Korea Capital Market Institute Issue Briefing

International Comparison of Stock Market Discount Rates and the Korea Premium Challenge

Over the past 20 years, the average discount rate in the Korean stock market has been found to be higher not only than the average of Organization for Economic Cooperation and Development (OECD) member countries, but also higher than that of emerging markets. As this undervaluation phenomenon, known as the 'Korea Discount,' continues over the long term, experts diagnose that the Korean stock market has fallen into a 'high-risk, low-return' structure.

On the morning of the 24th, Kim Minki and Lee Sangho, research fellows at the Korea Capital Market Institute, presented these findings at a KCMI issue briefing held at the institute's headquarters in Yeouido, under the theme "International Comparison of Stock Market Discount Rates and the Challenge of Achieving a Korea Premium." The discount rate is a key variable in calculating a company's intrinsic value; from an investor's perspective, it is the required rate of return, while from a company's perspective, it represents the cost of raising equity capital.

Comparison of Discount Rates Across 59 Countries... Consistently Exceeding Major Economies

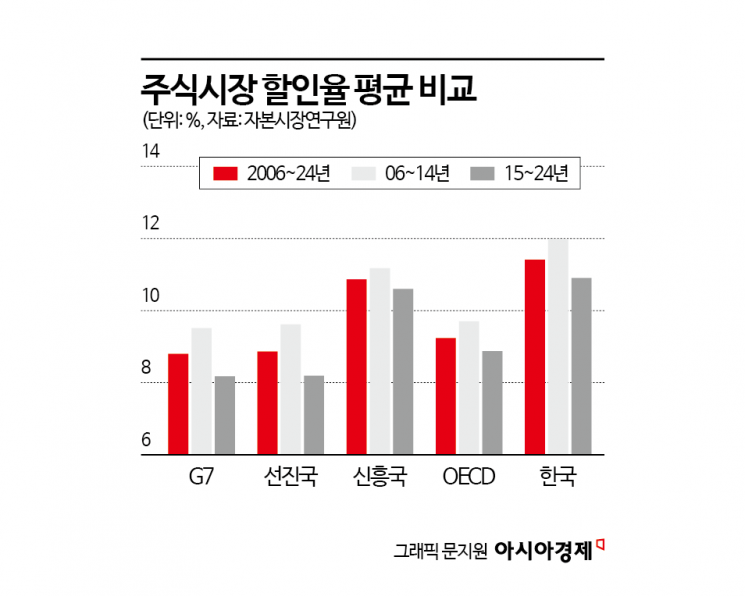

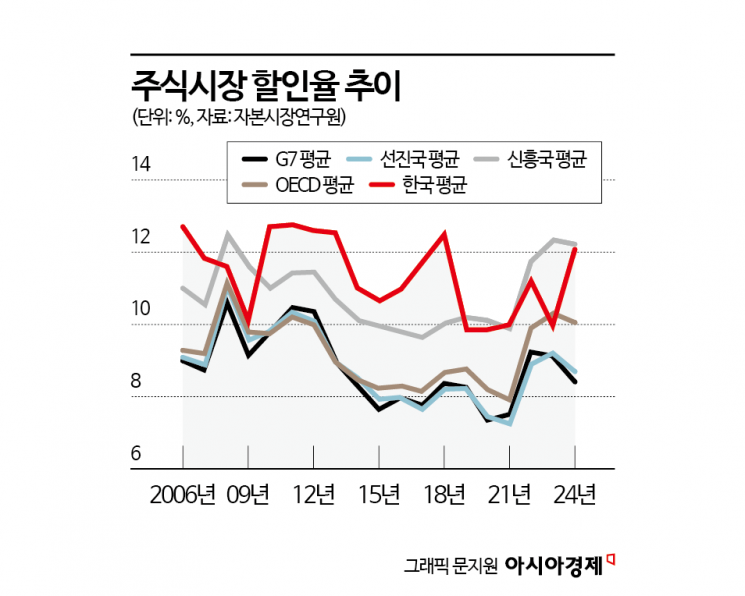

Based on an analysis and comparison of discount rate levels in major stock markets using panel data from 59 countries between 2006 and 2024, the average discount rate in the Korean stock market was 11.5%. This figure is significantly higher than the averages for the Group of Seven (G7) countries (8.8%), advanced economies (8.9%), and even the average for other OECD member countries excluding Korea (9.3%). It also surpasses the average for emerging markets (10.9%, excluding Korea). Kim pointed out, "Even when comparing individual countries, Korea's discount rate remains relatively high even among emerging markets."

