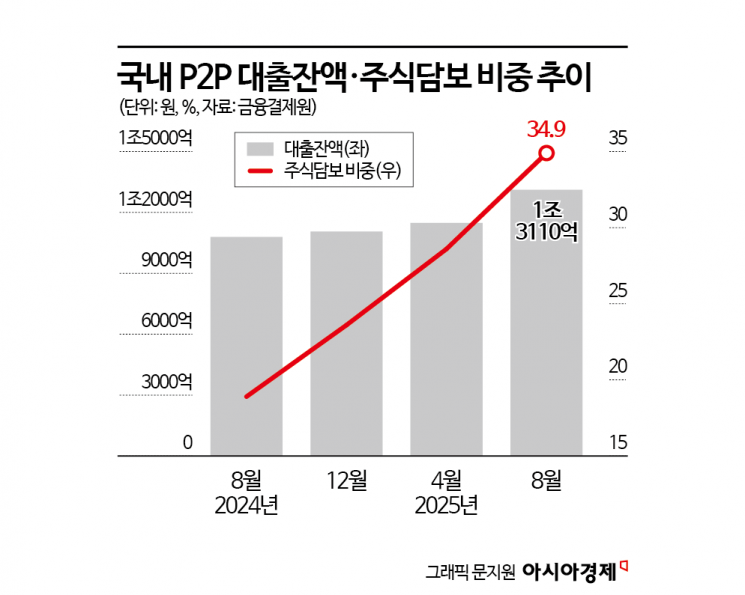

Outstanding P2P Loan Balance Reaches 1.311 Trillion Won Last Month, Up 21.5% Year-on-Year

Stock-Backed Loans Nearly Double to 34.9% in One Year

"Focus Needed on Core P2P Functions, Not Just Stock-Backed Lending"

The fervor for leveraged stock investments, fueled by the bullish domestic stock market, is now spreading to online investment-linked finance (P2P finance). While this trend is providing a short-term boost to the P2P finance industry, which has recently entered a stagnant phase, some experts argue that for sustainable market growth, the sector should focus on its core function rather than relying solely on stock-backed loans (Stock Loan).

According to the Korea Financial Telecommunications & Clearings Institute on September 23, the outstanding loan balance of 51 P2P finance companies last month reached 1.311 trillion won, up 21.5% from the same period last year. During this period, the share of other collateralized loans-mostly Stock Loans-nearly doubled, rising from 18.9% to 34.9%. As the KOSPI index surpassed 3,400 and continued to set new all-time highs, the proportion of Stock Loans, which offer leverage, has been steadily increasing.

A Stock Loan is a product that allows investors to borrow funds for stock purchases using stocks or deposits held in a securities account as collateral. When a borrower requests a loan from a P2P company using their securities account as collateral, the funds invested by investors are provided to the borrower through the P2P platform. After maturity, the principal and interest repaid by the borrower are distributed to investors via the P2P company, generating returns. If the collateral ratio falls below a certain threshold (120~125%), a forced liquidation is automatically triggered to recover the loan.

As demand for borrowing stock purchase funds through Stock Loans increases, investment products based on Stock Loans are also surging. From June 23 to the day before the article's publication, searching for the keyword "Stock Loan" in the Korea Financial Telecommunications & Clearings Institute's P2P finance product disclosure yielded 265 products over the past three months-a more than tenfold increase compared to 24 products during the same period last year. Eight Percent introduced a Stock Loan product with a fundraising target of 50 million won and an expected return of 8.6% from July 29 to August 29. In addition, companies such as NICE Business Platform and Leading Plus have also launched Stock Loan products with expected returns of around 8% in the past one to two months.

The increase in Stock Loan offerings is also reshuffling the rankings among P2P finance companies. From April 2022 through May of this year, PFCT (PFC Technologies) held the undisputed top spot in outstanding loan balances in the sector. However, in June, HiFunding overtook PFCT to claim first place. As of the end of last month, HiFunding's outstanding loan balance stood at 274.5 billion won. Notably, HiFunding's portfolio consists entirely of other collateralized loans, with no exposure to real estate project financing, real estate-backed loans, or personal credit loans, which were previously the main revenue sources for P2P finance companies.

Experts believe that ongoing interest rate cuts and the revitalization of the stock market will create a favorable environment for the P2P finance industry. However, they advise that the industry should not become complacent with Stock Loans alone but should fulfill its original role as a provider of mid-interest alternative loans in order to broaden the market base.

Lee Sooyoung, a research fellow at Hana Institute of Finance, stated, "P2P finance should meet the financial needs of mid- to low-credit borrowers through mid-interest loans and provide financing to borrowers who are restricted by financial regulations such as the Debt Service Ratio (DSR) and Loan-to-Value (LTV) limits." She added, "Offering tailored loans to platform workers, freelancers, and small business owners who are often excluded from traditional financial screenings is also a core reason for the existence of P2P finance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.