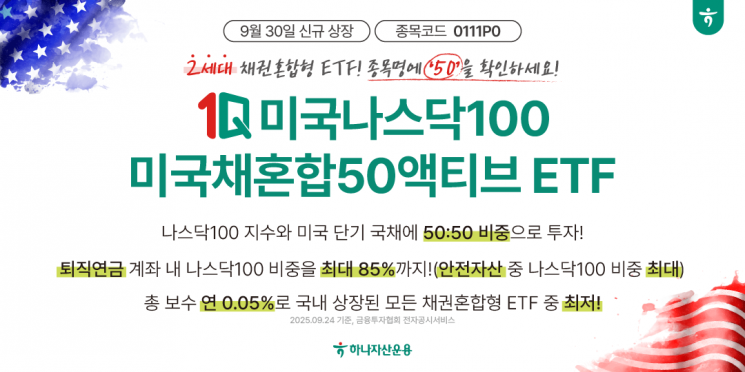

Hana Asset Management will list the '1Q US Nasdaq 100 US Treasury Mixed 50 Active ETF' as a new offering on September 26.

This ETF invests approximately 50% each in the US tech benchmark index Nasdaq 100 and US short-term government bonds. Among bond-mixed ETFs classified as safe assets under retirement pension supervisory regulations, it has the highest allocation.

This is a 'second-generation' Nasdaq 100 bond-mixed ETF, reflecting the latest retirement pension supervisory regulations revised on November 16, 2023. Compared to first-generation Nasdaq 100 bond-mixed ETFs, the allocation to the Nasdaq 100 is about 1.7 times higher.

It is suitable for strategies that actively increase the allocation to the Nasdaq 100 within retirement pension (DC/IRP) accounts. According to regulations, retirement pension accounts must invest 30% of total assets in safe assets such as deposits, savings, bonds, or bond-mixed funds, and up to 70% in risk assets such as stocks.

In accordance with these regulations, by including the '1Q US Nasdaq 100 US Treasury Mixed 50 Active' within the 30% safe asset portion and the 1Q US Nasdaq 100 within the 70% risk asset portion, investors can achieve up to 85% allocation to the Nasdaq 100 in their overall portfolio.

The total expense ratio is set at 0.05% per year, which is the lowest among all bond-mixed ETFs listed in Korea.

Hana Asset Management has launched a series of US index ETFs for pension investors this year, including ▲1Q US S&P 500 ▲1Q US S&P 500 US Treasury Mixed 50 Active ▲1Q US Nasdaq 100. With the listing of the 1Q US Nasdaq 100 US Treasury Mixed 50 Active ETF, the series is now complete.

The 1Q US S&P 500 US Treasury Mixed 50 Active ETF became the first among second-generation S&P 500 bond-mixed ETFs to surpass 50 billion won in net assets. It has established itself as a widely used ETF among retirement pension investors.

Kim Taewoo, CEO of Hana Asset Management, introduced the product by saying, "The 1Q US Nasdaq 100 US Treasury Mixed 50 ETF is optimized for pension investment, as it allows for diversified investment in the US tech benchmark index, US short-term government bonds, and dollar assets with a single investment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)