The actual total shareholder return (TSR) achieved by the Korean market over a long period also remained at an annual average of just 7.3%, falling significantly short of the rate of return demanded by investors (the discount rate). More than half of listed companies failed to even achieve the risk-free bond yield published by the Bank of Korea, indicating severe underperformance. In contrast, in major advanced and emerging markets, TSR exceeded the required rate of return to some extent.

Kim explained, "This is a sign that the overall discount rate in our market is structurally high," adding, "The long-standing phenomenon of a low price-to-book ratio (PBR) in the Korean stock market is closely linked to this high discount rate factor."

Particularly concerning is the fact that this situation has persisted regardless of macroeconomic conditions or timing. Kim warned, "If the market continues for an extended period without meeting shareholders' required rate of return, investors will continue to demand a high discount rate in response to uncertain rewards, making it difficult to break the vicious cycle in which the cost of capital for companies remains high." The return on equity (ROE) for Korean companies has remained below the cost of capital for a prolonged period.

Complex Factors at Play... Bold Innovation Investment and Dividend Policy Reform Needed

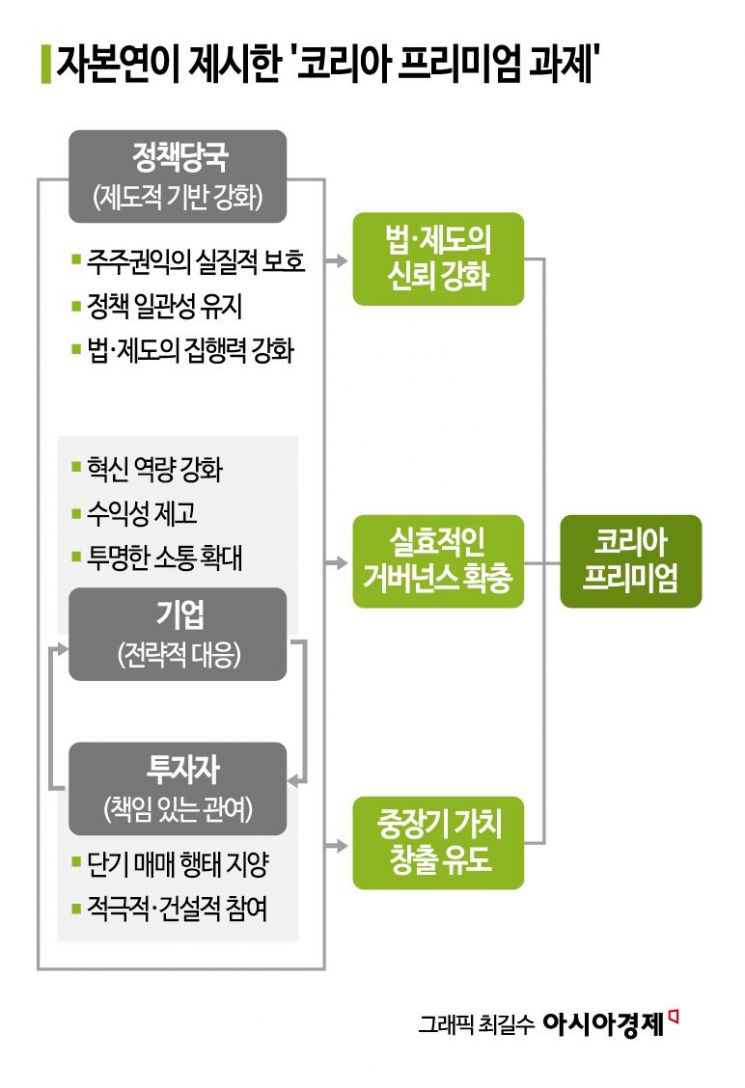

The high discount rate in the Korean stock market is analyzed as the result of a combination of factors: low capital efficiency and profitability of companies, weak institutional trust, and investor behavior focused on short-term performance. Accordingly, to overcome the low PBR phenomenon and achieve a 'Korea Premium,' experts suggest that both strategic responses at the corporate level and institutional reforms to lower the cost of capital are necessary.

Kim first advised companies to "enhance profitability and competitiveness through bold innovation investment and rational improvement of dividend policies," emphasizing that "it is important to establish a governance structure so that these processes can be internalized throughout overall management."

On the institutional side, he stressed the need to strengthen the enforceability of laws and regulations and ensure policy consistency, while also protecting the rights and interests of general shareholders to mitigate the institutional risk premium embedded in the Korean market. In addition, Kim added that investors themselves should move away from short-term trading-oriented behavior and become responsible participants who encourage companies to create sustainable value.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)