A Sixfold Surge in Three Years, from 400 in 2022

World's Highest Inheritance Tax Cited as Key Driver

United Arab Emirates, United States, and Italy as Top Destinations

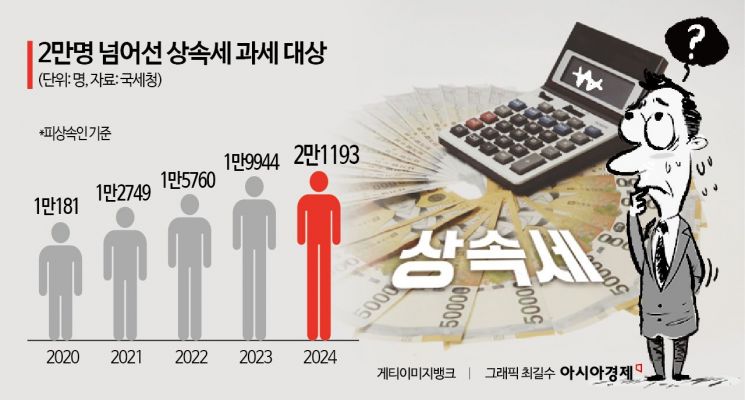

The proportion of inheritance tax collected in South Korea compared to total tax revenue is the highest among major countries, exceeding four times the OECD (Organisation for Economic Co-operation and Development) average. Even considering that the purpose of inheritance tax is to be levied on the middle class and wealthy individuals with significant assets, there are growing concerns that the inheritance tax burden in South Korea is excessive. Some analysts also argue that the country's inheritance tax system is prompting high-net-worth individuals to emigrate overseas.

According to the "2025 Wealth Migration Report" released on the 23rd (local time) by global investment migration consulting firm Henley & Partners, the number of high-net-worth individuals expected to leave South Korea this year is estimated at around 2,400. This figure represents a sixfold increase from about 400 in 2022. The report cited sharp tax increases and the world's highest level of inheritance tax burden as the main reasons for this trend.

South Korea's highest inheritance tax rate reaches up to 60% when including the surcharge for major shareholders. The United States and the United Kingdom have rates of 40%, Japan's rate is around 55%, and among 38 OECD countries, 14 have no inheritance tax. Such high rates are directly impacting actual business operations. Asia Economy

South Korea's highest inheritance tax rate reaches up to 60% when including the surcharge for major shareholders. The United States and the United Kingdom have rates of 40%, Japan's rate is around 55%, and among 38 OECD countries, 14 have no inheritance tax. Such high rates are directly impacting actual business operations. Asia Economy

The Henley & Partners report projects that South Korea will rank fourth in the world this year for net outflow of high-net-worth individuals, following the United Kingdom, China, and India. The most preferred destinations for these individuals are the United Arab Emirates (UAE), the United States, and Italy. The main reasons for this large-scale outflow include sharp tax hikes, the burden of inheritance tax, and political and economic uncertainty. Deteriorating educational environments and social conflict were also mentioned. South Korea's highest inheritance tax rate reaches up to 60% when including the surcharge for major shareholders. The United States and the United Kingdom have rates of 40%, Japan's rate is around 55%, and among 38 OECD countries, 14 have no inheritance tax.

Overseas Remittance for Migration Doubles in Eight Years

The high tax rate is also directly impacting actual business operations. This trend can be seen in statistics on overseas asset transfers. According to data submitted by Representative Yoon Youngseok of the National Assembly's Strategy and Finance Committee, based on information from the National Tax Service, the total amount of funds remitted overseas for migration reported in 6,300 cases from 2017 to the first half of this year reached 5.2 trillion won. The average amount remitted per case, which was 700 million won in 2017, more than doubled to 1.54 billion won in the first half of this year. Representative Yoon warned, "If the government insists on maintaining a tax system that is less favorable than those of competing countries, the wealthy will inevitably leave for overseas. Capital outflow will result in reduced domestic investment, fewer jobs, and a decline in tax revenue."

Meanwhile, the business community points out that excessive inheritance taxes actually affect corporate management and the economic ecosystem. A representative case is the late Kim Jungju, founder of Nexon. Of his approximately 10 trillion won estate, several trillion won-equivalent to 60%-was paid by his family as inheritance tax. As a result, the government secured 5 trillion won worth of shares in Nexon's holding company, becoming its second-largest shareholder. In addition, around June, Seo Jungjin, chairman of Celltrion Group, also publicly addressed the issue of inheritance tax. Chairman Seo criticized, "With the inheritance and gift taxes, I will have to pay at least 6 to 7 trillion won, so there is no way to pass on the company. If I die, half of the company will go to the state and the other half to the next generation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)