Five-Star Hotels Concentrated in Seoul and Jeju

Seoul Room Rates Up 33% in Four Years

Only 8 Concert Venues with Over 10,000 Seats in Korea, Compared to 34 in Japan

As of the end of December 2024, there is not a single five-star hotel in Gwangju, Sejong, North Chungcheong, South Chungcheong, North Jeolla, or South Gyeongsang. This highlights the reality facing Korea as it aspires to become a global tourism powerhouse. According to the Ministry of Culture, Sports and Tourism's tourism accommodation registration data, there are a total of 74 five-star hotels in the country, with 26 located in Seoul and 18 concentrated in Jeju.

The government has presented a vision to attract 30 million international tourists by 2030, aiming to transform Korea into a "tourism powerhouse." The tourism industry is considered a core strategic sector under the Lee Jaemyung administration. To support this, the annual National Tourism Strategy Meeting, usually held in December, will be moved up to the 25th of this year. The theme, "Regional Tourism Expansion Strategy for the Era of 30 Million Arrivals," underscores the poor state of regional tourism environments.

Weak Regional Tourism Infrastructure

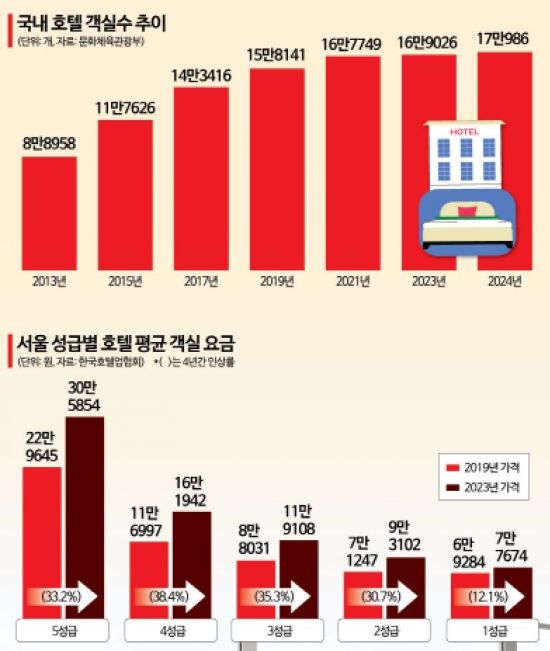

The key to reaching 30 million international tourists lies in revitalizing regional tourism. According to a 2024 survey, 82.7% of international tourists visited the Seoul metropolitan area, while only 33.9% visited areas outside the capital region. Due to this concentration, investment in regional accommodation infrastructure has been insufficient. An industry insider emphasized the need for government support, stating, "The lack of suitable accommodation in regional areas creates a vicious cycle where international tourists do not return." Since the COVID-19 pandemic, accommodation infrastructure has further contracted. Ministry of Culture, Sports and Tourism statistics show that the number of hotel rooms in Korea surpassed 100,000 in 2014 and had increased by about 10,000 each year, but over the past five years, the number has grown by only about 10,000 in total. Meanwhile, the number of international tourists is expected to reach 20 million this year, intensifying the imbalance between demand and supply for accommodations and leading to a sharp rise in room rates.

According to data from the Korea Hotel Association, the average room rate for five-star hotels in Seoul rose by 33.2% over four years, from 229,645 won in 2019 to 305,854 won in 2023. Four-star hotels saw a 38.4% increase during the same period. This creates a dual structure: a shortage of rooms in Seoul and an oversupply of vacant rooms in regional areas.

Shared Accommodation as a Potential Solution

The types of tourists visiting Korea are also changing. According to the Korea Hotel Association, whereas Chinese tourists previously traveled mostly in groups, now 80-90% are free independent travelers (FITs). These travelers tend to spend more and stay longer than groups, generating greater economic impact. However, due to a lack of suitable accommodation infrastructure for them, shared accommodation is emerging as an alternative.

Shared accommodation is similar to traditional homestays, but current regulations restrict it to "urban homestays for foreign tourists," meaning only foreigners can use them, and hosts are required to reside on the premises, among other restrictions.

Industry representatives point out, "Overseas platforms do not distinguish between domestic and foreign guests, but current regulations are out of touch with reality and effectively force operators into illegality." The fact that some tourists are uncomfortable with cohabiting with hosts is also cited as a problem.

K-Pop Venues Fall Short of Global Standards

The government is attempting to boost regional tourism by holding K-pop concerts outside of major cities and developing them into tourism products, but a lack of performance infrastructure remains a major obstacle. The Korea Creative Content Agency has pointed out that, due to the absence of dedicated concert venues, most K-pop concerts are held in sports facilities, and even noted the phenomenon of "Korea Passing," where Korea is excluded from global artists' tours. Minister of Culture, Sports and Tourism Choi Hwiyeong also highlighted that while Japan has 34 venues with more than 10,000 seats and five domed stadiums with over 40,000 seats, Korea only has eight venues with more than 10,000 seats and no domed stadiums of that size. Major concert production companies have stated that overseas concerts are more profitable, making domestic regional concerts less attractive. Regional performance venues are mostly large convention centers with low utilization rates, and the shortage of small and mid-sized theaters makes it difficult to plan stages tailored to artists' needs, which is also seen as a problem.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.