returns slightly exceed those of the KOSPI, enabling stable tracking. The index composition also shows an increased investment share in companies and industries with lower carbon intensity compared to the KOSPI."

Specifically, over the past 10 years from October 2015 to May 2025, the cumulative returns of the K-PAB, which has stricter index requirements, exceeded the KOSPI by 5.6 percentage points, and the K-CTB by 4.6 percentage points. During this period, the carbon intensity of the KOSPI decreased by 38.9%, while that of the K-PAB and K-CTB decreased by 47.9%, meaning the reduction rate was 9 percentage points higher.

However, the report pointed out that, to introduce a green index domestically, it is essential to expand climate data such as corporate carbon emissions and fossil fuel revenue ratios. It also noted that limited incentives for low-carbon investment could restrict demand, which is another constraint.

Park emphasized, "Introducing the index could increase investment in companies and industries with lower carbon intensity, and provide incentives for companies to reduce their carbon intensity in order to survive. Strengthening greenhouse gas reduction efforts and disclosing reliable climate-related information could increase the inflow of global investment funds and have a positive effect on enhancing corporate value across the stock market."

He added, "It is necessary to first calculate and operate a pilot index based on available data, and to consider incentives for investors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)