1 trillion won outflow from leveraged ETFs, 2 trillion won inflow into parking-type products

Rising demand for idle funds as investors hesitate to chase KOSPI rally

Securities firms remain optimistic on KOSPI, driven by semiconductor strength

As the rally in the KOSPI continues, changes in investor portfolios are being observed, particularly among those who are mindful of a potential market correction. There are reports that investors are reducing the proportion of leveraged products in their portfolios and shifting toward parking-type products to moderate their investment pace.

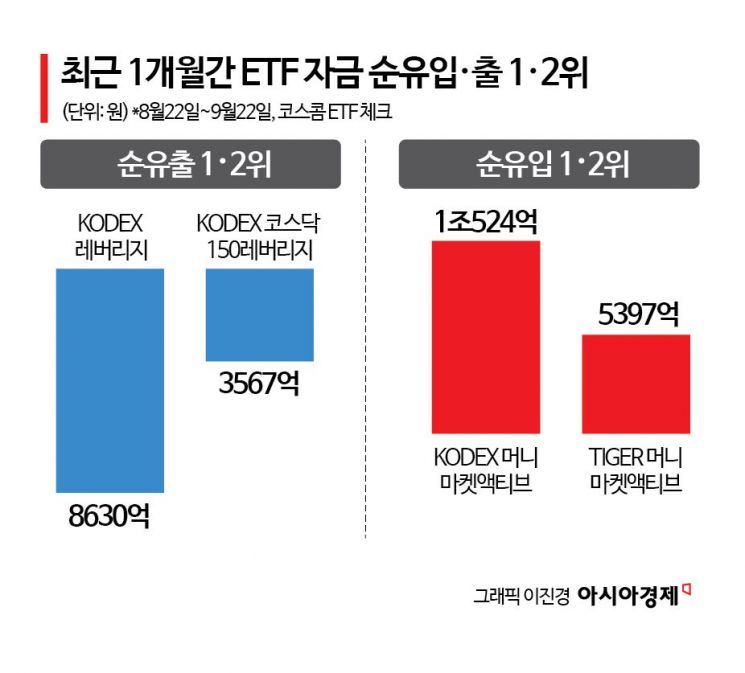

According to Koscom ETF Check on September 24, among all exchange-traded funds (ETFs), the ETF with the largest outflow of funds over the past month was "KODEX Leverage," which saw approximately 863 billion won withdrawn. "KODEX KOSDAQ150 Leverage" recorded a net outflow of 356.7 billion won, ranking second overall.

KODEX Leverage and KODEX KOSDAQ150 Leverage are ETFs that track twice the daily returns of the KOSPI200 Index and the KOSDAQ150 Index, respectively. Since the beginning of this month, the KOSPI200 and KOSDAQ150 indices have risen by 11.40% and 8.94%, respectively, outperforming the overall market returns (KOSPI 8.93%, KOSDAQ 8.82%). This has led investors to realize profits. Over the past month, these two ETFs have delivered returns of 24.04% and 23.71%, respectively.

Investors who have exited leveraged products are now turning to parking-type products. Over the past month, the ETF that attracted the most funds was "KODEX Money Market Active," with approximately 1.0524 trillion won in inflows. This was followed by "TIGER Money Market Active" (539.7 billion won, second in net inflows), "ACE Money Market Active" (342.8 billion won, fifth), and "RISE Money Market Active" (337.6 billion won, sixth). The total inflows into these four ETFs alone amounted to 2.2725 trillion won.

Money Market Active ETFs invest in ultra-short-term bonds with maturities of less than three months, commercial paper (CP), and certificates of deposit (CD), aiming to provide stable returns through short-term financial products. As the KOSPI has surged to record highs, demand for idle funds has increased among investors who feel burdened by the prospect of chasing the rally.

In fact, the turnover rate of KOSPI-listed stocks, which spiked to 0.88% on September 10 when the KOSPI began its record-breaking rally, has since been on a steady decline along with trading volume. The turnover rate is calculated by dividing the trading volume over a certain period by the number of listed shares. A lower turnover rate indicates diminished investor interest and sluggish trading activity. The turnover rate recorded the previous day was 0.55%, lower than the 1.75% recorded on July 6, 2021, when the KOSPI reached its previous all-time high.

However, despite concerns about a short-term correction following the rapid rise, the rosy outlook for the KOSPI in the securities industry remains undiminished. This is because the strong performance of leading semiconductor stocks, which drive the main board, shows no signs of weakening. Lee Jaewon, a researcher at Shinhan Investment Corp., stated, "Last year, Morgan Stanley, which predicted a 'semiconductor winter,' has now upgraded its investment opinion on the Korean semiconductor sector. As a result, there is now a consensus both domestically and internationally that the growth of the AI market will lead to a shortage in memory semiconductor supply, resulting in price increases and a supercycle. If there is no winter for semiconductors, it is difficult to expect a KOSPI downturn."

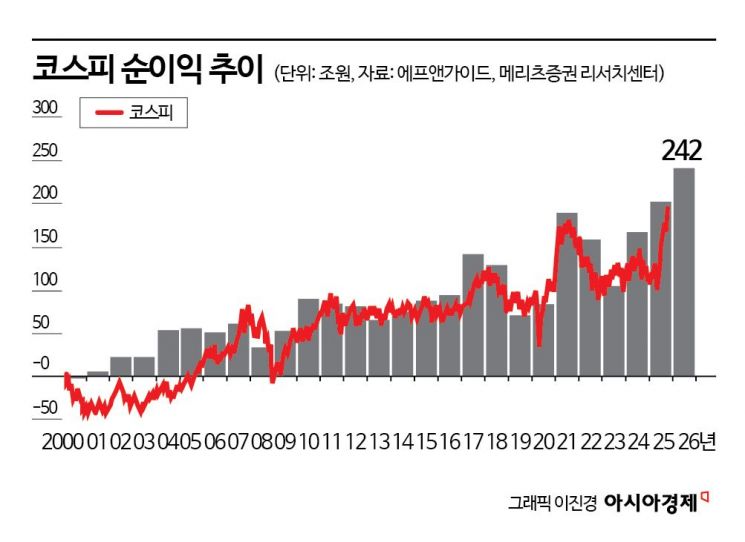

Lee Sujeong, a researcher at Meritz Securities, noted, "The KOSPI valuation has reached the upper range typical of a bull market, with a 12-month forward price-to-earnings ratio (PER) of 11.2 times and a trailing price-to-book ratio (PBR) of 1.16 times." She highlighted, "What is encouraging is that earnings estimates have rebounded thanks to the contribution from the semiconductor sector." She added, "The annual net profit of the KOSPI is estimated to grow by 19%, from 203.5 trillion won this year to 242.3 trillion won in 2026. This means that even if valuation rerating stops and simply holds steady, the index could reach the 4,000 mark."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.