Korea Ratings Hosts Petrochemical Industry Webcast

According to a recent analysis, domestic petrochemical companies facing the brink of restructuring would need to reduce their production capacity by 18% to return to the operating rates seen during past boom periods. There are also warnings that liquidity risks have risen across the entire industry.

On the afternoon of September 25, Korea Ratings announced these findings through the webcast titled "Petrochemical Industry on the Brink of Restructuring: Survival Strategies in an Era of Oversupply."

Kim Hoseop, a research fellow at Korea Ratings, stated, "A reduction of about 18% in domestic petrochemical production capacity, or approximately 17 million tons, is necessary." He estimated that, considering the expected increase in supply pressures such as China's capacity expansion, this is the minimum amount required to improve operating rates and supply-demand conditions.

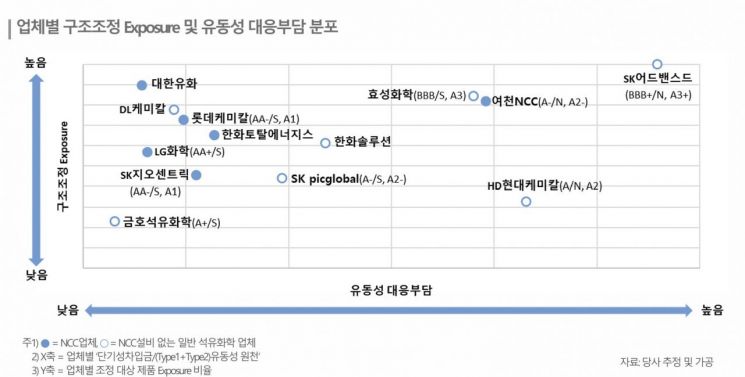

Given the difficulty of selling naphtha cracking centers (NCC) externally, it was assessed that among NCC companies, Daehan Oil & Chemical, Yeochun NCC, and Lotte Chemical have a particularly high need to reduce their facilities. Kim explained, "These companies mainly focus on the olefin segment, which is experiencing severe oversupply, making facility reduction more urgent."

In the cases of Hanwha Total and SK Geocentric, their higher proportion of general-purpose aromatic products (such as BTX) with relatively stable operating rates means they are less exposed compared to other NCC companies. LG Chem has also secured product lines such as PVC and synthetic rubber, which maintain solid operating rates, and is engaged in the secondary battery materials business, resulting in lower exposure. In contrast, SK Advanced and Hyosung Chemical were noted as needing adjustments due to their high proportion of general-purpose products such as propylene and polypropylene.

Concerns were also raised about the increased liquidity risk in the petrochemical industry compared to the past. Kim pointed out, "Given the possibility of reduced credit limits from financial institutions due to prolonged industry downturns, liquidity risk has increased across the sector." He added, "Most companies' operating cash flow generation has declined compared to previous years." Refinancing risk was assessed to be highest for market-based borrowings, followed by foreign financial institution loans, and then domestic financial institution loans.

By company, it was stressed that HD Hyundai Chemical must improve its financial structure, including capital expansion, within the year. For Yeochun NCC, there was a warning that if there are further credit rating downgrades or deterioration in financial indicators, the fulfillment of conditions for acceleration clauses could highlight liquidity risks again. Additionally, it was determined that SK Advanced and Hyosung Chemical each require sufficient financial support from shareholders, and that securing liquidity through additional shareholder support or business unit sales is necessary.

Kim predicted, "Downward pressure on the credit ratings of the domestic petrochemical industry is expected to continue," and added, "If restructuring accelerates, short-term shocks for each company will be inevitable." Specifically, he pointed out the potential for asset impairment due to facility reductions, compensation for shareholders, creditors, and employees in business transfers, related taxes, and increased costs and funding needs.

He explained, "Assuming that sufficient government support significantly reduces uncertainty in managing liquidity, we plan to comprehensively review short-term financial indicator changes by company, restructuring execution capabilities, business structure reorganization and outlook, government support, and post-management plans, and reflect these factors in credit ratings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)