Financial Supervisory Service Reveals Major Types of Automobile Insurance Fraud

Mr. A rear-ended another vehicle while driving under the influence of alcohol. According to the police investigation, his blood alcohol concentration was 0.08%, a level that warrants license revocation. However, when Mr. A filed an insurance claim with B Insurance Company for vehicle repairs, he failed to disclose that he had been caught driving under the influence. This was an attempt to avoid paying the accident liability surcharge required in drunk driving accidents. During the accident investigation, B Insurance Company discovered Mr. A's drunk driving record and reported him for insurance fraud.

On September 24, the Financial Supervisory Service released major types of automobile insurance fraud, including accident fabrication schemes.

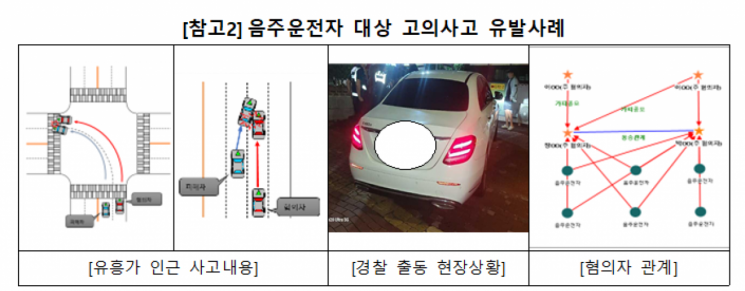

Mr. C, whose employment was unstable, conspired with his friend Mr. D, who was in urgent need of cash, to deliberately cause accidents involving drunk drivers near entertainment districts and bars for the purpose of defrauding insurance companies. E Insurance Company grew suspicious due to the frequent occurrence of accidents near entertainment districts and conducted an investigation, confirming that Mr. C and his associates were repeatedly involved in accidents targeting drunk drivers. Through a review of insurance fraud accident histories, E Insurance Company also found that Mr. C and Mr. D had colluded as both perpetrators and victims to stage intentional accidents. E Insurance Company gathered evidence of their deliberate accident schemes and reported them to the police.

Mr. F and Ms. G, a married couple, planned accidents by colliding with the side or rear of vehicles changing lanes in heavy traffic areas. They sometimes caused accidents while traveling with elderly parents or young children as passengers in order to demand higher settlement payments. When H Insurance Company began investigating, they repeatedly made false or exaggerated statements regarding the causes and damages of the accidents. The Financial Supervisory Service compared accident footage with statements from the passengers and confirmed the couple's insurance fraud, subsequently reporting them to the police.

Mr. J, a delivery service rider, found that the insurance premium for his motorcycle, which he used for deliveries, was high. To reduce costs, he falsely registered his motorcycle as a non-commercial vehicle (for commuting or household use) with K Insurance Company. When he struck a pedestrian during a delivery, Mr. J manipulated the accident report, claiming it occurred during commuting. However, K Insurance Company examined the motorcycle's black box footage and discovered a delivery container and parcels, which were inconsistent with typical commuting use. K Insurance Company confirmed that Mr. J had fraudulently obtained household motorcycle insurance for business purposes and had filed a false accident report, and reported the insurance fraud to the police.

Last year, the amount of fraudulent automobile insurance claims resulting from accident fabrication and similar schemes reached approximately 82.4 billion won. The amount was 53.4 billion won in 2022 and 73.9 billion won in 2023, showing a steady increase in the scale of fraud. Insurance fraud detected for violations of disclosure obligations at the time of policy enrollment, such as failing to report business use or purpose, amounted to about 70.6 billion won last year.

Automobile insurance fraud constitutes a violation of the Special Act on the Prevention of Insurance Fraud (Article 8), and offenders can face up to 10 years in prison or a fine of up to 50 million won. In cases involving the falsification of documents, such as submitting fake hospitalization records, offenders may also be charged under the Criminal Act for forgery of private documents (Article 231), which carries a penalty of up to 5 years in prison or a fine of up to 10 million won. False diagnoses and forged medical records by hospitals or clinics are punishable under the Medical Service Act for making false records (Article 88), with penalties of up to 3 years in prison or a fine of up to 30 million won, and medical professionals may also face suspension of their license for up to one year (Article 66).

If you receive an unreasonable insurance fraud proposal or become aware of a suspicious case, actively report it to the Insurance Fraud Reporting Center. If your report is confirmed as insurance fraud, the General Insurance Association of Korea or the insurance company may pay a reward of up to 2 billion won, according to their reward policies.

A representative from the Financial Supervisory Service stated, "We plan to continue identifying cases of consumer damage and important precautions for types of insurance fraud with a high risk of consumer involvement," adding, "We will actively respond to the ever-diversifying new types of automobile insurance fraud every year by closely cooperating with the National Police Agency, the General Insurance Association of Korea, the Korea Automobile Insurance Repair Research and Training Center, and the Korea Rent-a-Car Association."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.