Conversion to Holding Company Structure Cited as Compliance with Fair Trade Act

Widely Seen as the Starting Point for Group Governance Restructuring

Key Challenges for Affiliate Separation: Equity Adjustment and Resolving Dual Executive Roles

IPO Relaunch Momentum Growing for Eldest Son's Hoban Construction

As Hoban Group announced its plan to transition Hoban Industry, led by the second son Kim Minseong, to a holding company structure, attention is focusing on the group's future direction. On the surface, this move is intended to comply with the requirements of the Fair Trade Act. However, there is growing interpretation that this is, in reality, the starting signal for a split between affiliates, with the eldest son Kim Daeheon overseeing Hoban Construction and the second son leading Hoban Industry.

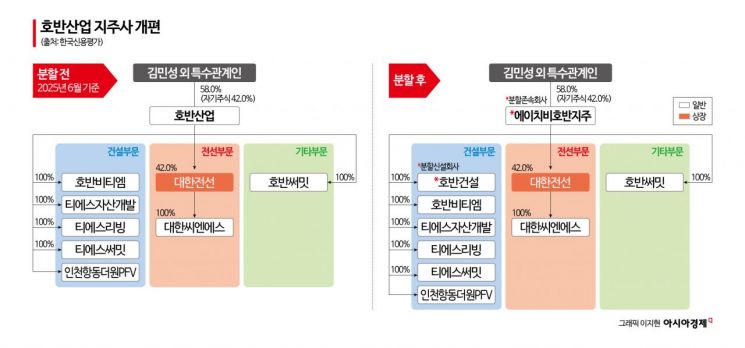

According to Hoban Group on September 27, Hoban Industry will undergo a physical division on October 31, resulting in the surviving entity HB Hoban Holdings and the newly established Hoban Industry. The existing Hoban Industry will be renamed HB Hoban Holdings and converted into a holding company. The newly created Hoban Industry will inherit the existing company name and become a subsidiary of HB Hoban Holdings.

This is a proactive measure taken with the Fair Trade Act in mind, which requires conversion to a holding company structure if the combined value of subsidiaries' equity exceeds 50%. As of last year, the combined equity value of Hoban Industry's subsidiaries, including Taihan Electric Wire, slightly surpassed 40%.

Founder Kim Sangyeol has completed the succession plan by entrusting Hoban Construction to his eldest son Kim Daeheon, Hoban Industry to his second son Kim Minseong, and Hoban Property to his eldest daughter Kim Yunhye. Industry insiders view this measure not merely as a regulatory adjustment, but as the starting point for a comprehensive restructuring of the group's governance. Korea Ratings stated, "After the transition to a holding company, a group-wide governance restructuring is expected, and additional corporate acquisitions cannot be ruled out following the 2021 acquisition of Taihan Electric Wire."

To make the split between affiliates a reality, the stakes that Hoban Construction and Hoban Property hold in Hoban Industry (16%), as well as the 20.6% stake that Kim Minseong holds in Hoban Property, are key variables. To meet the Fair Trade Act's requirements for affiliate separation, mutual equity sales and adjustments are unavoidable. In addition, besides equity structure adjustments, there remain several challenges such as resolving executive dual roles and severing financial lending and guarantee relationships.

As scenarios for affiliate separation are discussed, the group's two-track strategy is becoming more pronounced. HB Hoban Holdings, led by the second son, is expected to strengthen its "beyond construction" strategy, with Taihan Electric Wire at the forefront. Last year, Taihan Electric Wire accounted for 42.8% of HB Hoban Holdings' sales (about 4.1 trillion won), far surpassing the construction sector's 24.6%. Recently, Taihan Electric Wire has played a key role in group-wide fundraising, increasing its bond issuance to 155 billion won-well above the original target-thanks to strong demand forecasts.

In contrast, the eldest son's Hoban Construction is focusing on its core housing business. This year, the company has continued to win contracts for small-scale redevelopment projects such as Jayang District 1-4 and Sinwol-dong street housing renewal, expanding its reconstruction and redevelopment business. It recently established a dedicated office in Seoul for redevelopment projects. In addition, the long-delayed "Hoban Summit" apartment sales will resume next month, aiming to restore cash generation. The division is becoming clear: Hoban Construction is focusing on housing and redevelopment, while Hoban Industry is concentrating on manufacturing and infrastructure.

The possibility of an initial public offering (IPO) for Hoban Construction-a long-held ambition for Hoban Group-is also being discussed again. Hoban Construction attempted to go public in 2018 but suspended the plan due to the impact of COVID-19. At that time, after merging affiliates, the company ranked in the top 10 in the 2019 construction capability evaluation and was valued at between 3 trillion and 4 trillion won. An investment banking industry insider commented, "If the equity ties with Hoban Industry are sorted out, momentum for relaunching the IPO could be secured." In response, a Hoban Group representative said, "Nothing has been decided concretely yet."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)