KEA Survey of Top 600 Companies

October BSI Outlook at 96.3

Both Manufacturing and Non-Manufacturing Sectors Show Weak Performance

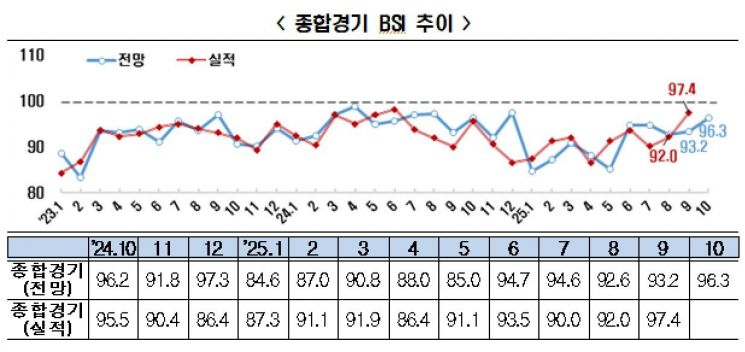

The business outlook for October among the top 600 companies by revenue has been found to be negative. The Business Survey Index (BSI) has recorded a negative outlook for more than three consecutive years since 2022.

According to a survey conducted by the Korea Economic Association on the top 600 companies by revenue, the BSI outlook for October 2025 was tallied at 96.3. A figure below the baseline of 100 indicates a negative business outlook. Although the BSI reached its highest point since December of last year (97.3), it has remained below the baseline for 43 consecutive months since April 2022 (99.1).

This month’s actual BSI was 97.4, which also marks 44 consecutive months of sluggishness since February 2022 (91.5). By sector, both manufacturing (96.8) and non-manufacturing (95.8) recorded figures below the baseline. The manufacturing BSI (96.8) has remained below the baseline for 19 consecutive months since April of last year, while the non-manufacturing BSI (95.8) has done so for three consecutive months since August of this year.

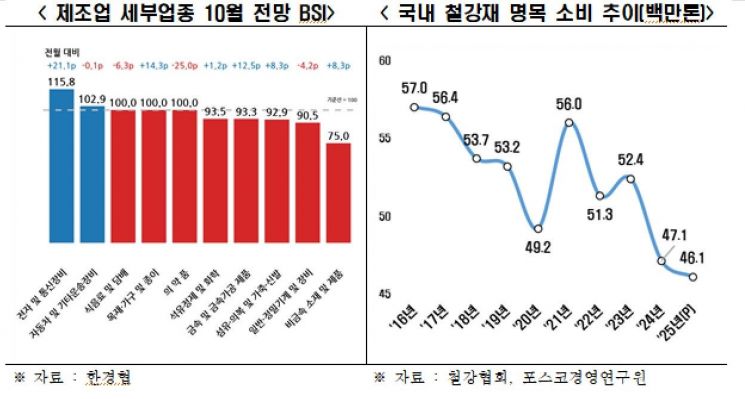

Among detailed manufacturing sectors, electronics and telecommunications equipment (115.8) and automobiles and transportation equipment (102.9) showed strong performance. Food and beverages and tobacco, wood, furniture and paper, and pharmaceuticals maintained the baseline at 100. However, non-metallic materials and products (75.0), general and precision machinery (90.5), textiles and apparel (92.9), metals and metal processing (93.3), and petroleum refining and chemicals (93.5) all showed a negative outlook.

In the non-manufacturing sector, only professional, scientific, technical, and business support services (113.3) showed a positive outlook, while electricity, gas, and water supply, wholesale and retail, and transportation and warehousing maintained the baseline at 100. Construction (82.2), leisure, accommodation, and food services (92.9), and information and communications (93.8) continued to show a negative outlook.

By category, all items, including domestic demand (94.2), investment (89.7), and exports (93.7), recorded sluggish performance, remaining below the baseline for 16 consecutive months since July of last year. In particular, the investment BSI fell back into the 80s for the first time in five months since May (87.2). Employment (91.0), financial conditions (91.6), and profitability (92.3) also remained below the baseline, while inventory (105.0) exceeded the baseline, indicating a negative outlook.

The Korea Economic Association interpreted that, despite improved performance in major export sectors such as semiconductors, automobiles, and ships, the prolonged downturn in downstream industries such as petrochemicals and steel has worsened the outlook for parts and materials suppliers.

Lee Sangho, Head of the Economic and Industrial Division at the Korea Economic Association, stated, "Due to the deterioration of the global trade environment, including protectionism and tariffs, as well as severe weakness in domestic demand, business conditions for companies are extremely challenging." He further pointed out, "In particular, weakened investment sentiment could become a significant burden on economic growth." He emphasized, "Above all, it is crucial to restore business sentiment by stabilizing the external trade environment and boldly innovating regulations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.